On January 1, 2024, Nurses Credit Union (NCU) issued 8%, 20-year bonds payable with face value of $1,100,000. These bonds pay interest on June 30 and December 31. The issue price of the bonds is 101. Journalize the following bond transactions: i (Click the icon to view the bond transactions.) (Assume bonds payable are amortized using the straight-line amortization method. Record debits first, then credits. Select explanations on the last line of the journal entry. Round your answers to the nearest whole dollar.) a. Journalize the issuance of the bonds on January 1, 2024. Date 2024 Jan. 1 Accounts and Explanation Bonds Payable Debit Credit Cash b. Journali 24. Discount on Bonds Payable Date Debit Credit 2024 Interest Expense Jun. 30 Premium on Bonds Payable c. Journalize the payment of interest and amortization on December 31, 2024. Date 2024 Dec. 31 Accounts and Explanation Debit Credit More info a. Issuance of the bonds on January 1, 2024. b. Payment of interest and amortization on June 30, 2024. c. Payment of interest and amortization on December 31, 2024. d. Retirement of the bond at maturity on December 31, 2043, assuming the last interest payment has already been recorded. Print Done d. Journalize the retirement of the bond at maturity on December 31, 2043, assuming the last interest payment has already been recorded. Accounts and Explanation Date Debit Credit 2043 Dec. 31

On January 1, 2024, Nurses Credit Union (NCU) issued 8%, 20-year bonds payable with face value of $1,100,000. These bonds pay interest on June 30 and December 31. The issue price of the bonds is 101. Journalize the following bond transactions: i (Click the icon to view the bond transactions.) (Assume bonds payable are amortized using the straight-line amortization method. Record debits first, then credits. Select explanations on the last line of the journal entry. Round your answers to the nearest whole dollar.) a. Journalize the issuance of the bonds on January 1, 2024. Date 2024 Jan. 1 Accounts and Explanation Bonds Payable Debit Credit Cash b. Journali 24. Discount on Bonds Payable Date Debit Credit 2024 Interest Expense Jun. 30 Premium on Bonds Payable c. Journalize the payment of interest and amortization on December 31, 2024. Date 2024 Dec. 31 Accounts and Explanation Debit Credit More info a. Issuance of the bonds on January 1, 2024. b. Payment of interest and amortization on June 30, 2024. c. Payment of interest and amortization on December 31, 2024. d. Retirement of the bond at maturity on December 31, 2043, assuming the last interest payment has already been recorded. Print Done d. Journalize the retirement of the bond at maturity on December 31, 2043, assuming the last interest payment has already been recorded. Accounts and Explanation Date Debit Credit 2043 Dec. 31

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 5PA: Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July...

Related questions

Question

plz help

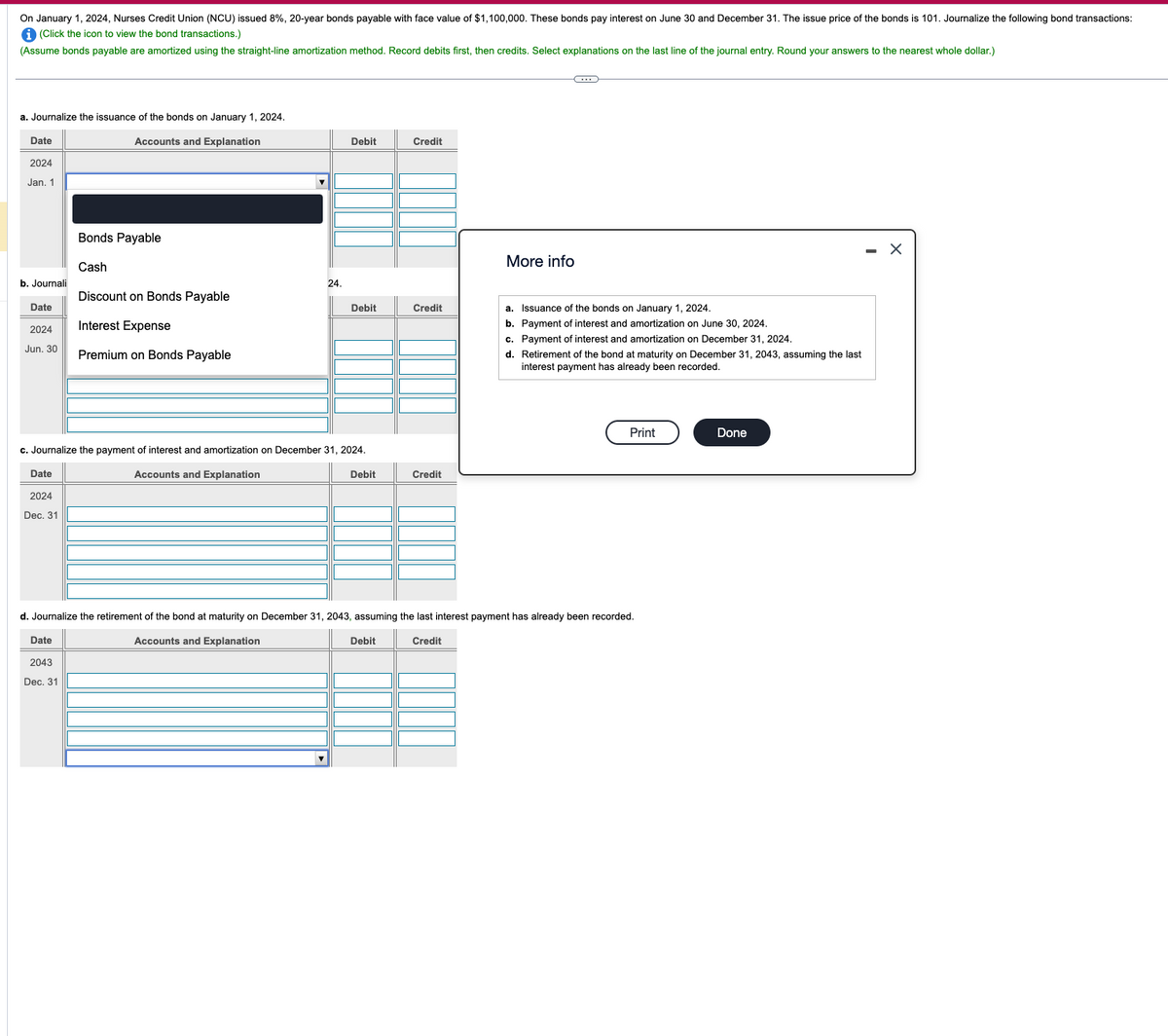

Transcribed Image Text:On January 1, 2024, Nurses Credit Union (NCU) issued 8%, 20-year bonds payable with face value of $1,100,000. These bonds pay interest on June 30 and December 31. The issue price of the bonds is 101. Journalize the following bond transactions:

i (Click the icon to view the bond transactions.)

(Assume bonds payable are amortized using the straight-line amortization method. Record debits first, then credits. Select explanations on the last line of the journal entry. Round your answers to the nearest whole dollar.)

a. Journalize the issuance of the bonds on January 1, 2024.

Date

2024

Jan. 1

Accounts and Explanation

Bonds Payable

Debit

Credit

Cash

b. Journali

24.

Discount on Bonds Payable

Date

Debit

Credit

2024

Interest Expense

Jun. 30

Premium on Bonds Payable

c. Journalize the payment of interest and amortization on December 31, 2024.

Date

2024

Dec. 31

Accounts and Explanation

Debit

Credit

More info

a. Issuance of the bonds on January 1, 2024.

b. Payment of interest and amortization on June 30, 2024.

c. Payment of interest and amortization on December 31, 2024.

d. Retirement of the bond at maturity on December 31, 2043, assuming the last

interest payment has already been recorded.

Print

Done

d. Journalize the retirement of the bond at maturity on December 31, 2043, assuming the last interest payment has already been recorded.

Accounts and Explanation

Date

Debit

Credit

2043

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT