The following events occurred between December 31, 2020 (the reporting date) and March 22, 2021, the date that Kaizza Inc.'s financial statements were approved for issue: 1. January 8, 2021: The local government approved the expropriation of one of the company's manufacturing facilities for construction of a new motorway. On December 31, 2021, the carrying value of the property, land and building, was PhP 27,500,000. The company has determined that they will be able to move most of the manufacturing machines to other facilities. The company was not previously aware of the local government's plan, as the council discussions had been held in camera. The local government has not yet proposed a compensation amount. The appropriation will occur later in 2021. 2. January 27, 2021: The board of directors approved a staff bonus of PhP 2,500,000. The terms of this bonus were included in the employment contracts of key management personnel and the bonus calculation was based on the reported financial results of the December 31, 2020 fiscal year. 3. February 3, 2021: The company received notice from the Bureau of Internal Revenue that additional income taxes of PhP 750,000 for the 2020 and 2021 fiscal years were payable. The company had previously disputed the calcilation of these tayes and bad renorted an accrual PhP 300.000 on Decemher 31 2020

The following events occurred between December 31, 2020 (the reporting date) and March 22, 2021, the date that Kaizza Inc.'s financial statements were approved for issue: 1. January 8, 2021: The local government approved the expropriation of one of the company's manufacturing facilities for construction of a new motorway. On December 31, 2021, the carrying value of the property, land and building, was PhP 27,500,000. The company has determined that they will be able to move most of the manufacturing machines to other facilities. The company was not previously aware of the local government's plan, as the council discussions had been held in camera. The local government has not yet proposed a compensation amount. The appropriation will occur later in 2021. 2. January 27, 2021: The board of directors approved a staff bonus of PhP 2,500,000. The terms of this bonus were included in the employment contracts of key management personnel and the bonus calculation was based on the reported financial results of the December 31, 2020 fiscal year. 3. February 3, 2021: The company received notice from the Bureau of Internal Revenue that additional income taxes of PhP 750,000 for the 2020 and 2021 fiscal years were payable. The company had previously disputed the calcilation of these tayes and bad renorted an accrual PhP 300.000 on Decemher 31 2020

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 39P

Related questions

Question

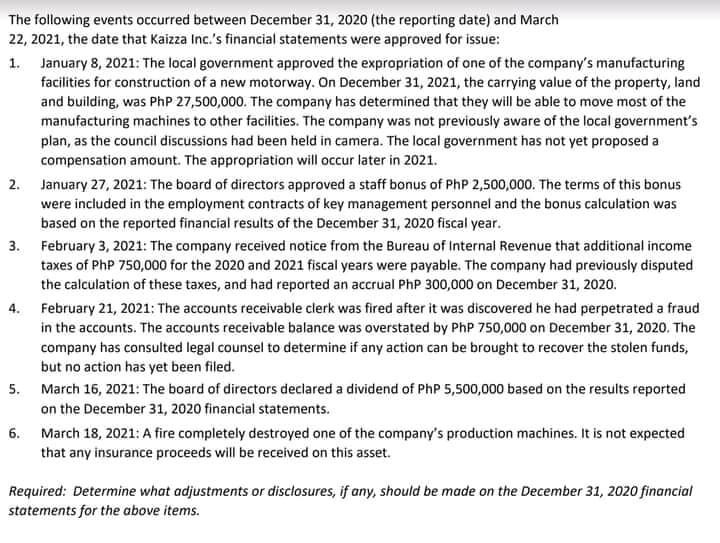

Transcribed Image Text:The following events occurred between December 31, 2020 (the reporting date) and March

22, 2021, the date that Kaizza Inc.'s financial statements were approved for issue:

1. January 8, 2021: The local government approved the expropriation of one of the company's manufacturing

facilities for construction of a new motorway. On December 31, 2021, the carrying value of the property, land

and building, was PhP 27,500,000. The company has determined that they will be able to move most of the

manufacturing machines to other facilities. The company was not previously aware of the local government's

plan, as the council discussions had been held in camera. The local government has not yet proposed a

compensation amount. The appropriation will occur later in 2021.

2. January 27, 2021: The board of directors approved a staff bonus of PhP 2,500,000. The terms of this bonus

were included in the employment contracts of key management personnel and the bonus calculation was

based on the reported financial results of the December 31, 2020 fiscal year.

3. February 3, 2021: The company received notice from the Bureau of Internal Revenue that additional income

taxes of PhP 750,000 for the 2020 and 2021 fiscal years were payable. The company had previously disputed

the calculation of these taxes, and had reported an accrual PhP 300,000 on December 31, 2020.

4. February 21, 2021: The accounts receivable clerk was fired after it was discovered he had perpetrated a fraud

in the accounts. The accounts receivable balance was overstated by PhP 750,000 on December 31, 2020. The

company has consulted legal counsel to determine if any action can be brought to recover the stolen funds,

but no action has yet been filed.

5. March 16, 2021: The board of directors declared a dividend of PhP 5,500,000 based on the results reported

on the December 31, 2020 financial statements.

6. March 18, 2021: A fire completely destroyed one of the company's production machines. It is not expected

that any insurance proceeds will be received on this asset.

Required: Determine what adjustments or disclosures, if any, should be made on the December 31, 2020 financial

statements for the above items.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT