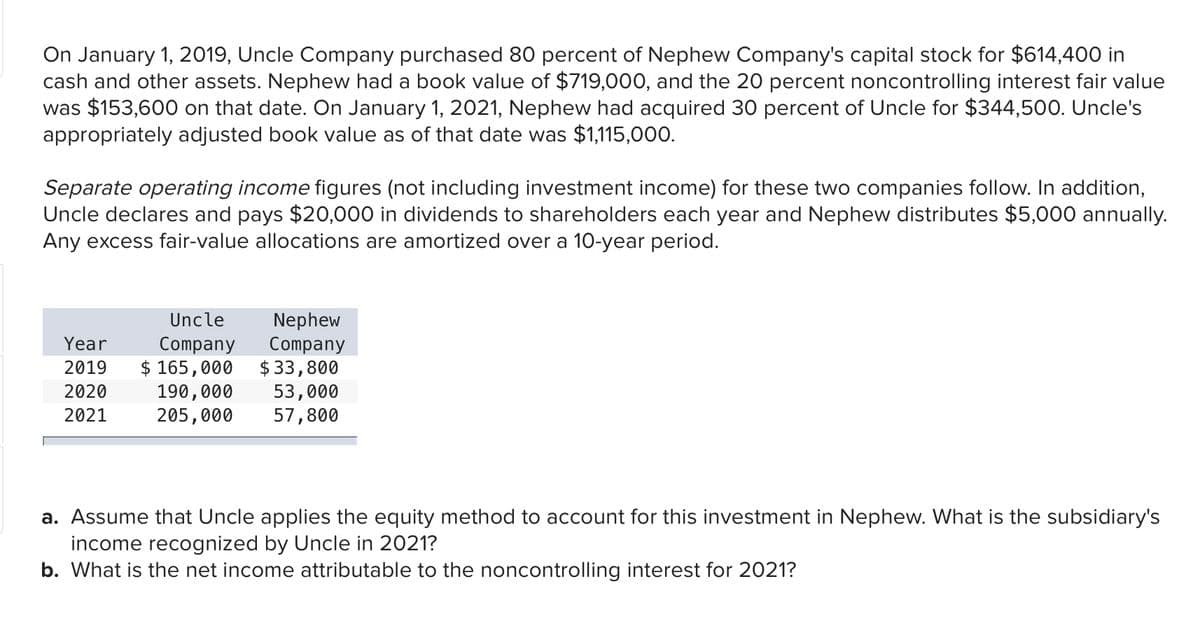

On January 1, 2019, Uncle Company purchased 80 percent of Nephew Company's capital stock for $614,400 in cash and other assets. Nephew had a book value of $719,000, and the 20 percent noncontrolling interest fair value was $153,600 on that date. On January 1, 2021, Nephew had acquired 30 percent of Uncle for $344,500. Uncle's appropriately adjusted book value as of that date was $1,115,000. Separate operating income figures (not including investment income) for these two companies follow. In addition, Uncle declares and pays $20,000 in dividends to shareholders each year and Nephew distributes $5,000 annually. Any excess fair-value allocations are amortized over a 10-year period. Uncle Nephew Company $33,800 53,000 57,800 Year Company $ 165,000 190,000 205,000 2019 2020 2021 a. Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary's income recognized by Uncle in 2021? b. What is the net income attributable to the noncontrolling interest for 2021?

On January 1, 2019, Uncle Company purchased 80 percent of Nephew Company's capital stock for $614,400 in cash and other assets. Nephew had a book value of $719,000, and the 20 percent noncontrolling interest fair value was $153,600 on that date. On January 1, 2021, Nephew had acquired 30 percent of Uncle for $344,500. Uncle's appropriately adjusted book value as of that date was $1,115,000. Separate operating income figures (not including investment income) for these two companies follow. In addition, Uncle declares and pays $20,000 in dividends to shareholders each year and Nephew distributes $5,000 annually. Any excess fair-value allocations are amortized over a 10-year period. Uncle Nephew Company $33,800 53,000 57,800 Year Company $ 165,000 190,000 205,000 2019 2020 2021 a. Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary's income recognized by Uncle in 2021? b. What is the net income attributable to the noncontrolling interest for 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:On January 1, 2019, Uncle Company purchased 80 percent of Nephew Company's capital stock for $614,400 in

cash and other assets. Nephew had a book value of $719,000, and the 20 percent noncontrolling interest fair value

was $153,600 on that date. On January 1, 2021, Nephew had acquired 30 percent of Uncle for $344,500. Uncle's

appropriately adjusted book value as of that date was $1,115,000.

Separate operating income figures (not including investment income) for these two companies follow. In addition,

Uncle declares and pays $20,000 in dividends to shareholders each year and Nephew distributes $5,000 annually.

Any excess fair-value allocations are amortized over a 10-year period.

Nephew

Company

$ 33,800

53,000

57,800

Uncle

Company

$ 165,000

190,000

205,000

Year

2019

2020

2021

a. Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary's

income recognized by Uncle in 2021?

b. What is the net income attributable to the noncontrolling interest for 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning