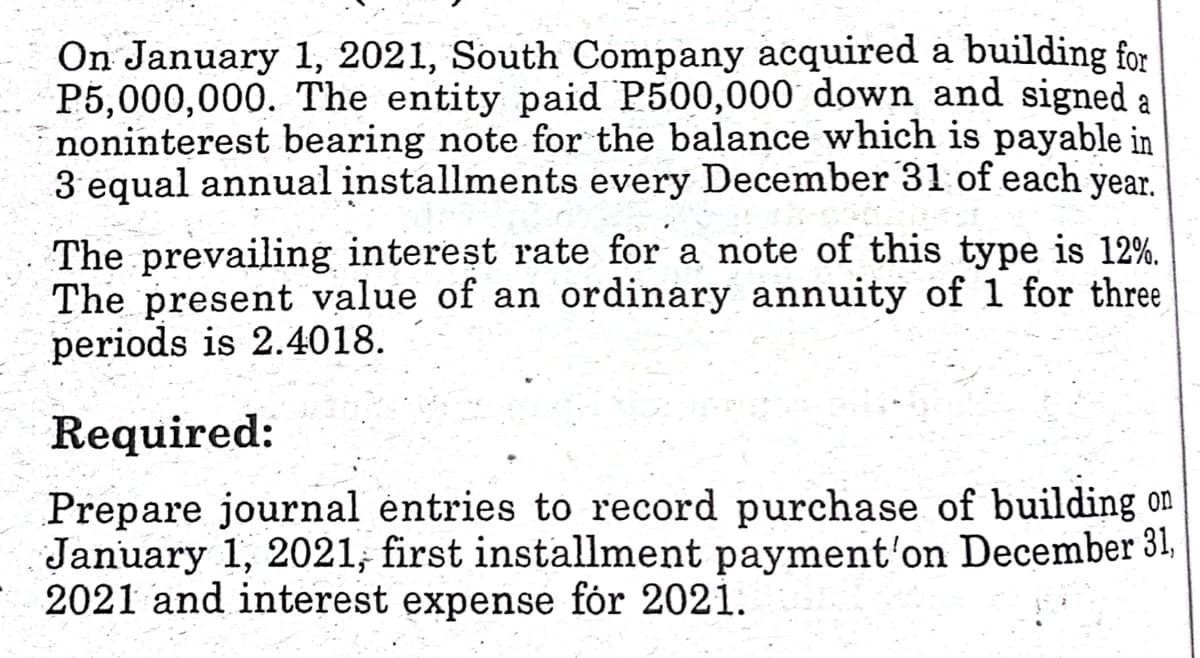

On January 1, 2021, South Company acquired a building for P5,000,000. The entity paid P500,000 down and signed a noninterest bearing note for the balance which is payable in 3 equal annual installments every December 31 of each year. The prevailing interest rate for a note of this type is 12%. The present value of an ordinary annuity of 1 for three periods is 2.4018. Required: Prepare journal entries to record purchase of building on January 1, 2021, first installment payment'on December 31, 2021 and interest expense for 2021.

On January 1, 2021, South Company acquired a building for P5,000,000. The entity paid P500,000 down and signed a noninterest bearing note for the balance which is payable in 3 equal annual installments every December 31 of each year. The prevailing interest rate for a note of this type is 12%. The present value of an ordinary annuity of 1 for three periods is 2.4018. Required: Prepare journal entries to record purchase of building on January 1, 2021, first installment payment'on December 31, 2021 and interest expense for 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 10MC: On January 1, 2019, Park Company accepted a 36,000, non-interest-bearing, 3-year note from a major...

Related questions

Question

7. Answer what is required of the problem.

Transcribed Image Text:On January 1, 2021, South Company acquired a building for

P5,000,000. The entity paid P500,000 down and signed a

noninterest bearing note for the balance which is payable in

3 equal annual installments every December 31 of each year.

The prevailing interest rate for a note of this type is 12%.

The present value of an ordinary annuity of 1 for three

periods is 2.4018.

Required:

Prepare journal entries to record purchase of building on

January 1, 2021, first installment payment'on December 31,

2021 and interest expense for 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College