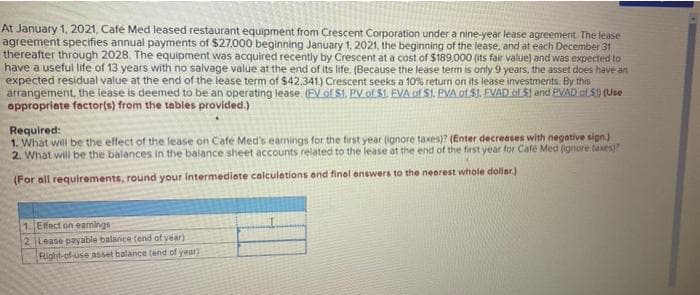

t January 1, 2021, Café Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement The lease greement specifies annual payments of $27000 beginning January 1, 2021, the beginning of the lease, and at each December 31 nereafter through 2028. The equipment was acquired recently by Crescent at a cost of $189,000 (its fair value) and was expected to ave a useful life of 13 years with no salvage value at the end of its life, (Because the lease term is only 9 years, the asset does have an expected residual value at the end of the lease term of $42.341) Crescent seeks a 10% return on its lease investments. By this arrangement, the lease is deemed to be an operating lease (EVof $1, PV. of S1. EVA of $1. PVA ot 51. EVAD of $1 and PVAD of S (Use appropriate factor(s) from the tables provided.) Required: 1. What will be the effect of the lease on Cafe Med's eamings for the first year (ignore taxes)? (Enter decreases with negetive sign.) 2. What will be the balances in the balance sheet accounts related to the lease at the end of the first year for Cafe Med (ignore taxes) (For all requirements, round your intermediate calculetions end final enswers to the nearest whole dollar) Effoct oo eaminas

t January 1, 2021, Café Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement The lease greement specifies annual payments of $27000 beginning January 1, 2021, the beginning of the lease, and at each December 31 nereafter through 2028. The equipment was acquired recently by Crescent at a cost of $189,000 (its fair value) and was expected to ave a useful life of 13 years with no salvage value at the end of its life, (Because the lease term is only 9 years, the asset does have an expected residual value at the end of the lease term of $42.341) Crescent seeks a 10% return on its lease investments. By this arrangement, the lease is deemed to be an operating lease (EVof $1, PV. of S1. EVA of $1. PVA ot 51. EVAD of $1 and PVAD of S (Use appropriate factor(s) from the tables provided.) Required: 1. What will be the effect of the lease on Cafe Med's eamings for the first year (ignore taxes)? (Enter decreases with negetive sign.) 2. What will be the balances in the balance sheet accounts related to the lease at the end of the first year for Cafe Med (ignore taxes) (For all requirements, round your intermediate calculetions end final enswers to the nearest whole dollar) Effoct oo eaminas

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 28E

Related questions

Question

1

Transcribed Image Text:At January 1, 2021, Café Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. The lease

agreement specifies annual payments of $27,000 beginning January 1, 2021, the beginning of the lease, and at each December 31

thereafter through 2028. The equipment was acquired recently by Crescent at a cost of $189,000 (its fair value) and was expected to

have a useful life of 13 years with no salvage value at the end of its life, (Because the lease term is only 9 years, the asset does have an

expected residual value at the end of the lease term of $42.341) Crescent seeks a 10% return on its lease investments. By this

arrangement, the lease is deemed to be an operating lease (EVof $1, PV of $1. EVA of $1. PVA of S1. EVAD of $1 and PVAD of S (Use

appropriete factor(s) from the tables provided.)

Required:

1. What will be the effect of the lease on Cafe Med's eamings for the tirst year (gnore taxes)? (Enter decreeses with negative sign)

2. What will be the balances in the balance sheet accounts related to the lease at the end of the first year for Cofé Med (ignore taxes)

(For all requirements, round your intermediate calculetions and final enswers to the nearest whole dollar.)

1 Effect on eamings

2 Lease payable balance fend of year)

Right-of-use asset balance (end of year)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT