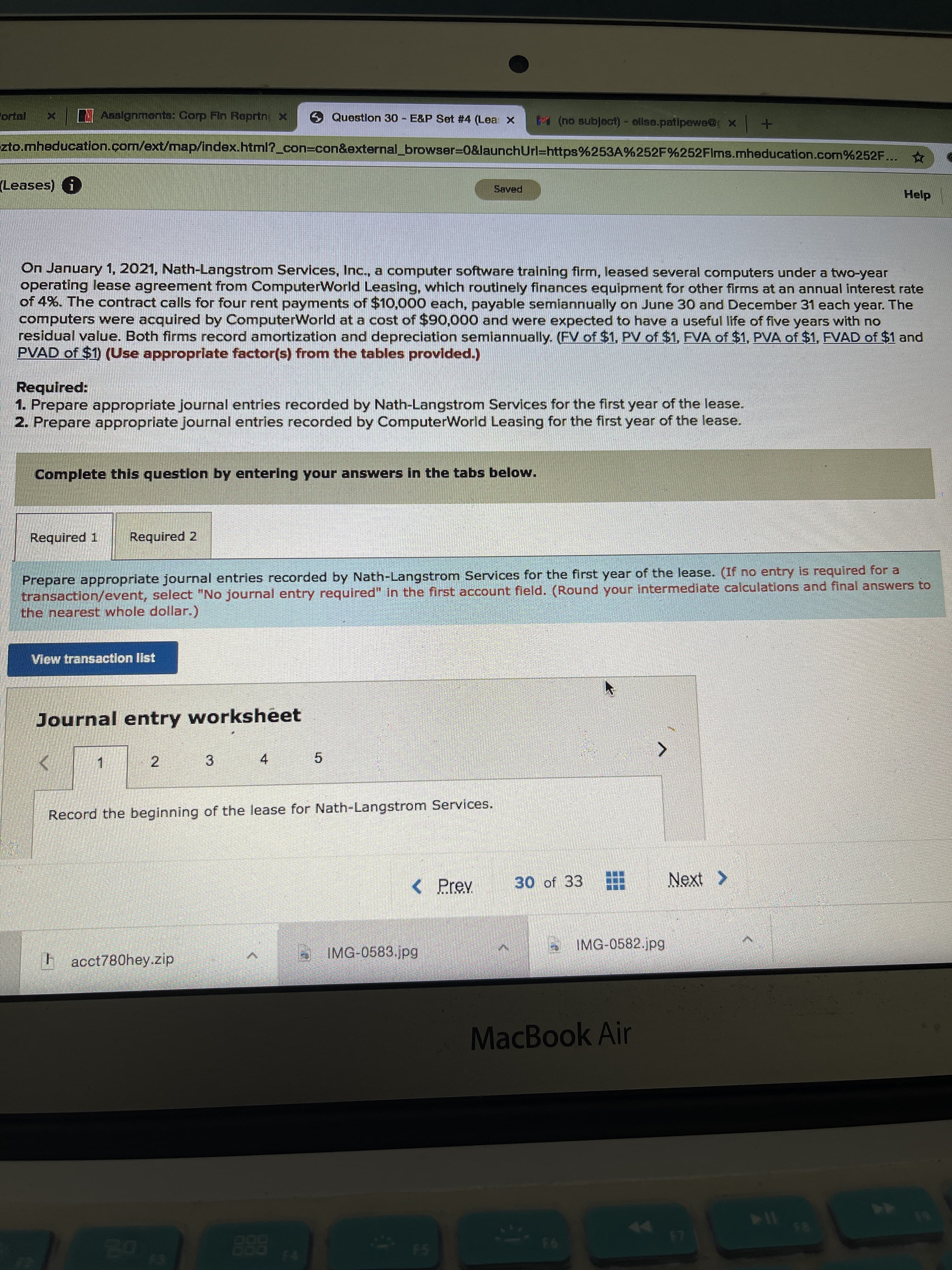

On January 1, 2021, Nath-Langstrom Services, Inc., a computer software training firm, leased several computers under a two-ye operating lease agreement from ComputerWorld Leasing, which routinely finances equipment for other firms at an annual inte of 4%. The contract calls for four rent payments of $10,000 each, payable semiannually on June 30 and December 31 each ye computers were acquired by ComputerWorld at a cost of $90,000 and were expected to have a useful life of five years with n residual value. Both firms record amortization and depreciation semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD o PVAD of $1) (Use approprlate factor(s) from the tables provided.)

On January 1, 2021, Nath-Langstrom Services, Inc., a computer software training firm, leased several computers under a two-ye operating lease agreement from ComputerWorld Leasing, which routinely finances equipment for other firms at an annual inte of 4%. The contract calls for four rent payments of $10,000 each, payable semiannually on June 30 and December 31 each ye computers were acquired by ComputerWorld at a cost of $90,000 and were expected to have a useful life of five years with n residual value. Both firms record amortization and depreciation semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD o PVAD of $1) (Use approprlate factor(s) from the tables provided.)

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 63P

Related questions

Question

Transcribed Image Text:On January 1, 2021, Nath-Langstrom Services, Inc., a computer software training firm, leased several computers under a two-ye

operating lease agreement from ComputerWorld Leasing, which routinely finances equipment for other firms at an annual inte

of 4%. The contract calls for four rent payments of $10,000 each, payable semiannually on June 30 and December 31 each ye

computers were acquired by ComputerWorld at a cost of $90,000 and were expected to have a useful life of five years with n

residual value. Both firms record amortization and depreciation semiannually. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD o

PVAD of $1) (Use approprlate factor(s) from the tables provided.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT