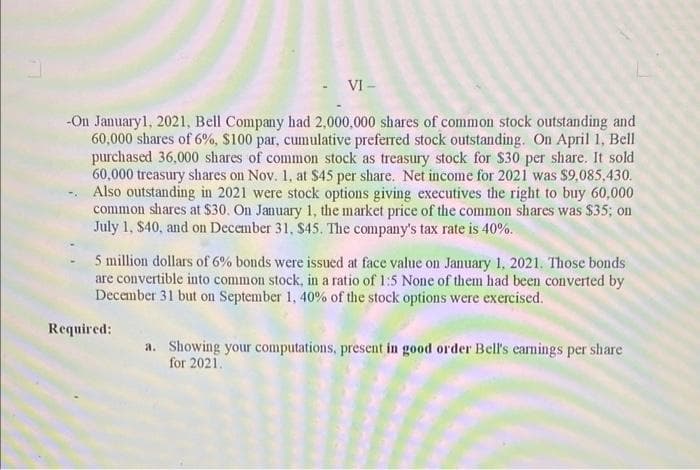

-On January 1, 2021, Bell Company had 2,000,000 shares of common stock outstanding and 60,000 shares of 6%, $100 par, cumulative preferred stock outstanding. On April 1, Bell purchased 36,000 shares of common stock as treasury stock for $30 per share. It sold 60,000 treasury shares on Nov. 1, at $45 per share. Net income for 2021 was $9,085,430. Also outstanding in 2021 were stock options giving executives the right to buy 60,000 common shares at $30. On January 1, the market price of the common shares was $35; on July 1, $40, and on December 31, $45. The company's tax rate is 40%. 5 million dollars of 6% bonds were issued at face value on January 1, 2021. Those bonds are convertible into common stock, in a ratio of 1:5 None of them had been converted by December 31 but on September 1, 40% of the stock options were exercised. Required: a. Showing your computations, present in good order Bell's earnings per share for 2021.

-On January 1, 2021, Bell Company had 2,000,000 shares of common stock outstanding and 60,000 shares of 6%, $100 par, cumulative preferred stock outstanding. On April 1, Bell purchased 36,000 shares of common stock as treasury stock for $30 per share. It sold 60,000 treasury shares on Nov. 1, at $45 per share. Net income for 2021 was $9,085,430. Also outstanding in 2021 were stock options giving executives the right to buy 60,000 common shares at $30. On January 1, the market price of the common shares was $35; on July 1, $40, and on December 31, $45. The company's tax rate is 40%. 5 million dollars of 6% bonds were issued at face value on January 1, 2021. Those bonds are convertible into common stock, in a ratio of 1:5 None of them had been converted by December 31 but on September 1, 40% of the stock options were exercised. Required: a. Showing your computations, present in good order Bell's earnings per share for 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 18E: Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares...

Related questions

Question

Transcribed Image Text:- VI-

-On January 1, 2021, Bell Company had 2,000,000 shares of common stock outstanding and

60,000 shares of 6%, $100 par, cumulative preferred stock outstanding. On April 1, Bell

purchased 36,000 shares of common stock as treasury stock for $30 per share. It sold

60,000 treasury shares on Nov. 1, at $45 per share. Net income for 2021 was $9,085,430.

Also outstanding in 2021 were stock options giving executives the right to buy 60,000

common shares at $30. On January 1, the market price of the common shares was $35; on

July 1, $40, and on December 31, $45. The company's tax rate is 40%.

5 million dollars of 6% bonds were issued at face value on January 1, 2021. Those bonds

are convertible into common stock, in a ratio of 1:5 None of them had been converted by

December 31 but on September 1, 40% of the stock options were exercised.

Required:

a. Showing your computations, present in good order Bell's earnings per share

for 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning