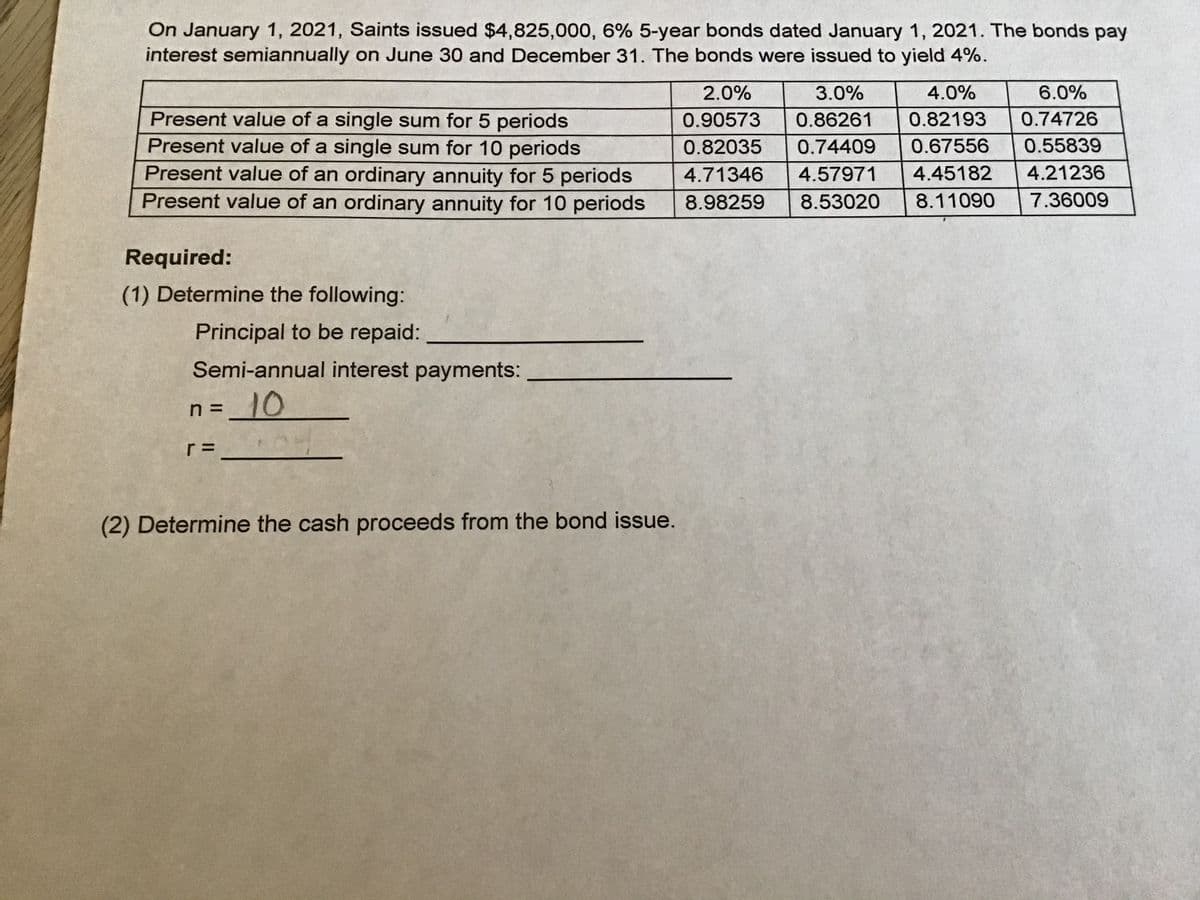

On January 1, 2021, Saints issued $4,825,000, 6% 5-year bonds dated January 1, 2021. The bonds pay interest semiannually on June 30 and December 31. The bonds were issued to yield 4%. 2.0% 3.0% 4.0% 6.0% Present value of a single sum for 5 periods Present value of a single sum for 10 periods Present value of an ordinary annuity for 5 periods Present value of an ordinary annuity for 10 periods 0.90573 0.86261 0.82193 0.74726 0.82035 0.74409 0.67556 0.55839 4.71346 4.57971 4.45182 4.21236 8.98259 8.53020 8.11090 7.36009 Required: (1) Determine the following: Principal to be repaid: Semi-annual interest payments: n=_10 (2) Determine the cash proceeds from the bond issue.

On January 1, 2021, Saints issued $4,825,000, 6% 5-year bonds dated January 1, 2021. The bonds pay interest semiannually on June 30 and December 31. The bonds were issued to yield 4%. 2.0% 3.0% 4.0% 6.0% Present value of a single sum for 5 periods Present value of a single sum for 10 periods Present value of an ordinary annuity for 5 periods Present value of an ordinary annuity for 10 periods 0.90573 0.86261 0.82193 0.74726 0.82035 0.74409 0.67556 0.55839 4.71346 4.57971 4.45182 4.21236 8.98259 8.53020 8.11090 7.36009 Required: (1) Determine the following: Principal to be repaid: Semi-annual interest payments: n=_10 (2) Determine the cash proceeds from the bond issue.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PA: Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

Question in picture

Transcribed Image Text:On January 1, 2021, Saints issued $4,825,000, 6% 5-year bonds dated January 1, 2021. The bonds pay

interest semiannually on June 30 and December 31. The bonds were issued to yield 4%.

2.0%

3.0%

4.0%

6.0%

Present value of a single sum for 5 periods

Present value of a single sum for 10 periods

Present value of an ordinary annuity for 5 periods

Present value of an ordinary annuity for 10 periods

0.90573

0.86261

0.82193

0.74726

0.82035

0.74409

0.67556

0.55839

4.71346

4.57971

4.45182

4.21236

8.98259

8.53020

8.11090

7.36009

Required:

(1) Determine the following:

Principal to be repaid:

Semi-annual interest payments:

n = _10

r =

(2) Determine the cash proceeds from the bond issue.

Expert Solution

Step 1

Bond is a security that is used by entities to raise debt from public-at-large. Bonds are also listed at exchanges which provide liquidity to holders.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning