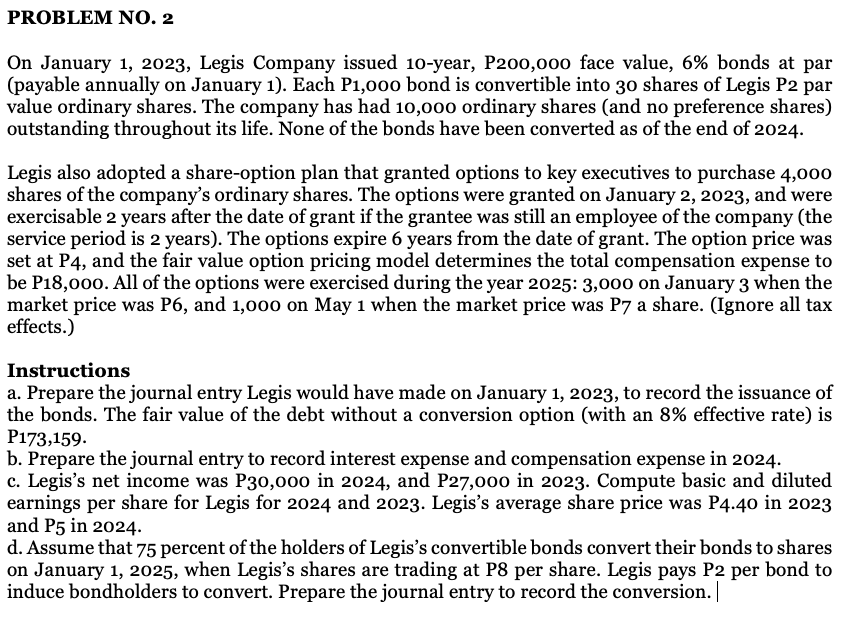

On January 1, 2023, Legis Company issued 10-year, P200,000 face value, 6% bonds at par (payable annually on January 1). Each P1,000 bond is convertible into 30 shares of Legis P2 par value ordinary shares. The company has had 10,000 ordinary shares (and no preference shares) outstanding throughout its life. None of the bonds have been converted as of the end of 2024. Legis also adopted a share-option plan that granted options to key executives to purchase 4,000 shares of the company's ordinary shares. The options were granted on January 2, 2023, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company (the service period is 2 years). The options expire 6 years from the date of grant. The option price was set at P4, and the fair value option pricing model determines the total compensation expense to be P18,000. All of the options were exercised during the year 2025: 3,000 on January 3 when the market price was P6, and 1,000 on May 1 when the market price was P7 a share. (Ignore all tax effects.)

On January 1, 2023, Legis Company issued 10-year, P200,000 face value, 6% bonds at par (payable annually on January 1). Each P1,000 bond is convertible into 30 shares of Legis P2 par value ordinary shares. The company has had 10,000 ordinary shares (and no preference shares) outstanding throughout its life. None of the bonds have been converted as of the end of 2024. Legis also adopted a share-option plan that granted options to key executives to purchase 4,000 shares of the company's ordinary shares. The options were granted on January 2, 2023, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company (the service period is 2 years). The options expire 6 years from the date of grant. The option price was set at P4, and the fair value option pricing model determines the total compensation expense to be P18,000. All of the options were exercised during the year 2025: 3,000 on January 3 when the market price was P6, and 1,000 on May 1 when the market price was P7 a share. (Ignore all tax effects.)

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 10QE

Related questions

Question

Transcribed Image Text:PROBLEM NO. 2

On January 1, 2023, Legis Company issued 10-year, P200,000 face value, 6% bonds at par

(payable annually on January 1). Each P1,000 bond is convertible into 30 shares of Legis P2 par

value ordinary shares. The company has had 10,000 ordinary shares (and no preference shares)

outstanding throughout its life. None of the bonds have been converted as of the end of 2024.

Legis also adopted a share-option plan that granted options to key executives to purchase 4,000

shares of the company's ordinary shares. The options were granted on January 2, 2023, and were

exercisable 2 years after the date of grant if the grantee was still an employee of the company (the

service period is 2 years). The options expire 6 years from the date of grant. The option price was

set at P4, and the fair value option pricing model determines the total compensation expense to

be P18,000. All of the options were exercised during the year 2025: 3,000 on January 3 when the

market price was P6, and 1,000 on May 1 when the market price was P7 a share. (Ignore all tax

effects.)

Instructions

a. Prepare the journal entry Legis would have made on January 1, 2023, to record the issuance of

the bonds. The fair value of the debt without a conversion option (with an 8% effective rate) is

P173,159.

b. Prepare the journal entry to record interest expense and compensation expense in 2024.

c. Legis's net income was P30,0o0 in 2024, and P27,000 in 2023. Compute basic and diluted

earnings per share for Legis for 2024 and 2023. Legis's average share price was P4.40 in 2023

and P5 in 2024.

d. Assume that 75 percent of the holders of Legis's convertible bonds convert their bonds to shares

on January 1, 2025, when Legis's shares are trading at P8 per share. Legis pays P2 per bond to

induce bondholders to convert. Prepare the journal entry to record the conversion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College