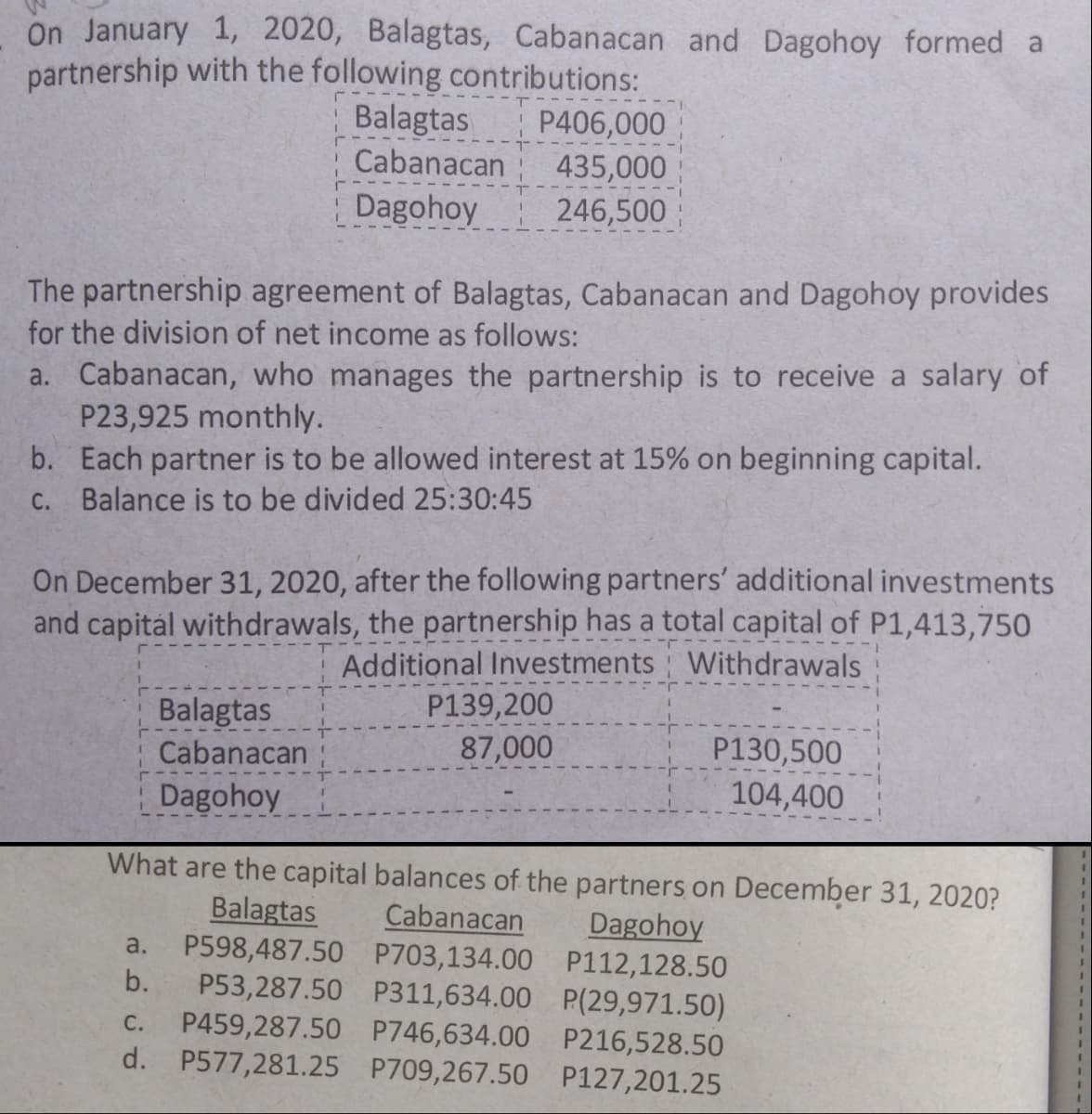

On January 1, 2020, Balagtas, Cabanacan and Dagohoy formed a partnership with the following contributions: P406,000 435,000 246,500 Balagtas Cabanacan Dagohoy The partnership agreement of Balagtas, Cabanacan and Dagohoy provides for the division of net income as follows: a. Cabanacan, who manages the partnership is to receive a salary of P23,925 monthly. b. Each partner is to be allowed interest at 15% on beginning capital. C. Balance is to be divided 25:30:45 On December 31, 2020, after the following partners' additional investments and capital withdrawals, the partnership has a total capital of P1,413,750 Additional Investments Withdrawals Balagtas P139,200 Cabanacan 87,000 P130,500 Dagohoy 104,400 What are the capital balances of the partners on December 31, 2020? Balagtas P598,487.50 P703,134.00 P112,128.50 b. Cabanacan Dagohoy a. P53,287.50 P311,634.00 P(29,971.50) P459,287.50 P746,634.00 P216,528.50 d. P577,281.25 P709,267.50 P127,201,25 С.

On January 1, 2020, Balagtas, Cabanacan and Dagohoy formed a partnership with the following contributions: P406,000 435,000 246,500 Balagtas Cabanacan Dagohoy The partnership agreement of Balagtas, Cabanacan and Dagohoy provides for the division of net income as follows: a. Cabanacan, who manages the partnership is to receive a salary of P23,925 monthly. b. Each partner is to be allowed interest at 15% on beginning capital. C. Balance is to be divided 25:30:45 On December 31, 2020, after the following partners' additional investments and capital withdrawals, the partnership has a total capital of P1,413,750 Additional Investments Withdrawals Balagtas P139,200 Cabanacan 87,000 P130,500 Dagohoy 104,400 What are the capital balances of the partners on December 31, 2020? Balagtas P598,487.50 P703,134.00 P112,128.50 b. Cabanacan Dagohoy a. P53,287.50 P311,634.00 P(29,971.50) P459,287.50 P746,634.00 P216,528.50 d. P577,281.25 P709,267.50 P127,201,25 С.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

Transcribed Image Text:On January 1, 2020, Balagtas, Cabanacan and Dagohoy formed a

partnership with the following contributions:

Balagtas

P406,000

435,000

246,500

Cabanacan

Dagohoy

The partnership agreement of Balagtas, Cabanacan and Dagohoy provides

for the division of net income as follows:

a. Cabanacan, who manages the partnership is to receive a salary of

P23,925 monthly.

b. Each partner is to be allowed interest at 15% on beginning capital.

C. Balance is to be divided 25:30:45

On December 31, 2020, after the following partners' additional investments

and capitál withdrawals, the partnership has a total capital of P1,413,750

Additional Investments Withdrawals

P139,200

Balagtas

87,000

P130,500

104,400

Cabanacan

Dagohoy

What are the capital balances of the partners on December 31, 2020?

Balagtas

P598,487.50 P703,134.00 P112,128.50

b.

Cabanacan

Dagohoy

a.

P53,287.50 P311,634.00 P(29,971.50)

P459,287.50 P746,634.00 P216,528.50

d. P577,281.25 P709,267.50 P127,201.25

С.

------.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,