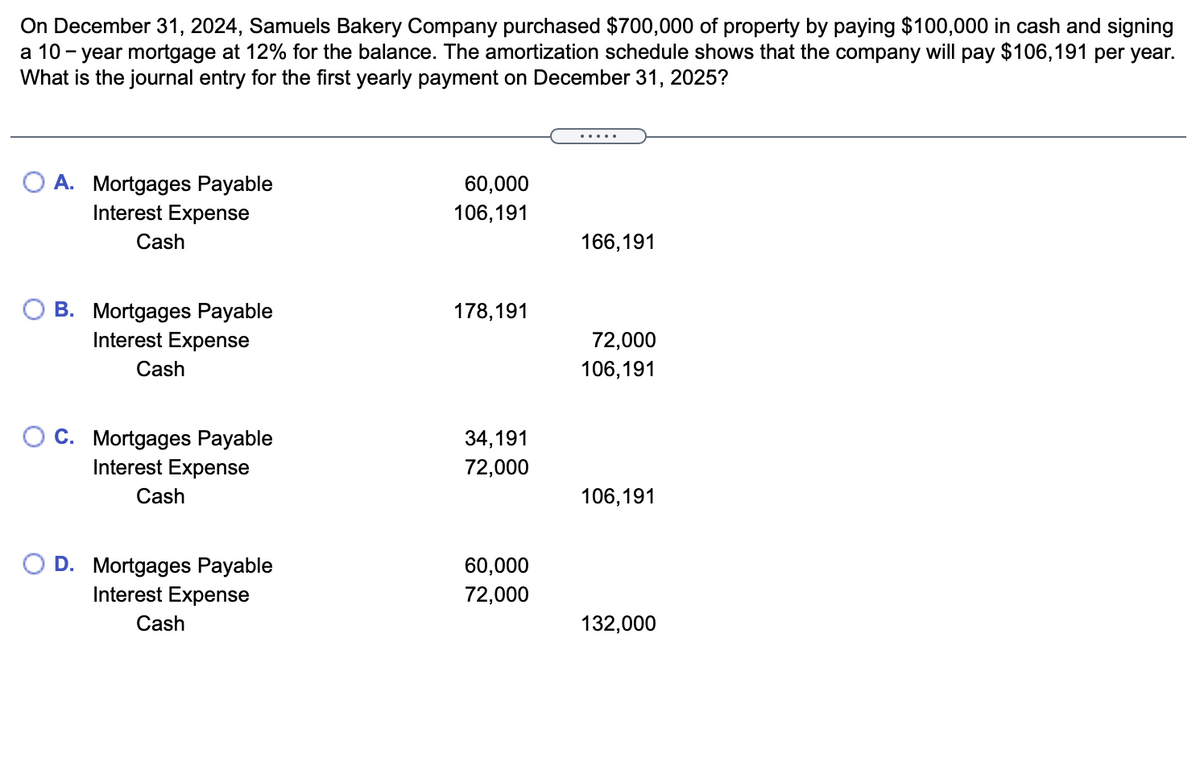

On December 31, 2024, Samuels Bakery Company purchased $700,000 of property by paying $100,000 in cash and signing a 10 - year mortgage at 12% for the balance. The amortization schedule shows that the company will pay $106,191 per year. What is the journal entry for the first yearly payment on December 31, 2025? ..... A. Mortgages Payable Interest Expense 60,000 106,191 Cash 166,191 B. Mortgages Payable Interest Expense 178,191 72,000 Cash 106,191 O C. Mortgages Payable Interest Expense 34,191 72,000 Cash 106,191 D. Mortgages Payable Interest Expense 60,000 72,000 Cash 132,000

On December 31, 2024, Samuels Bakery Company purchased $700,000 of property by paying $100,000 in cash and signing a 10 - year mortgage at 12% for the balance. The amortization schedule shows that the company will pay $106,191 per year. What is the journal entry for the first yearly payment on December 31, 2025? ..... A. Mortgages Payable Interest Expense 60,000 106,191 Cash 166,191 B. Mortgages Payable Interest Expense 178,191 72,000 Cash 106,191 O C. Mortgages Payable Interest Expense 34,191 72,000 Cash 106,191 D. Mortgages Payable Interest Expense 60,000 72,000 Cash 132,000

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 1EA: Halep Inc. borrowed $30,000 from Davis Bank and signed a 4-year note payable stating the interest...

Related questions

Question

Please help me

Transcribed Image Text:On December 31, 2024, Samuels Bakery Company purchased $700,000 of property by paying $100,000 in cash and signing

a 10 - year mortgage at 12% for the balance. The amortization schedule shows that the company will pay $106,191 per year.

What is the journal entry for the first yearly payment on December 31, 2025?

.....

A. Mortgages Payable

Interest Expense

60,000

106,191

Cash

166,191

B. Mortgages Payable

178,191

Interest Expense

72,000

Cash

106,191

C. Mortgages Payable

Interest Expense

34,191

72,000

Cash

106,191

D. Mortgages Payable

Interest Expense

60,000

72,000

Cash

132,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College