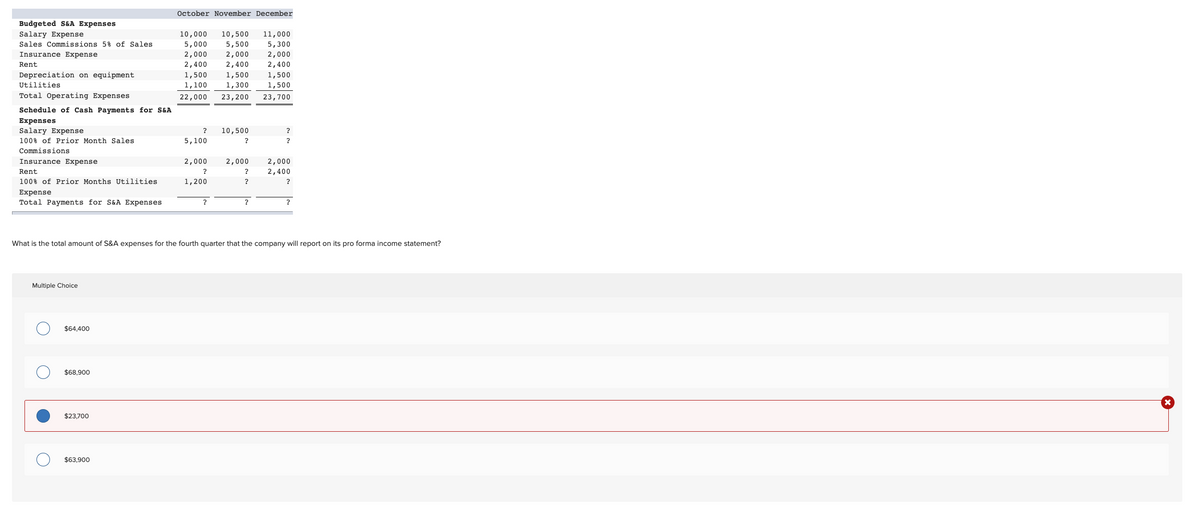

What is the total amount of S&A expenses for the fourth quarter that the company will report on its pro forma income statement? Multiple Choice

Q: Blossom Company reported the following information for November and December 2022. November December…

A: Ending inventory is the price of factors handy there at cease of a reporting period. For a company…

Q: The Company issued a short-term debt of $65,000 on July 1, 2021 for a period of 5 months with a note…

A:

Q: Closing entries The ledger of the General Fund of the City of New Lanier shows the following…

A: The appropriation amount is divided into Estimated revenue and Budgetary fund balance.

Q: Jeremiah Wood wants to set up a fund to pay for his daughter's education. In order to pay her…

A: We will find present value of the future requirement of funds to know what amount we must invest to…

Q: Just like Accounts Receivable being recorded at gross with the Allowance for Doubtful Accounts in…

A: Solution Concept The books of accounts of partnership such as statement of financial position has…

Q: Daxter Bakers is trying to decide whethe Should keep its existing bread-making machi inological…

A: Let us first understand the meaning of opportunity cost Opportunity cost is the benefit foregone…

Q: The QYU, Inc. has sales of P5 million per year (all credit) and an average collection period of 35…

A: The average collection period is an accounting metric used to represent the average number of days…

Q: Explain the data provided

A: Gross profit is that profit of a company that is left over after accounting for all costs that the…

Q: Jan 1 Bought new machineries worth P80.000 in account. Jan 3 Purchased P50,000 worth of computer…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Joferlyn corporation leased a building and received P4,000,000 annual payment on June 15, 2015. The…

A: Introduction: It is the amount reported on the balance sheet's asset side. Essentially, it is…

Q: Loss on sale of plant and machinery should be written off against: Depreciation fund account Sales…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: GST is called as consumption based tax. Discuss and verify this statement with the help of a…

A: Goods and services tax (GST) is also called consumption based tax, as we consume goods like food…

Q: ing skill may destroy people ability to innovate. Provide your opinion on the cost and

A: Team cooperation occurs when team members work together to attain corporate goals. Each member of…

Q: On May 1, 2022, Carlo and Jamie formed a partnership agreeing to share profits and losses in the…

A: Given that, Carlo and james are partners. Profit and loss sharing ratio = 2:3 Investment by carlo =…

Q: Define Liabilities and Equity

A: its assets, debts, equity (equity) equity, short- and long-term loans, and other related items A…

Q: ABC Company has sales of $500,000, COGS of $250,000, operating expenses of $200,000, net income of…

A: The times interest earned ratio is calculated as EBIT or operating income divided by Interest…

Q: What is a key distinction in the presentation of the Income Statement in a Partnership

A: Income statement shows the net income or net loss that is calculated by deducting the expenses from…

Q: These statements are presented to you for evaluation: Statement I - A deficient but not delinquent…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: The standard rate of pay is $12 per direct labor hour, If the actual direct labor payroll was $42336…

A: Lets understand the basics. Direct labor rate variance is a variance between the standard rate at…

Q: One of the products manufactured by Cooper Company is a plastic tray. The information below relates…

A: Process productivity in the Tray Production Department= Units started in production/ Value added…

Q: You were engaged by CPA Co. to audit its financial statements for the first time. In ex: you found…

A: Retained Earnings- Retained earnings are the accumulated portion of a company's profits in a fiscal…

Q: Bonita Industries has 33000 units in beginning finished goods. If sales are expected to be 60000…

A: Introduction: Finished goods are items that have been completed by the manufacturing process or…

Q: nswers are correct or not. Ps. In your solution, you identify the given and the what is being…

A: Time period id denoted as ‘n’ and interest rate is denoted as ‘i’. Increase in revenue (R) can be…

Q: Which of the following statements is true with respect to intangible assets with indefinite lives? O…

A: As per IAS 36 Intangible assets, For Intangible assets with indefinite useful, Intangible assets not…

Q: Required: Q4.1 Journalise the adjustments for the year ended 31" December 2021. First Voucher Number…

A: The pre-adjusted trial balance of Petrea General Dealers as on 31st Dec 2021 is given to us.…

Q: The taxpayers are husband and wife with the following data during the taxable year: Husband:…

A: Income Tax Calculation Here to discuss the details of the calculation of income tax for both Husband…

Q: QUESTION 1-(COMPULSORY) 1(a) Nairobi Ltd…

A: Calculation of depreciation on machinery = 122,000 * 10% = 12,200 Calculation of depreciation on…

Q: Shipments of inventory to the branch may be billed at other than cost. When billing prices are above…

A: Introduction:- Branch Accounting is the different type of bookkeeping or accounting.…

Q: Total amount of depreciation of an asset cannot exceed its: None of these Scrap value Depreciation…

A: 1 Total amount of depreciation of an asset cannot exceed its: Answer Option c: Depreciation value…

Q: A company is considering the following alternatives: Alternative 1 Alternative 2 Revenues…

A: The income statement shows the net income or net loss that is calculated by deducting the expenses…

Q: Potential partners might not want to form a partnership because of the risk of having their personal…

A: The partnership is a form of business where two or more individuals agree to carry a business and…

Q: aders owns the following assets on 31 December 2021: rd EcoSport- CS 23 TM GP: Purchased on…

A: Accumulated depreciation refers to an asset's depreciation up to a single point in its life. Because…

Q: 8. S1: Fringe benefit that is exempt from fringe benefit tax is likewise exempt from any other…

A: S1: Fringe benefits tax (FBT) was a form of tax that companies paid in lieu of benefits they offered…

Q: Stephen, a manager, believes that if his company's revenue hadn't increased last year, it wouldn't…

A: Revenue means the amount earned by selling the goods or services. Profit means the difference…

Q: CABLES General Professional Partnership, a business formed by Carlo and Jamie, have the following…

A: The weighted average capital of partners is calculated on the basis of time period for the…

Q: Assuming the Kreditor / Marble Partnership has $20,000 of net income for the year, the closing entry…

A: Partnership Account - A partnership is a mutual agreement enter into two or more entities for the…

Q: The following four Cases make different assumptions with respect to the amounts of income and…

A: Net Income is the total exact income after necessary deductions like expenses, such as taxes and…

Q: You are the Treasurer for Short Run Sports Club and the manager asked you to prepare the financial…

A: Trading Account is a part of Income Statement that shows the Gross Profits earned or the Gross…

Q: ed in the physical count of inventory is P140,000 of merchandise purchased on Dec.26 from Standing.…

A: The answer has been mentioned below.

Q: g Statement of Cash Flows

A: Cash flow statement shows the cash inflow and cash outflow due to the operating activities,…

Q: 3) Esme transfers land with a FMV of $900,000 to a newly formed corporation in exchange for all the…

A: Basis of an property means amount of investment in capital assets for the purpose of tax.

Q: A resident foreign corporation received 900,000 dividends from a domestic corporation. How much…

A: Resident foreign corporations (i.e. foreign corporations engaged in trade or business in the…

Q: What is the controllable margin for the year?

A: Controllable margin refers to a margin which is expected from a balanced and controlled process of…

Q: ollowing data in its books: 1 Feb 28 Carlo, Capital P50,000 Jan 1 Balance. June 1 Oct 1 P300,000…

A: Given that, Carlo's capital on ; Jan 1 = P300,000 Additional capital contributed on ; June 1 =…

Q: The Accounting Cycle of a Partnership and sole proprietorship are generally similar EXCEPT for: O…

A: Accounting cycle is the sequence which is used for maintaining the books the accounts.

Q: June 30, 2015, Patya Co. prepaid a 1,000,000 premium on an annual insurance policy. The premium…

A: Deferred tax liability is created when taxable income per books of accounts is higher than the…

Q: What adjustment is required when a check written in a prior month appears on the bank statement for…

A: A bank statement is just a monthly document sent by a bank to its customers that lists the…

Q: Caine Company exchanged a car from inventory for a computer to be used as a long-term asset. The…

A: The answer is stated below:

Q: (Adjustment of accumulated profit and reserves) A, B and Care partners sharing profit and losses in…

A: Partnership means where two or more partners agree to do the business jointly and share profit and…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- CASE 1 The following are the information obtained from AMC Company:July August SeptemberCash Sales P24,000 P32,000 P36,000Credit Sales 220,000 300,000 240,000Purchases 180,000 240,000 220,000Operating Expenses 30,000 36,000 32,000Interest Expense - 4,000 -Credit sales are collected 50% in the month of sale, 40% in the month following, 8% in the second monthfollowing, and 2% uncollectible. Credit sales for May and June are expected to be P200,000 and P180,000,respectively. Purchases of merchandise, all on account, are paid 60% in the month of purchase and 40% in themonth following. Purchases for June are estimated at P160,000. Expenses include depreciation of P4,000monthly and are paid in the month incurred. The cash balance on June 30, 201A is P54,000.Required: Prepare a cash budget by month for the quarter ending September 30, 201A. Support your solutionwith schedules of cash receipts and cash payments CASE 2 Sanchez Company, a wholesaler, budgeted the following sales for the…Sales 8.250.000.00 Operating costs 4,725.000.00 Operating income 3,525,000.00 Interest expense 1,750,000.00 Earnings before taxes 1,775,000.00 Taxes (40%) 621,250.00 Net income 1,153,750.00 WACC = 8%, Total invested capital 24,875,000. Calculate the EVA. (2 decimal places)September October November Sales $119,000 $143,000 $199,000 Manufacturing costs 50,000 61,000 72,000 Selling and administrative expenses 42,000 43,000 76,000 Capital expenditures _ _ 48,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $8,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: Current…

- 57) Overcharge Card reports that following amounts: Sales = $3,000,000; Cost of GoodsSold = $1,200,000; Depreciation Expense = $140,000; Administrative Expense =$270,000; Interest Expense = $70,000; Marketing Expense = $60,000; and Taxes=$80,000. What is Overcharge’s operating income?Ace Business Forms Month Current Assets Fixed Assets Total Assets January P125,000 P250,000 P375,000 February 130,000 250,000 380,000 March 135,000 250,000 385,000 April 150,000 250,000 400,000 May 150,000 250,000 400,000 June 125,000 250,000 375,000 July 115,000 250,000 365,000 August 120,000 250,000 370,000 September 115,000 250,000 370,000 October 100,000 250,000 350,000 November 110,000 250,000 360,000 December 115,000 250,000 365,000 Ace Business Forms has compiled several factors relative to its financing mix. The firm pays 8 percent on short-term funds and 10 percent on long-term funds. The firm’s monthly current, fixed and total asset requirements for the previous year are summarized in table above. Determine: a. the monthly average permanent funds requirement b. the monthly average seasonal funds requirementAce Business Forms Month Current Assets Fixed Assets Total Assets January P125,000 P250,000 P375,000 February 130,000 250,000 380,000 March 135,000 250,000 385,000 April 150,000 250,000 400,000 May 150,000 250,000 400,000 June 125,000 250,000 375,000 July 115,000 250,000 365,000 August 120,000 250,000 370,000 September 115,000 250,000 370,000 October 100,000 250,000 350,000 November 110,000 250,000 360,000 December 115,000 250,000 365,000 Ace Business Forms has compiled several factors relative to its financing mix. The firm pays 8 percent on short-term funds and 10 percent on long-term funds. The firm’s monthly current, fixed and total asset requirements for the previous year are summarized in table above. Determine: 1. the annual financing costs (aggressive strategy) 2. the annual financing costs (conservative strategy)

- 1. Year one income statement by months ( sales by year 3 $2.7m 2.7 m /3 = $900,000 average each year sales 900,000 / 12 = $75,000 sales each month Revenues: Net sales $75,000 each month Expenses and loses Costs of goods sold 1,786 x $15.60 = $27,863.78 Capital expenses $1,150 / 12= $95.83 Location expenses $76,415/ 12 = $6,367.92 Advertising / Promotional expenses $78,285/ 12 = $6,523.75 CalculateTotal expenses Depreciation expense is straight line for this project ?. Use the market value of the asset divided by monthly expected life of the asset, We will not use salvage value in calculating depreciation expense.Schedule of cash payments for a service companySafeMark Financial Inc. was organized on February 28. Projected selling andadministrative expenses for each of the first three months of operations are asfollows:March 578,400April 83,500May 96,900Depreciation, insurance, and property taxes represent $10,000 of the estimatedmonthly expenses. The annual insurance premium was paid on February 28, andproperty taxes for the year will be paid in June. Seventy percent of the remainder ofthe expenses are expected to be paid in the month in which they are incurred, withthe balance to be paid in the following month.Prepare a schedule indicating cash payments for selling and administrative expensesfor March, April, and May18. The following information pertains to Q Company:Trade accounts receivable, net of P10,000 credit balance in customers’ accounts, P350,000Notes receivable, P30,000 due in 12 months, P210,000Advances to officers, due in 2 years, P20,000Advances to suppliers, P10,000Sale price of unsold goods sent on consignment to Entity F (120% of cost), P24,000Security deposit paid on a one-year lease contract, P6,000Dividends receivable, P30,000Determine the total current receivables.

- SCRUMPTIOUS CUPCAKESProfit and loss accountfor the year ended 30 April 20202020£SalesSales 220,000Cost of sales 120,000Gross Profit 100,000ExpensesSalaries 24,000Other Fixed cost 4,800Distribution 3,000Advertising 4,500Rent 13,200AHUtilities 3,600Other Cost 4,00057,100Operating Profit 42,900 SCRUMPTIOUS CUPCAKESBalance Sheetas at 30 April 20202020£Fixed assetsIntangible assets -Tangible assets 35,000Investments -35,000Current assetsStocks 3,000Debtors 10,000Cash at bank and in hand 6,30019,300Written ReportsCreditors: amounts falling duewithin one year (11,300)Net Current Assets 8,000Total assets less currentliabilities 43,000Net Assets 43,000Capital and reservesCalled up share capital 100Profit and loss account 42,900Shareholders' funds 43,000 please calculate the folliwing ratios: Profitability Ratios – Gross Profit Margin, Net Profit Margin and ROCE● Liquidity – Current Test and Acid Test● Gearing● Activity/Performance – Stock Turnover, Debtors’ Collection Period and AssetTurnover…tion 8Income statement for the year ended 31 December, 2019 of KKMTN Ghana Ltd2018 2019ȼ ‘000 ȼ ‘000Turnover 420,000 523,600Cost of sales (330,000) (417,200)Gross profit 89,000 106,400Expenses:Administration 44,600 50,200Selling and distribution 15,400 (60,000) 19,600 (69,800)Profit before interest 29,000 36,600Debenture interest - (2,800)Net profit before tax 29,000 33,800Taxation (8,000) (10,000)Net Profit after tax 21,000 23,800Ordinary dividend paid 8,400 9,250Ordinary shares issued 12 million and trading at ȼ3 each as at yesterday onGSE.You are required to compute the following investment ratios:a). Earnings per shareb). Dividend per sharec). Payout ratiod). Price earnings ratioe). Earnings yield2. ABC Co.’s records show the following information: 20x1 20x2Deferred gross profit (adjusted ending balances):from 20x1 sale 240,000 160,000from 20x2 sale 324,000Gross profit rates based on sales 40% 45%Cash collections from:20x1 sales 400,000 200,00020x2 sales 480,000 How much is the total installment receivable on December 31, 20x2?