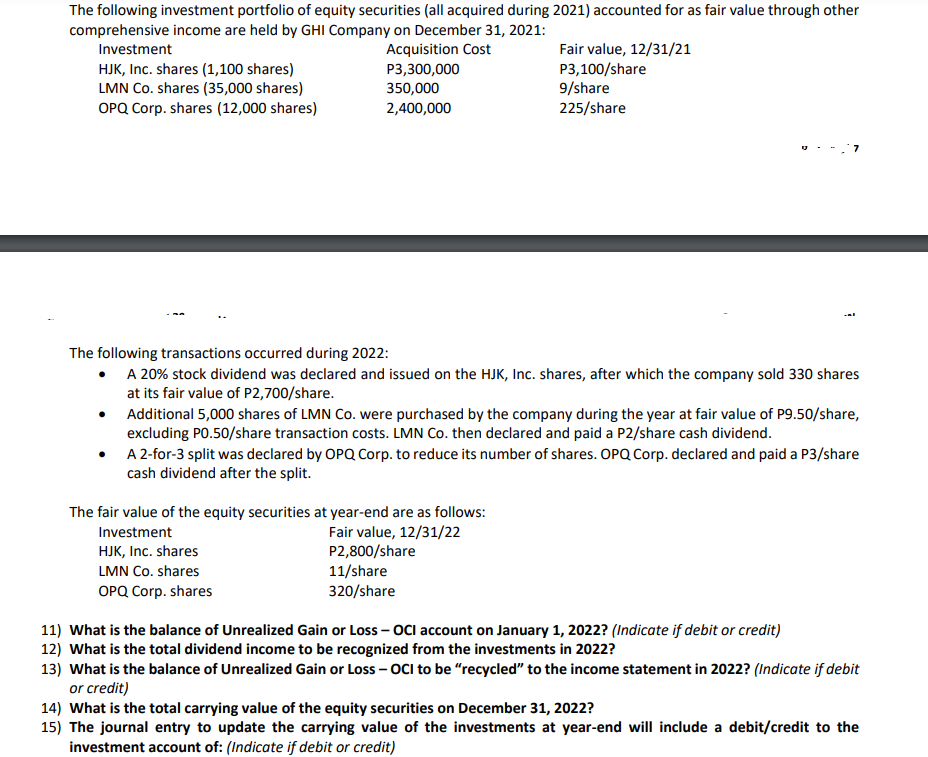

The following investment portfolio of equity securities (all acquired during 2021) accounted for as fair value through other comprehensive income are held by GHI Company on December 31, 2021: Investment Acquisition Cost P3,300,000 HJK, Inc. shares (1,100 shares) LMN Co. shares (35,000 shares) OPQ Corp. shares (12,000 shares) Fair value, 12/31/21 P3,100/share 9/share 225/share 350,000 2,400,000 The following transactions occurred during 2022: • A 20% stock dividend was declared and issued on the HJK, Inc. shares, after which the company sold 330 shares at its fair value of P2,700/share. ● Additional 5,000 shares of LMN Co. were purchased by the company during the year at fair value of P9.50/share, excluding P0.50/share transaction costs. LMN Co. then declared and paid a P2/share cash dividend. A 2-for-3 split was declared by OPQ Corp. to reduce its number of shares. OPQ Corp. declared and paid a P3/share cash dividend after the split. The fair value of the equity securities at year-end are as follows: Investment Fair value, 12/31/22 HJK, Inc. shares LMN Co. shares P2,800/share 11/share 320/share OPQ Corp. shares 11) What is the balance of Unrealized Gain or Loss - OCI account on January 1, 2022? (Indicate if debit or credit) 12) What is the total dividend income to be recognized from the investments in 2022? 13) What is the balance of Unrealized Gain or Loss - OCI to be "recycled" to the income statement in 2022? (Indicate if debit or credit) 14) What is the total carrying value of the equity securities on December 31, 2022? 15) The journal entry to update the carrying value of the investments at year-end will include a debit/credit to the investment account of: (Indicate if debit or credit)

The following investment portfolio of equity securities (all acquired during 2021) accounted for as fair value through other comprehensive income are held by GHI Company on December 31, 2021: Investment Acquisition Cost P3,300,000 HJK, Inc. shares (1,100 shares) LMN Co. shares (35,000 shares) OPQ Corp. shares (12,000 shares) Fair value, 12/31/21 P3,100/share 9/share 225/share 350,000 2,400,000 The following transactions occurred during 2022: • A 20% stock dividend was declared and issued on the HJK, Inc. shares, after which the company sold 330 shares at its fair value of P2,700/share. ● Additional 5,000 shares of LMN Co. were purchased by the company during the year at fair value of P9.50/share, excluding P0.50/share transaction costs. LMN Co. then declared and paid a P2/share cash dividend. A 2-for-3 split was declared by OPQ Corp. to reduce its number of shares. OPQ Corp. declared and paid a P3/share cash dividend after the split. The fair value of the equity securities at year-end are as follows: Investment Fair value, 12/31/22 HJK, Inc. shares LMN Co. shares P2,800/share 11/share 320/share OPQ Corp. shares 11) What is the balance of Unrealized Gain or Loss - OCI account on January 1, 2022? (Indicate if debit or credit) 12) What is the total dividend income to be recognized from the investments in 2022? 13) What is the balance of Unrealized Gain or Loss - OCI to be "recycled" to the income statement in 2022? (Indicate if debit or credit) 14) What is the total carrying value of the equity securities on December 31, 2022? 15) The journal entry to update the carrying value of the investments at year-end will include a debit/credit to the investment account of: (Indicate if debit or credit)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:The following investment portfolio of equity securities (all acquired during 2021) accounted for as fair value through other

comprehensive income are held by GHI Company on December 31, 2021:

Investment

Acquisition Cost

P3,300,000

HJK, Inc. shares (1,100 shares)

Fair value, 12/31/21

P3,100/share

9/share

225/share

LMN Co. shares (35,000 shares)

OPQ Corp. shares (12,000 shares)

350,000

2,400,000

The following transactions occurred during 2022:

• A 20% stock dividend was declared and issued on the HJK, Inc. shares, after which the company sold 330 shares

at its fair value of P2,700/share.

Additional 5,000 shares of LMN Co. were purchased by the company during the year at fair value of P9.50/share,

excluding P0.50/share transaction costs. LMN Co. then declared and paid a P2/share cash dividend.

●

A 2-for-3 split was declared by OPQ Corp. to reduce its number of shares. OPQ Corp. declared and paid a P3/share

cash dividend after the split.

The fair value of the equity securities at year-end are as follows:

Investment

Fair value, 12/31/22

HJK, Inc. shares

LMN Co. shares

P2,800/share

11/share

320/share

OPQ Corp. shares

11) What is the balance of Unrealized Gain or Loss - OCI account on January 1, 2022? (Indicate if debit or credit)

12) What is the total dividend income to be recognized from the investments in 2022?

13) What is the balance of Unrealized Gain or Loss - OCI to be "recycled" to the income statement in 2022? (Indicate if debit

or credit)

14) What is the total carrying value of the equity securities on December 31, 2022?

15) The journal entry to update the carrying value of the investments at year-end will include a debit/credit to the

investment account of: (Indicate if debit or credit)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning