Berkeley Inc. is engaged in manufacturing. For the procurement of machines, Berkeley Inc. uses the leasing method. On May 1, 2016, Berkeley Inc. entered into a lease contract with Mindy Corp. on a printing machine that costs Rp180,000,000 with the following agreement: - The lease period is 3 years, payments are made semi-annually with the first payment is November 1, 2016. - The lease payment per 6 months is Rp35,000,000,-. - Berkeley Inc. has the option to purchase the production machine at a price of Rp1,500,000,- at the end of the lease period - The economic life of the production machine is 5 years - The incremental borrowing rate is 15% - Mindy Corp's implicit interest rate is 12%, known to Berkeley Inc. Prepare the schedule of lease payment! (Use the following format)

Berkeley Inc. is engaged in manufacturing. For the procurement of machines, Berkeley Inc. uses the leasing method. On May 1, 2016, Berkeley Inc. entered into a lease contract with Mindy Corp. on a printing machine that costs Rp180,000,000 with the following agreement:

- The lease period is 3 years, payments are made semi-annually with the first payment is November 1, 2016.

- The lease payment per 6 months is Rp35,000,000,-.

- Berkeley Inc. has the option to purchase the production machine at a price of Rp1,500,000,- at the end of the lease period

- The economic life of the production machine is 5 years

- The incremental borrowing rate is 15%

- Mindy Corp's implicit interest rate is 12%, known to Berkeley Inc.

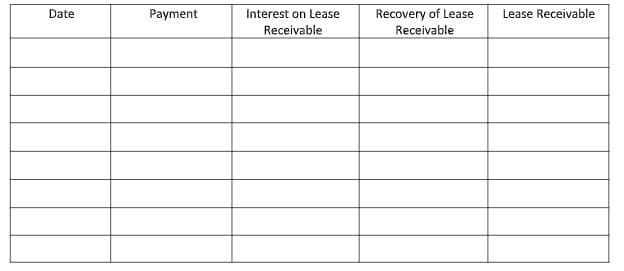

Prepare the schedule of lease payment! (Use the following format)

Step by step

Solved in 2 steps with 2 images