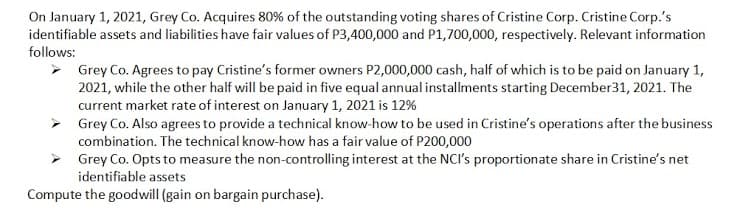

On January 1, 2021, Grey Co. Acquires 80% of the outstanding voting shares of Cristine Corp. Cristine Corp.'s identifiable assets and liabilities have fair values of P3,400,000 and P1,700,000, respectively. Relevant information follows: > Grey Co. Agrees to pay Cristine's former owners P2,000,000 cash, half of which is to be paid on January 1, 2021, while the other half will be paid in five equal annual installments starting December31, 2021. The current market rate of interest on January 1, 2021 is 12% - Grey Co. Also agrees to provide a technical know-how to be used in Cristine's operations after the business combination. The technical know-how has a fair value of P200,000 > Grey Co. Opts to measure the non-controlling interest at the NCI's proportionate share in Cristine's net identifiable assets Compute the goodwill (gain on bargain purchase).

On January 1, 2021, Grey Co. Acquires 80% of the outstanding voting shares of Cristine Corp. Cristine Corp.'s identifiable assets and liabilities have fair values of P3,400,000 and P1,700,000, respectively. Relevant information follows: > Grey Co. Agrees to pay Cristine's former owners P2,000,000 cash, half of which is to be paid on January 1, 2021, while the other half will be paid in five equal annual installments starting December31, 2021. The current market rate of interest on January 1, 2021 is 12% - Grey Co. Also agrees to provide a technical know-how to be used in Cristine's operations after the business combination. The technical know-how has a fair value of P200,000 > Grey Co. Opts to measure the non-controlling interest at the NCI's proportionate share in Cristine's net identifiable assets Compute the goodwill (gain on bargain purchase).

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Grey co.

A. 280,955

B. 360,955

C. 340,955

D. (220,045)

Transcribed Image Text:On January 1, 2021, Grey Co. Acquires 80% of the outstanding voting shares of Cristine Corp. Cristine Corp.'s

identifiable assets and liabilities have fair values of P3,400,000 and P1,700,000, respectively. Relevant information

follows:

> Grey Co. Agrees to pay Cristine's former owners P2,000,000 cash, half of which is to be paid on January 1,

2021, while the other half will be paid in five equal annual installments starting December31, 2021. The

current market rate of interest on January 1, 2021 is 12%

> Grey Co. Also agrees to provide a technical know-how to be used in Cristine's operations after the business

combination. The technical know-how has a fair value of P200,000

> Grey Co. Opts to measure the non-controlling interest at the NCI's proportionate share in Cristine's net

identifiable assets

Compute the goodwill (gain on bargain purchase).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning