On January 1, 2020, Carla Vista Incorporated amended its pension plan which caused an increase of $5,460,150 in its projected benefit obligation. The company has 445 employees who are expected to receive benefits under the company's defined-benefit pension plan. The personnel department provided the following information regarding expected employee retirements: Number of Employees Expected Retirements On December 31 49 2020 129 2021 69 2022 169 2023 29 2024 445 The company plans to use the years-of-service method in calculating the amortization of prior service cost as a component of pension expense. Prepare a schedule which shows the amount of annual prior service cost amortization that the company will recognize as a component of pension expense fro

On January 1, 2020, Carla Vista Incorporated amended its pension plan which caused an increase of $5,460,150 in its projected benefit obligation. The company has 445 employees who are expected to receive benefits under the company's defined-benefit pension plan. The personnel department provided the following information regarding expected employee retirements: Number of Employees Expected Retirements On December 31 49 2020 129 2021 69 2022 169 2023 29 2024 445 The company plans to use the years-of-service method in calculating the amortization of prior service cost as a component of pension expense. Prepare a schedule which shows the amount of annual prior service cost amortization that the company will recognize as a component of pension expense fro

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 1cM

Related questions

Question

On January 1, 2020, Carla Vista Incorporated amended its pension plan which caused an increase of $5,460,150 in its projected benefit obligation. The company has 445 employees who are expected to receive benefits under the company's defined-benefit pension plan. The personnel department provided the following information regarding expected employee retirements:

|

Number of

Employees |

Expected Retirements

On December 31 |

|||

| 49 | 2020 | |||

| 129 | 2021 | |||

| 69 | 2022 | |||

| 169 | 2023 | |||

| 29 | 2024 | |||

| 445 |

The company plans to use the years-of-service method in calculating the amortization of prior service cost as a component of pension expense.

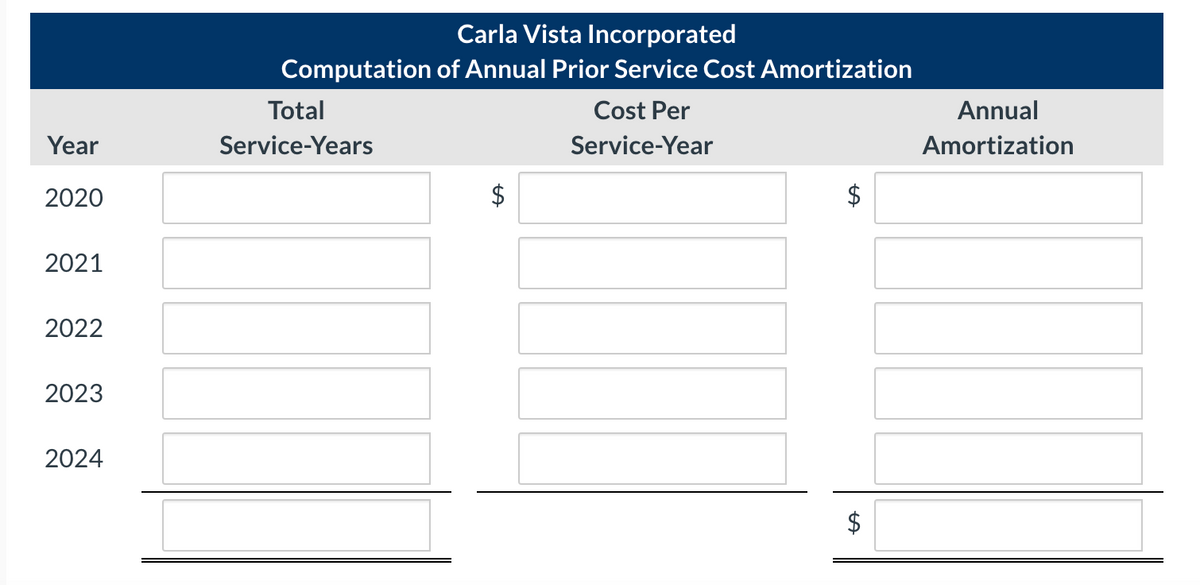

Prepare a schedule which shows the amount of annual prior service cost amortization that the company will recognize as a component of pension expense from 2020 through 2024.

Transcribed Image Text:Carla Vista Incorporated

Computation of Annual Prior Service Cost Amortization

Total

Cost Per

Annual

Year

Service-Years

Service-Year

Amortization

2020

$

$

2021

2022

2023

2024

$

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning