Compute free cash flow. (Show amounts that decrease free cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) Free cash flow $

Compute free cash flow. (Show amounts that decrease free cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) Free cash flow $

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 7MC: What is the effect on cash when current noncash operating assets increase? A. Cash increases by the...

Related questions

Topic Video

Question

Please do not give solution in image format thanku

Transcribed Image Text:Compute free cash flow. (Show amounts that decrease free cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).)

Free cash flow $

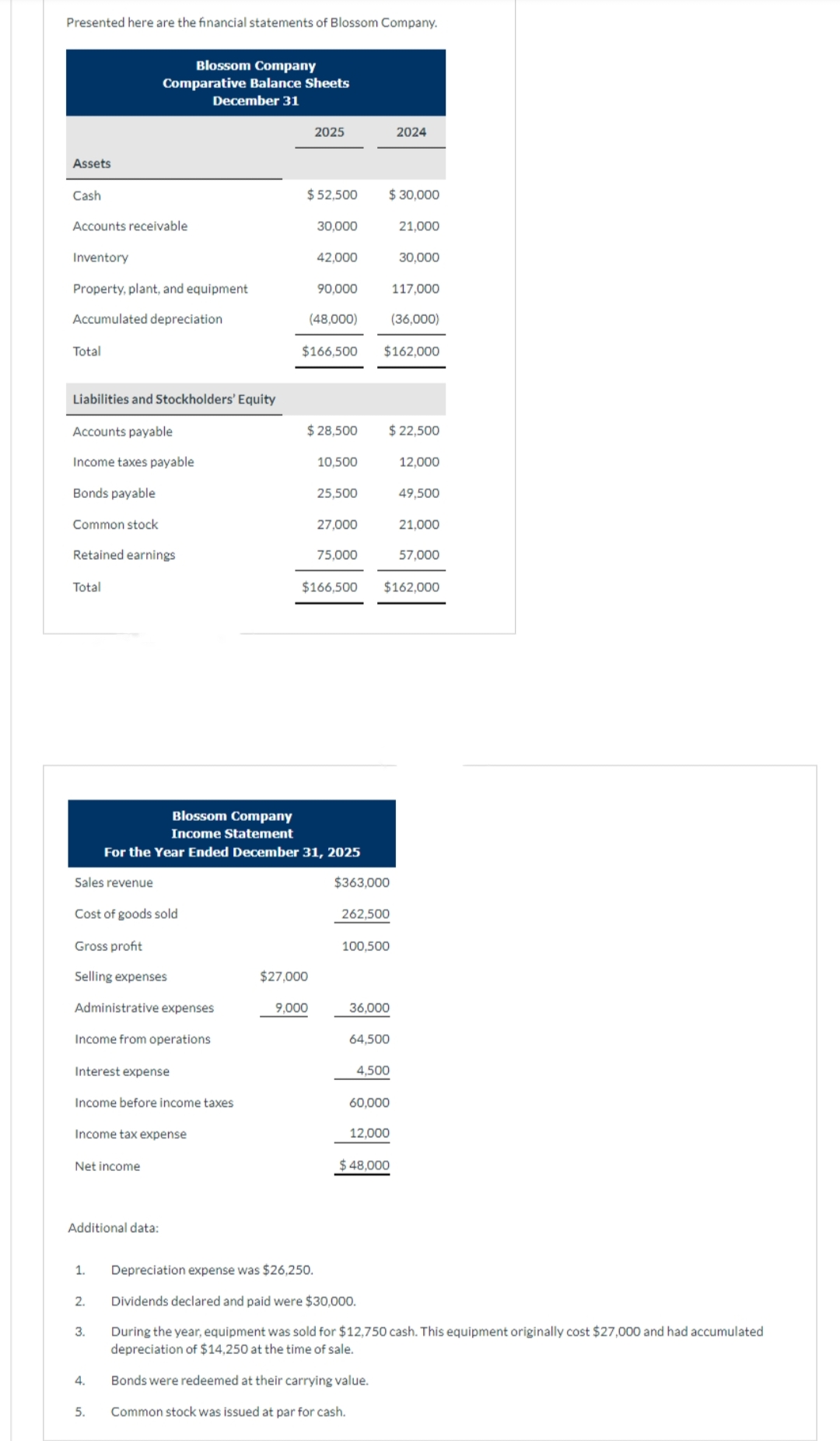

Transcribed Image Text:Presented here are the financial statements of Blossom Company.

Assets

Cash

Accounts receivable

Inventory

Property, plant, and equipment

Accumulated depreciation

Total

Liabilities and Stockholders' Equity

Accounts payable

Income taxes payable

Bonds payable

Common stock

Retained earnings

Total

Sales revenue

Cost of goods sold

Gross profit

Selling expenses

Blossom Company

Comparative Balance Sheets

December 31

Administrative expenses

Income from operations

Interest expense

Income before income taxes

Income tax expense

Net income

Additional data:

1.

3.

4.

5.

$ 52,500

2025

30,000

Blossom Company

Income Statement

For the Year Ended December 31, 2025

42,000

(48,000)

$166,500

$27,000

90,000

$ 28,500

9,000

10,500

25,500

$166,500

27,000

75,000

$ 30,000

$363,000

262,500

(36,000)

$162,000

100,500

$ 22,500

36,000

64,500

4,500

2024

60,000

Bonds were redeemed at their carrying value.

Common stock was issued at par for cash.

12,000

21,000

$162,000

$ 48,000

30,000

117,000

12,000

Depreciation expense was $26,250.

2. Dividends declared and paid were $30,000.

During the year, equipment was sold for $12,750 cash. This equipment originally cost $27,000 and had accumulated

depreciation of $14,250 at the time of sale.

49,500

21,000

57,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning