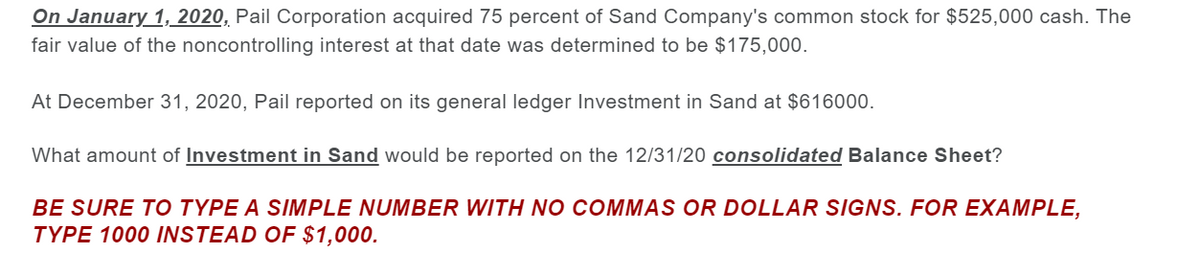

On January 1, 2020, Pail Corporation acquired 75 percent of Sand Company's common stock for $525,000 cash. The fair value of the noncontrolling interest at that date was determined to be $175,000. At December 31, 2020, Pail reported on its general ledger Investment in Sand at $616000. What amount of Investment in Sand would be reported on the 12/31/20 consolidated Balance Sheet? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000.

On January 1, 2020, Pail Corporation acquired 75 percent of Sand Company's common stock for $525,000 cash. The fair value of the noncontrolling interest at that date was determined to be $175,000. At December 31, 2020, Pail reported on its general ledger Investment in Sand at $616000. What amount of Investment in Sand would be reported on the 12/31/20 consolidated Balance Sheet? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:On January 1, 2020, Pail Corporation acquired 75 percent of Sand Company's common stock for $525,000 cash. The

fair value of the noncontrolling interest at that date was determined to be $175,000.

At December 31, 2020, Pail reported on its general ledger Investment in Sand at $616000.

What amount of Investment in Sand would be reported on the 12/31/20 consolidated Balance Sheet?

BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE,

TYPE 1000 INSTEAD OF $1,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT