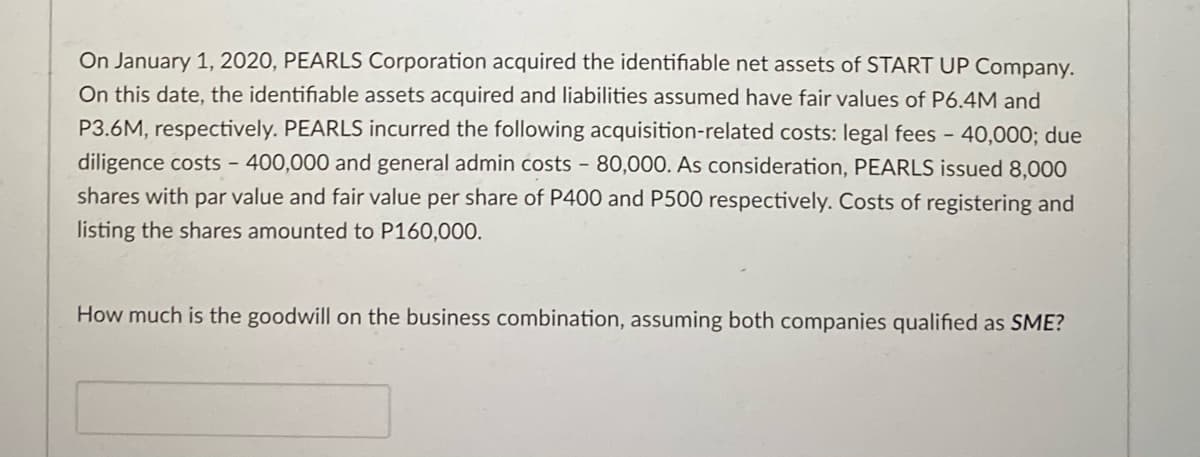

On January 1, 2020, PEARLS Corporation acquired the identifiable net assets of START UP Company. On this date, the identifiable assets acquired and liabilities assumed have fair values of P6.4M and P3.6M, respectively. PEARLS incurred the following acquisition-related costs: legal fees - 40,000; due diligence costs - 400,000 and general admin costs - 80,000. As consideration, PEARLS issued 8,000 shares with par value and fair value per share of P400 and P500 respectively. Costs of registering and listing the shares amounted to P160,000. How much is the goodwill on the business combination, assuming both companies qualified as SME?

On January 1, 2020, PEARLS Corporation acquired the identifiable net assets of START UP Company. On this date, the identifiable assets acquired and liabilities assumed have fair values of P6.4M and P3.6M, respectively. PEARLS incurred the following acquisition-related costs: legal fees - 40,000; due diligence costs - 400,000 and general admin costs - 80,000. As consideration, PEARLS issued 8,000 shares with par value and fair value per share of P400 and P500 respectively. Costs of registering and listing the shares amounted to P160,000. How much is the goodwill on the business combination, assuming both companies qualified as SME?

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 15DQ

Related questions

Question

.30

Transcribed Image Text:On January 1, 2020, PEARLS Corporation acquired the identifiable net assets of START UP Company.

On this date, the identifiable assets acquired and liabilities assumed have fair values of P6.4M and

P3.6M, respectively. PEARLS incurred the following acquisition-related costs: legal fees - 40,000; due

diligence costs - 400,000 and general admin costs - 80,000. As consideration, PEARLS issued 8,000

shares with par value and fair value per share of P400 and P500 respectively. Costs of registering and

listing the shares amounted to P160,000.

How much is the goodwill on the business combination, assuming both companies qualified as SME?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning