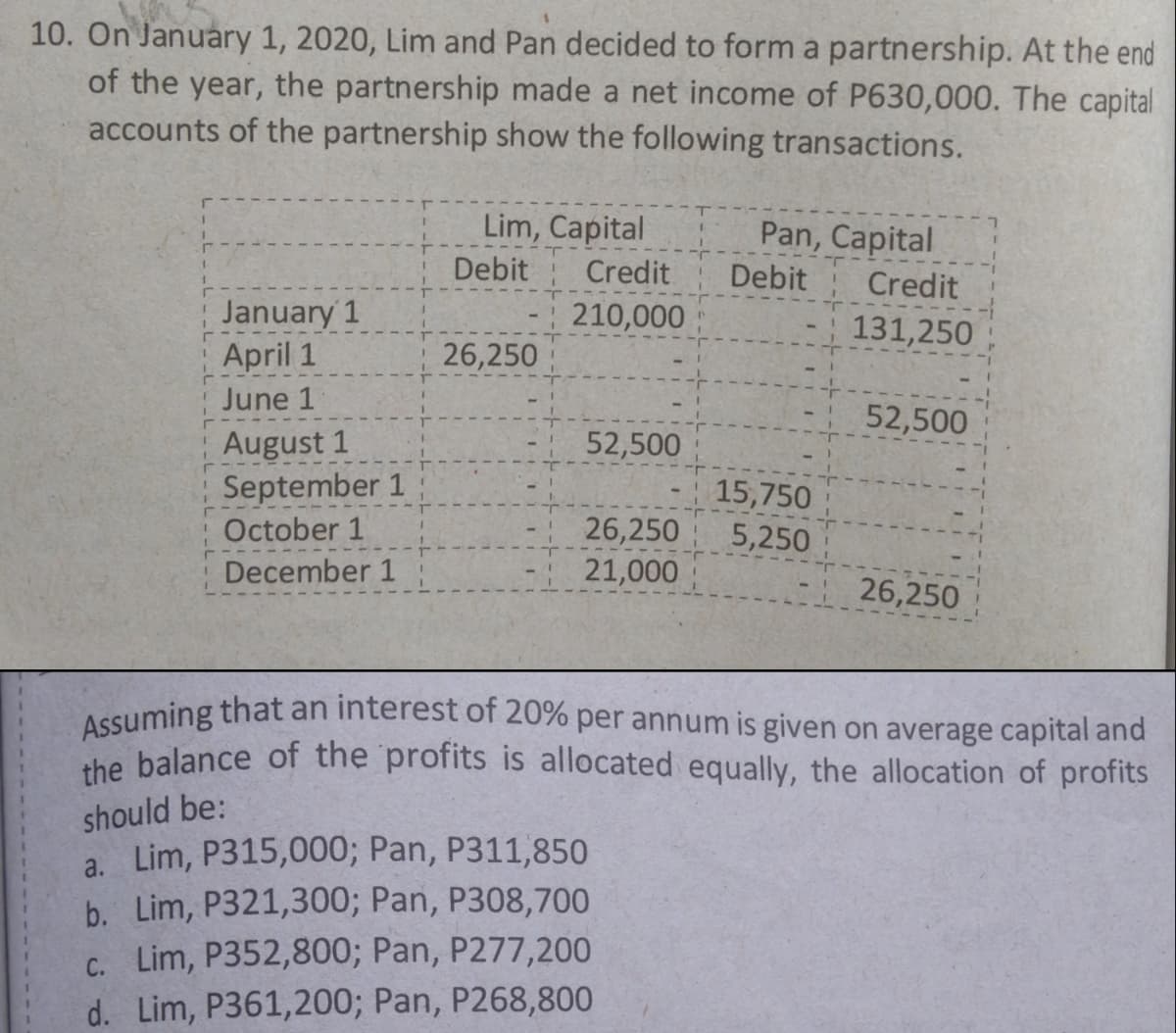

On January 1, 2020, Lim and Pan decided to form a partnership. At the end of the year, the partnership made a net income of P630,000. The capital accounts of the partnership show the following transactions. Lim, Capital Pan, Capital Debit Credit Debit Credit January 1 April 1 210,000 131,250 26,250 June 1 52,500 52,500 August 1 September 1 October 1 15,750 5,250 26,250 December 1 21,000 26,250

On January 1, 2020, Lim and Pan decided to form a partnership. At the end of the year, the partnership made a net income of P630,000. The capital accounts of the partnership show the following transactions. Lim, Capital Pan, Capital Debit Credit Debit Credit January 1 April 1 210,000 131,250 26,250 June 1 52,500 52,500 August 1 September 1 October 1 15,750 5,250 26,250 December 1 21,000 26,250

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:Assuming that an interest of 20% per annum is given on average capital and

10. On January 1, 2020, Lim and Pan decided to form a partnership. At the end

of the year, the partnership made a net income of P630,000. The capital

accounts of the partnership show the following transactions.

Lim, Capital

Pan, Capital

Debit

Credit

Debit

Credit

January 1

April 1

210,000

131,250

26,250

June 1

52,500

August 1

September 1

52,500

15,750

26,250

21,000

October 1

5,250

December 1

26,250

the balance of the profits is allocated equally, the allocation of profits

should be:

a. Lim, P315,000; Pan, P311,850

b. Lim, P321,300; Pan, P308,700

c. Lim, P352,800; Pan, P277,200

d. Lim, P361,200; Pan, P268,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT