On January 1, 2022, Rosewood Corp. purchased a put option on shares of ICM stock. Terms of the contract were as follows: Number of shares: 100 • Strike price: $220 per share Expiration date: May 31, 2022 • Total cost of the option contract: $100 • Seller of the option contract: First Investment Bank On January 1, 2022, ICM stock was trading at $220 per share. The following additional information is known: • On March 31, 2022, the price of ICM stock was $210 per share. A market appraisal indicated that the time value of the option contract was $80. • On May 10, 2022, the price of ICM stock was $215 per share. A market appraisal indicated that the time value of the option contract was $70. On this date, Rosewood settled the option contract. Required: 1. Indicate any amounts that Rosewood Corp. would have included in its March 2022 quarterly financial statements related to the option contract.

On January 1, 2022, Rosewood Corp. purchased a put option on shares of ICM stock. Terms of the contract were as follows: Number of shares: 100 • Strike price: $220 per share Expiration date: May 31, 2022 • Total cost of the option contract: $100 • Seller of the option contract: First Investment Bank On January 1, 2022, ICM stock was trading at $220 per share. The following additional information is known: • On March 31, 2022, the price of ICM stock was $210 per share. A market appraisal indicated that the time value of the option contract was $80. • On May 10, 2022, the price of ICM stock was $215 per share. A market appraisal indicated that the time value of the option contract was $70. On this date, Rosewood settled the option contract. Required: 1. Indicate any amounts that Rosewood Corp. would have included in its March 2022 quarterly financial statements related to the option contract.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 1P: Subscriptions On August 3, 2019, the date of incorporation, Quinn Company accepts separate...

Related questions

Question

36.

Subject : - Accounting

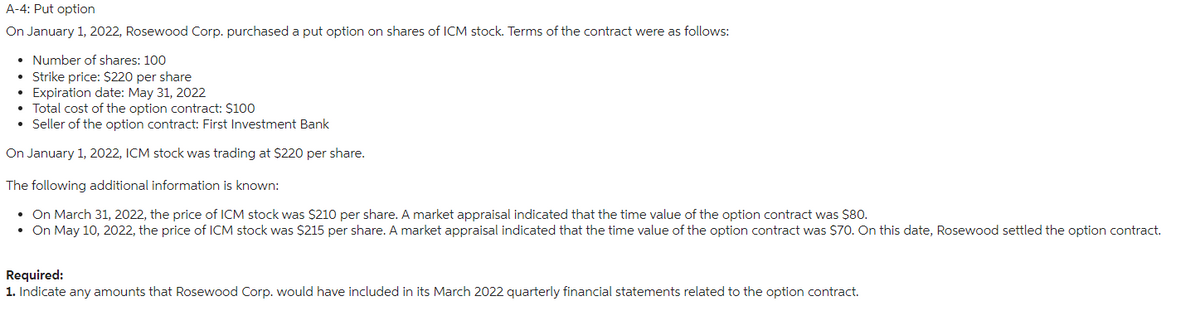

Transcribed Image Text:A-4: Put option

On January 1, 2022, Rosewood Corp. purchased a put option on shares of ICM stock. Terms of the contract were as follows:

Number of shares: 100

Strike price: $220 per share

Expiration date: May 31, 2022

• Total cost of the option contract: $100

• Seller of the option contract: First Investment Bank

On January 1, 2022, ICM stock was trading at $220 per share.

The following additional information is known:

• On March 31, 2022, the price of ICM stock was $210 per share. A market appraisal indicated that the time value of the option contract was $80.

• On May 10, 2022, the price of ICM stock was $215 per share. A market appraisal indicated that the time value of the option contract was $70. On this date, Rosewood settled the option contract.

Required:

1. Indicate any amounts that Rosewood Corp. would have included in its March 2022 quarterly financial statements related to the option contract.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT