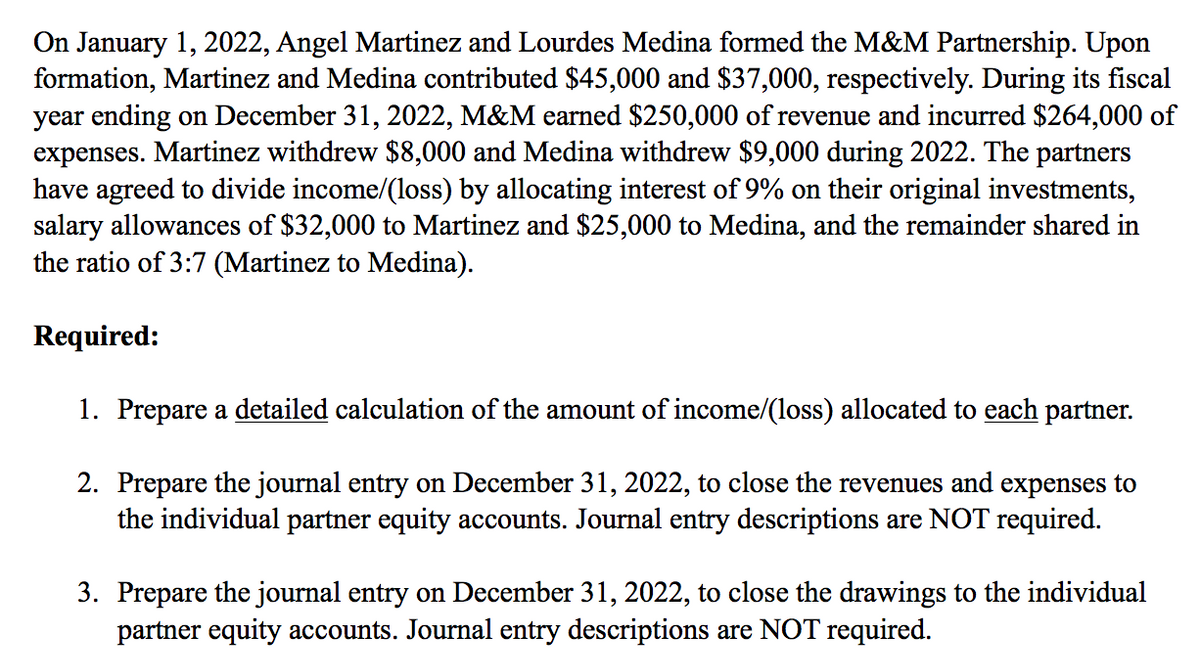

On January 1, 2022, Angel Martinez and Lourdes Medina formed the M&M Partnership. Upon formation, Martinez and Medina contributed $45,000 and $37,000, respectively. During its fiscal year ending on December 31, 2022, M&M earned $250,000 of revenue and incurred $264,000 of expenses. Martinez withdrew $8,000 and Medina withdrew $9,000 during 2022. The partners have agreed to divide income/(loss) by allocating interest of 9% on their original investments, salary allowances of $32,000 to Martinez and $25,000 to Medina, and the remainder shared in the ratio of 3:7 (Martinez to Medina). Required: 1. Prepare a detailed calculation of the amount of income/(loss) allocated to each partner. 2. Prepare the journal entry on December 31, 2022, to close the revenues and expenses to the individual partner equity accounts. Journal entry descriptions are NOT required. 3. Prepare the journal entry on December 31, 2022, to close the drawings to the individual partner equity accounts. Journal entry descriptions are NOT required.

On January 1, 2022, Angel Martinez and Lourdes Medina formed the M&M Partnership. Upon formation, Martinez and Medina contributed $45,000 and $37,000, respectively. During its fiscal year ending on December 31, 2022, M&M earned $250,000 of revenue and incurred $264,000 of expenses. Martinez withdrew $8,000 and Medina withdrew $9,000 during 2022. The partners have agreed to divide income/(loss) by allocating interest of 9% on their original investments, salary allowances of $32,000 to Martinez and $25,000 to Medina, and the remainder shared in the ratio of 3:7 (Martinez to Medina). Required: 1. Prepare a detailed calculation of the amount of income/(loss) allocated to each partner. 2. Prepare the journal entry on December 31, 2022, to close the revenues and expenses to the individual partner equity accounts. Journal entry descriptions are NOT required. 3. Prepare the journal entry on December 31, 2022, to close the drawings to the individual partner equity accounts. Journal entry descriptions are NOT required.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 3SEB

Related questions

Question

1

Transcribed Image Text:On January 1, 2022, Angel Martinez and Lourdes Medina formed the M&M Partnership. Upon

formation, Martinez and Medina contributed $45,000 and $37,000, respectively. During its fiscal

year ending on December 31, 2022, M&M earned $250,000 of revenue and incurred $264,000 of

expenses. Martinez withdrew $8,000 and Medina withdrew $9,000 during 2022. The partners

have agreed to divide income/(loss) by allocating interest of 9% on their original investments,

salary allowances of $32,000 to Martinez and $25,000 to Medina, and the remainder shared in

the ratio of 3:7 (Martinez to Medina).

Required:

1. Prepare a detailed calculation of the amount of income/(loss) allocated to each partner.

2. Prepare the journal entry on December 31, 2022, to close the revenues and expenses to

the individual partner equity accounts. Journal entry descriptions are NOT required.

3. Prepare the journal entry on December 31, 2022, to close the drawings to the individual

partner equity accounts. Journal entry descriptions are NOT required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning