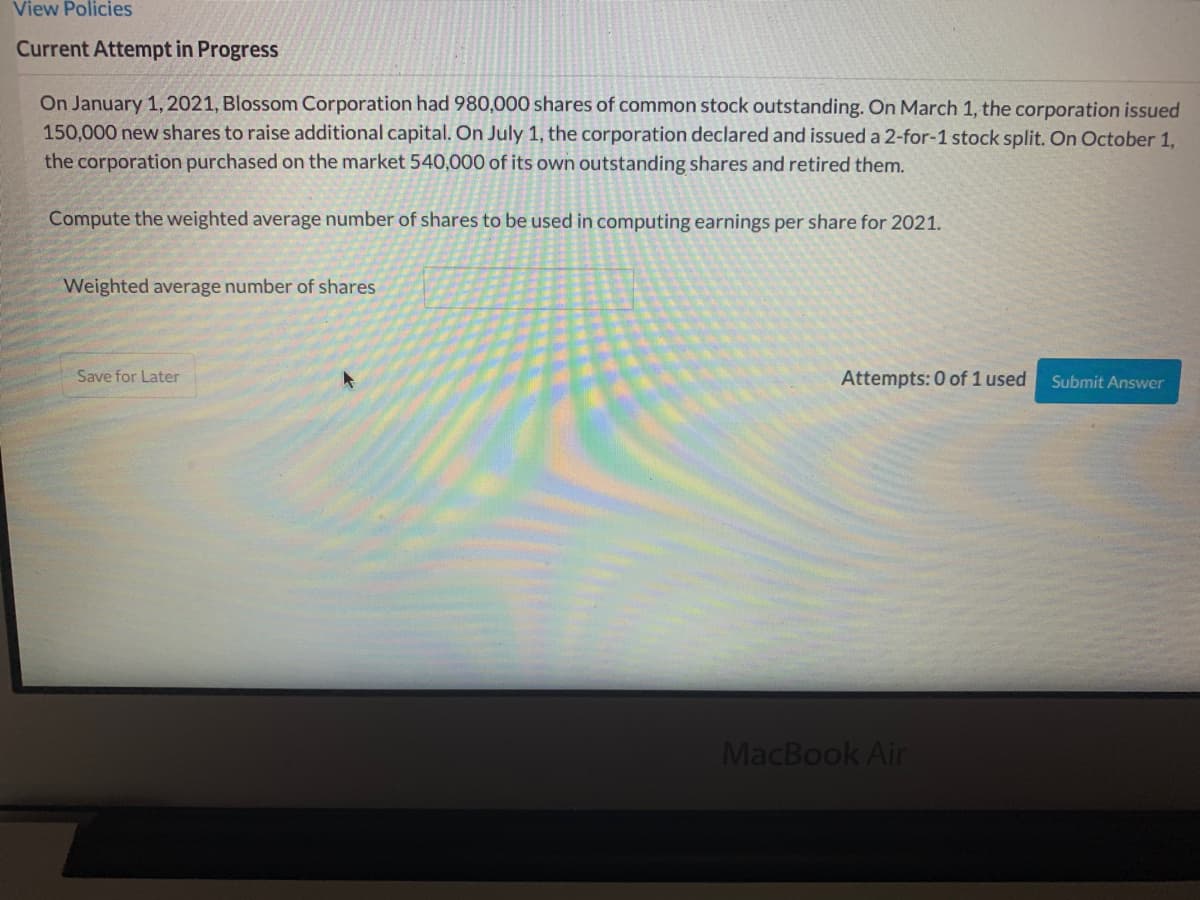

On January 1, 2021, Blossom Corporation had 980,000 shares of common stock outstanding. On March 1, the corporation issued 150,000 new shares to raise additional capital. On July 1, the corporation declared and issued a 2-for-1 stock split. On October 1, the cor

Q: On August 15, 2021, EasyMoney, Inc.’s Board of Directors meets and declares that EasyMoney will pay…

A: The question is based on the concept of Financial Accounting.

Q: On January 1, 2021, Sunland Corp. had 459,000 shares of common stock outstanding. During 2021, it…

A: Note: Since we are entitled to answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit…

Q: Macanas Company had 125,000 shares issued as of January 1, 2018, which includes 25,000 treasury…

A: Answer) Calculation of Number of shares issued Number of shares issued = Total number of shares…

Q: Oriole Corporation was organized on January 1, 2021. During its first year, the corporation issued…

A: calculation of above requirement are as follows

Q: tive, preferred stock were outstanding. (convertible into 40,000 shares of common). No dividends…

A: After distributing the net income to the preference shareholders whatever has been left is divided…

Q: Coda Corporation was organized on January 1, 2019, with an authorization of 2,000,000 shares of $5…

A: Formula: Amount received on issue of shares = Number of shares issued x Issue price Multiplying…

Q: On October 1, 2021, Nicklaus Corporation receives permission to replace its $1 par value common…

A: Introduction: A journal entry is a commercial transaction that is recorded in an organization's…

Q: On August 15, 2021, EasyMoney, Inc.s Board of Directors meets and declares that EasyMoney will pay a…

A: Retained earnings refers to the account that accumulates the earnings of the company that are not…

Q: Publisher Inc. has 1,000,000 shares of common stock authorized. In 2020, Publisher issued 400,000…

A: Organizations have the power to raise funds with different methods such as by issuing common stock,…

Q: Sheffield Corporation was organized on January 1, 2020. It is authorized to issue 11,000 shares of…

A: Date Account Titles and explanation Debit Credit Jan.10 Cash (75500*6) $453,000…

Q: Oriole Corporation was organized on January 1, 2021. During its first year, the corporation issued…

A: Calculation of above requirement are as follows

Q: Paris Co. has a December 31 year-end date. Data for 2021 shows: • There were 60,000, $3, cumulative…

A: Number of common shares Common shares as on January 1 370000 Shares issued 60000 Less; shares…

Q: Gogalor Co. was incorporated on January 1, 2020. Upon inspection of its stock and transfer book, the…

A: Number of outstanding shares means number of shares which are issued and outstanding in the name of…

Q: The Topeka Corporation has 40,000 shares of P30 par value ordinary shares outstanding. On July 1,…

A: The stock dividend is a method of capitalizing the retained earnings. it is issued in a proportion…

Q: On January 1, 2021, Coronado Industries had 124000 shares of its $5 par value common stock…

A: Stock dividends: Stock dividends are the number of shares issued by a company to the existing…

Q: Buffalo Limited has the following information available regarding its share capital at December 31,…

A: Shareholders also invest money in the company and in return they become the owners in proportion to…

Q: the end of 2021, selected records and accounts of Megamoth Corporation reflected the following…

A: 1) Calculate the weighted average number of shares outstanding: Months Actual Share Outstanding…

Q: On July 1, 2021, Luke Corp. has 200,000 shares of P100 par common stock outstanding and the market…

A: A company has several sources from where it can raise funds. It can issue equity shares and the…

Q: Sunland Corporation was organized on January 1, 2019. During its first year, the corporation issued…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: On January 1, 2020, Addy Company had 110,000 shares issued and 100,000 shares outstanding. The…

A: Gven, Shares outstanding on Jan 1, 2020 = 100,000 shares Shares issued on march 1 = 15,000 Treasury…

Q: On August 15, 2021, EasyMoney, Inc.'s Board of Directors meets and declares that EasyMoney will pay…

A: Cash dividends are distribution of accumulated earnings by a companies to its stockholders.…

Q: On January 1, 2021 a corporation was organized. The firm was authorized to Issue 150,000 shares of…

A: Stockholder's equity at the end of 2021 = Common stock + Paid in capital in excess of par common…

Q: Show

A:

Q: The following transactions relate to the shareholders' equity of Telecom Corporation for 2021, its…

A: Authorized capital represents the limit of capital set at the time of incorporation where the…

Q: On July 1, 2021, TJH Corporation has 200,000 shares of P10 par common stock outstanding and the…

A: The stock split leads to change in number of outstanding shares.

Q: Ivanhoe Corporation was organized on January 1, 2020. It is authorized to issue 9,100 shares of 8%,…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Tolkin Corporation was organized on January 1, 2019, with an authorization of 5,000,000 shares of $1…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: The board of directors of ABC Corporation voted on June 1, 2021 to declare a 10% share distributable…

A: GIVEN The board of directors of ABC Corporation voted on June 1, 2021 to declare a 10% share…

Q: transactions that affected the Common Stock account. February 1 Issued 120,000 shares March 1…

A: a. Computation of weighted average outastanding shares Number of shares Stock Dividend…

Q: During 2022, the corporation had the following transactions and events pertaining to its…

A: Step 1 Journal and ledger is the part of book keeping

Q: Oriole Corporation was organized on January 1, 2021. During its first year, the corporation issued…

A: recording of journal entry are as follows

Q: Buffalo Limited has the following information available regarding its share capital at December 31,…

A: The dividend represents the distribution of proot among the shareholders of the company. It is…

Q: On December 31, 2020, Dow Steel Corporation had 610,000 shares of common stock and 301,000 shares of…

A: EPS termed as Earnings per share which states that how much amount of money that business makes from…

Q: Hill Corp. had 600,000 shares of common stock outstanding on January 1, issued 900,000 shares on…

A: Earnings per share is used to measure income earned per share. Earnings per share is equal to…

Q: Halpern Corporation is authorized to issue 1,000,000 shares of $3 par value common stock. During…

A: Journal Entry :- A journal entry is the act of recording any transaction, whether one that is…

Q: Poodle Corporation was organized on January 3, 2021. The firm was authorized to issue 100,000 shares…

A: calculation of paid in capital are as follows:

Q: Southwestern Exposure Ltd. began operations on January 2, 2020. During the year, the following…

A: Shareholders' equity on the balance sheet is affected by the on the k issue, preference stock…

Q: On October 1, 2021, Nicklaus Corporation receives permission to replace its $1 par value common…

A: What are journal entries? It is the first step to record the financial transactions in the books of…

Q: n January 1, 2021, Splish Corp. had 478,000 shares of common stock outstanding. During 2021, it had…

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share…

Q: Helu Corporation was organized on January 1, 2021, with an authorization of 1,000,000 ordinary…

A: Share premium is the accounting term used to represent the amount collected over the par value of…

Q: What should Monty report as preferred stocks on its December 31, 2021, balance sheet?

A: The Shares on the company's balance sheet are to be recognized on the par value. Any excess of issue…

Q: On August 15, 2021, EasyMoney, Inc.'s Board of Directors meets and declares that EasyMoney will pay…

A: The dividends are declared from the retained earnings balance.

Q: Hideo Co. was organized on January 1, 2021, with 300,000 shares of common stock with a $6 par value…

A: Cost method of treasury stock is simple as it considers the cost that is paid to repurchase that…

Q: On April 1, 2019, Kelly Corporation began operations and authorized 100,000 shares of $5 par value…

A: Date Accounts titles and explanation Debit ($) Credit ($) 1-Apr Cash $200,000 Common…

Q: Carlmont Corporation is authorized to issue 5,000,000 shares of $2 par value common stock. As of…

A: The treasury stock shares decreases the number of outstanding chares. The dividend is declared for…

Q: In late 2020, the Nicklaus Corporation was formed. The corporate charter authorizes the issuance of…

A: The question is based on the concept of Financial Accounting.

Q: Kedzie Corporation was organized on January 1, 2019, with an authorization of 5,000,000 shares of $2…

A: Formula: Common stock value = Shares issued x PAR value Multiplication of PAR value with Shares…

Q: 1. Prepare the Nicklaus Corporation shareholders' equity section as it would appear in a balance…

A: Given: The transactions of Nicklaus corporation during the year 2021 is given.

Q: Moosonee Ltd. was incorporated as a private company on January 2, 2021, and is authorized to issue…

A: Value of common stock Jan6=Number of shares×Issue price=200,000×$1.50=$300,000

Q: Whispering Ltd. began its latest fiscal year on January 1, 2020, with 12,000 common shares…

A: The weighted average common shares are the common equity shares outstanding at the end of the year…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.

- Common Dividends Thompson Payroll Service began in 2019 with 1,500,000 authorized and 820,000 issued and outstanding S8 par common shares. During 2019, Thompson entered into the following transactions: Declared a S0.20 per-share cash dividend on March 24. Paid the S0.20 per-share dividend on April 6. Repurchased 13,000 common shares for the treasury at a cost of S12 each on May 9. Sold 2,500 unissued common shares for $15 per share on June 19. Declared a $0.40 per-share cash dividend on August 1. Paid the $0.40 per-share dividend on September 14. Declared and paid a 10% stock dividend on October 25 when the market price of the common stock was $15 per share. Declared a 50.45 per-share cash dividend on November 20. Paid the $0.45 per-share dividend on December 20. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) What is the total dollar amount of dividends (cash and stock) for the year? CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.Preferred Stock Dividends Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has $200,000 available for dividends in 2019, how much could it pay to the common stockholders Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has S200,000 available for dividends in 2019, how much could it pay to the common stockholdersTreasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.

- Cumulative Preferred Dividends Capital stock of Barr Company includes: As of December 31, 2018, 2 years dividends are in arrears on the preferred stock. During 2019, Barr plans to pay dividends that total S360.000. Required: Determine the amount of dividends that will be paid to Barrs common and preferred stockholders in 2019. If Barr paid $280,000 of dividends, determine how much each group of stockholders would receive.Common Dividends Fusion Payroll Service began 2019 with 1,200,000 authorized and 375,000 issued and outstand ing $5 par common shares. During 2019, Fusion entered into the following transactions: Declared a S0.30 per-share cash dividend on March 10. Paid the $0.30 per-share dividend on April 10. Repurchased 8,000 common shares at a cost of $18 each on May 2. Sold 1.500 unissued common shares for $23 per share on June 9. Declared a $0.45 per-share cash dividend on August 10. Paid the $0.45 per-share dividend on September 10. Declared and paid a 5% stock dividend on October 15 when the market price of the common stock was $25 per share. Declared a $0.50 per-share cash dividend on November 10. Paid the $0.50 per-share dividend on December 10. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) Determine the total dollar amount of dividends (cash and stock) for the year. CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its preferred and common stock: Preferred stock, S30 par, 12% cumulative; 300,000 shares authorized; 150,000 shares issued and outstanding Common stock, $2 par; 2,500,000 shares authorized; 1,200,000 shares issued; 1,000,000 outstanding As of December 31, 2019, Lemon was 3 years in arrears on its dividends. During 2020, Lemon declared and paid dividends. As a result, the common stockholders received dividends of $0.45 per share. Required: What was the total amount of dividends declared and paid? What journal entry was made at the date of declaration?

- Stock Dividends Crystal Corporation has the following information regarding its common stock: S10 par. with 500.000 shares authorized, 213,000 shares issued, and 183,700 shares outstanding. On August 22, 2019, Crystal declared and paid a 15% stock dividend when the market price of the common stock was $30 per share. Required: Prepare the journal entries to record declaration and payment of this stock dividend. Prepare the journal entries to record declaration and payment assuming it was a 30% stock dividend.Stock Dividend The balance sheet of Cohen Enterprises includes the following stockholders equity section: Required: On April 15, 2019, when its stock was selling for $18 per share, Cohen Enterprises issued a small stock dividend. After making the journal entry to recognize the stock dividend, Cohens total capital stock increased by $270,000. In percentage terms, what was the size of the stock dividend? Ignoring the small stock dividend discussed in Requirement 1, assume that on June 1, 2019, when its stock was selling for $22 per share, Cohen issued a large stock dividend. After making the journal entry to recognize the stock dividend, Cohens retained earnings decreased by $75,000. In percentage terms, what was the size of the stock dividend?Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73