On January 1, 2021, ABC Co. has one, 1-year old, animal with carrying amount of P1.000. On March 31, ABC Co. acquired another animal, aged 2.25 years old. for P2,000, the fair value less costs of the animal on this date, One animal was born on October 1, 2021. The fair value less costs to sell of the newborn animal on this date 15 P500. ABC Co. determined the following fair values less costs to sell on December 31, 2021: New born P600 .25 year old P800 1 year old 2 year old 2.25 year old P1,200 P2,400 P3,000 P3,500 3 years old quirement: compute for the following: a. Total gain (loss) from the change in FVLCS during the period . Change in FVLCS due to price change Change in FVLCS due to physical change

On January 1, 2021, ABC Co. has one, 1-year old, animal with carrying amount of P1.000. On March 31, ABC Co. acquired another animal, aged 2.25 years old. for P2,000, the fair value less costs of the animal on this date, One animal was born on October 1, 2021. The fair value less costs to sell of the newborn animal on this date 15 P500. ABC Co. determined the following fair values less costs to sell on December 31, 2021: New born P600 .25 year old P800 1 year old 2 year old 2.25 year old P1,200 P2,400 P3,000 P3,500 3 years old quirement: compute for the following: a. Total gain (loss) from the change in FVLCS during the period . Change in FVLCS due to price change Change in FVLCS due to physical change

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 10MC

Related questions

Question

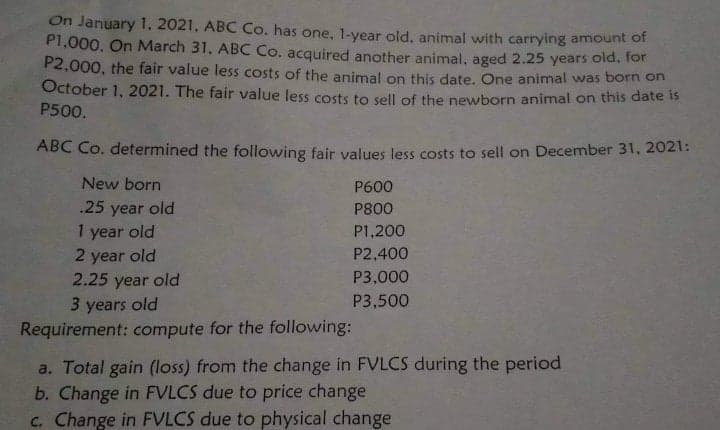

Transcribed Image Text:On January 1.2021. ABC Co. has one, 1-year old, animal with carrying amount of

P1.000. On March 31, ABC Co. acquired another animal, aged 2.25 years old. for

P2,000, the fair value less costs of the animal on this date. One animal was born on

October 1, 2021. The fair value less costs to sell of the newborn animal on this date is

P500.

ABC Co. determined the following fair values less costs to sell on December 31, 2021:

New born

P600

.25 year old

P800

1 year old

2 year old

2.25 year old

P1,200

P2,400

P3,000

P3,500

3 years old

Requirement: compute for the following:

a. Total gain (loss) from the change in FVLCS during the period

b. Change in FVLCS due to price change

c. Change in FVLCS due to physical change

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning