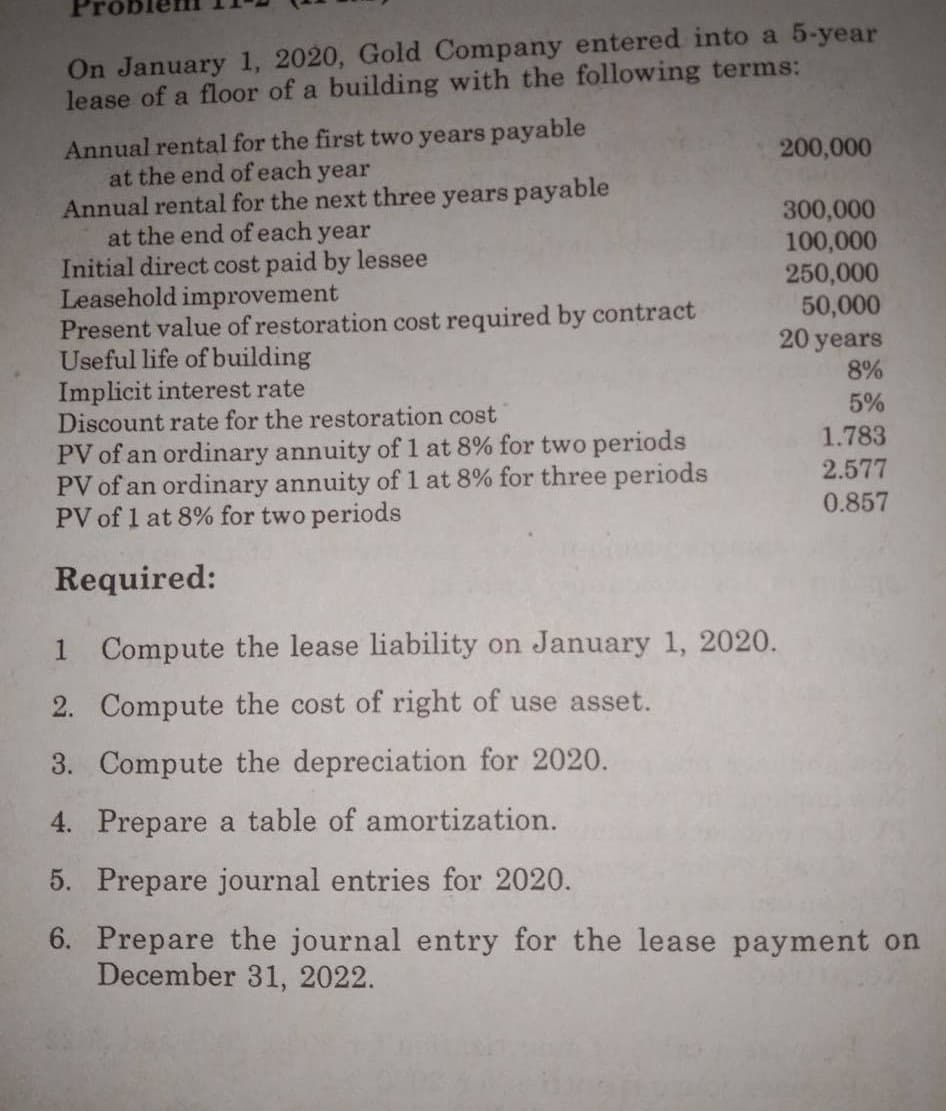

On January 1, 2020, Gold Company entered into a 5-year lease of a floor of a building with the following terms: Annual rental for the first two years payable at the end ofeach Annual rental for the next three years payable at the end of each year Initial direct cost paid by lessee Leasehold improvement Present value of restoration cost required by contract Useful life of building Implicit interest rate Discount rate for the restoration cost PV of an ordinary annuity of 1 at 8% for two periods PV of an ordinary annuity of 1 at 8% for three periods PV of 1 at 8% for two periods 200,000 year 300,000 100,000 250,000 50,000 20 years 8% 5% 1.783 2.577 0.857 Required: 1 Compute the lease liability on January 1, 2020. 2. Compute the cost of right of use asset. 3. Compute the depreciation for 2020.

On January 1, 2020, Gold Company entered into a 5-year lease of a floor of a building with the following terms: Annual rental for the first two years payable at the end ofeach Annual rental for the next three years payable at the end of each year Initial direct cost paid by lessee Leasehold improvement Present value of restoration cost required by contract Useful life of building Implicit interest rate Discount rate for the restoration cost PV of an ordinary annuity of 1 at 8% for two periods PV of an ordinary annuity of 1 at 8% for three periods PV of 1 at 8% for two periods 200,000 year 300,000 100,000 250,000 50,000 20 years 8% 5% 1.783 2.577 0.857 Required: 1 Compute the lease liability on January 1, 2020. 2. Compute the cost of right of use asset. 3. Compute the depreciation for 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 8P: At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the...

Related questions

Question

100%

SHOW COMPLETE SOLUTIONS AND ANSWERS

Transcribed Image Text:On January 1, 2020, Gold Company entered into a 5-year

lease of a floor of a building with the following terms:

Annual rental for the first two years payable

at the end of each year

Annual rental for the next three years payable

at the end of each year

Initial direct cost paid by lessee

Leasehold improvement

Present value of restoration cost required by contract

Useful life of building

Implicit interest rate

Discount rate for the restoration cost

200,000

300,000

100,000

250,000

50,000

20 years

8%

5%

1.783

2.577

PV of an ordinary annuity of 1 at 8% for two periods

PV of an ordinary annuity of 1 at 8% for three periods

PV of 1 at 8% for two periods

0.857

Required:

1 Compute the lease liability on January 1, 2020.

2. Compute the cost of right of use asset.

3. Compute the depreciation for 2020.

4. Prepare a table of amortization.

5. Prepare journal entries for 2020.

6. Prepare the journal entry for the lease payment on

December 31, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT