This year, Amber purchased a business that processes and packages landscape mulch. Approimately 20 percent of manage time, space, and expenses are spent on this manufacturing process. At the end of the year, Amber's accountant indicated the business had processed 10 million bags of mulch, but only 1 million bags remained in the ending inventory What is Amber's tax basis in her ending inventory if the UNICAP rules are used to allocate indirect costs to inventory? Assum costs are allocated to inventory according to the level of ending inventory. In contrast, indirect costs are first allocated by time and then according to level of ending inventory) (Leave no answers blank. Enter zero if applicable) Costs Tax Inventory Material Mulch and packaging 710,000 66,500 1,360.000 430.000 750,000 945.000 Material Administrative supplies Salaries: Factory labor Salaries Sales & advertising Salaries: Administration Property taxes Factory Property taxes: Ofces 450,000 005 000

This year, Amber purchased a business that processes and packages landscape mulch. Approimately 20 percent of manage time, space, and expenses are spent on this manufacturing process. At the end of the year, Amber's accountant indicated the business had processed 10 million bags of mulch, but only 1 million bags remained in the ending inventory What is Amber's tax basis in her ending inventory if the UNICAP rules are used to allocate indirect costs to inventory? Assum costs are allocated to inventory according to the level of ending inventory. In contrast, indirect costs are first allocated by time and then according to level of ending inventory) (Leave no answers blank. Enter zero if applicable) Costs Tax Inventory Material Mulch and packaging 710,000 66,500 1,360.000 430.000 750,000 945.000 Material Administrative supplies Salaries: Factory labor Salaries Sales & advertising Salaries: Administration Property taxes Factory Property taxes: Ofces 450,000 005 000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 1BD

Related questions

Question

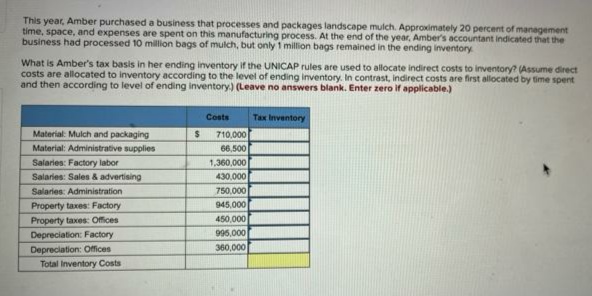

Transcribed Image Text:This year, Amber purchased a business that processes and packages landscape mulch. Approximately 20 percent of management

time, space, and expenses are spent on this manufacturing process. At the end of the year, Amber's accountant indicated that the

business had processed 10 million bags of mulch, but only 1 million bags remained in the ending inventory

What is Amber's tax basis in her ending inventory if the UNICAP rules are used to allocate indirect costs to inventory? (Assume direct

costs are allocated to inventory according to the level of ending inventory. In contrast, indirect costs are first allocated by time spent

and then according to level of ending inventory.) (Leave no answers blank. Enter zero if applicable.)

Costs

Tax Inventory

Material: Mulch and packaging

710,000

Material: Administrative supplies

66,500

Salaries: Factory labor

1.360,000

430.000

Salaries: Sales & advertising

Salaries: Administration

750,000

945,000

450,000

995,000

360,000

Property taxes: Factory

Property taxes: Ofices

Depreciation: Factory

Depreciation: Offices

Total Inventory Costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT