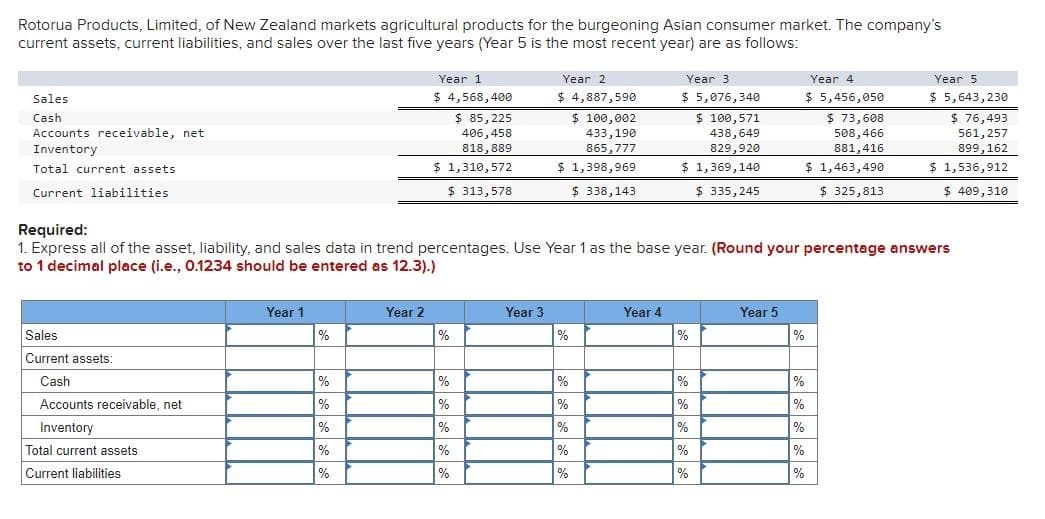

Rotorua Products, Limited, of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows: Sales Cash Accounts receivable, net Inventory Total current assets Current liabilities Required: Year 1 $ 4,568,400 $ 85,225 406,458 818,889 $ 1,310,572 $ 313,578 Year 2 $ 4,887,590 $ 100,002 433,190 865,777 $ 1,398,969 $ 338,143 Year 3 $ 5,076,340 $ 100,571 438,649 829,920 $ 1,369,140 $ 335,245 Year 4 $ 5,456,050 $ 73,608 508,466 881,416 $ 1,463,490 $ 325,813 Year 5 $ 5,643,230 $ 76,493 561,257 899,162 $ 1,536,912 $ 409,310 1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) Sales Year 1 Year 2 Year 3 Year 4 Year 5 % % % % % Current assets: Cash % % % % % Accounts receivable, net % % % % % Inventory % % % % % Total current assets % % % % % Current liabilities % % % % %

Rotorua Products, Limited, of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows: Sales Cash Accounts receivable, net Inventory Total current assets Current liabilities Required: Year 1 $ 4,568,400 $ 85,225 406,458 818,889 $ 1,310,572 $ 313,578 Year 2 $ 4,887,590 $ 100,002 433,190 865,777 $ 1,398,969 $ 338,143 Year 3 $ 5,076,340 $ 100,571 438,649 829,920 $ 1,369,140 $ 335,245 Year 4 $ 5,456,050 $ 73,608 508,466 881,416 $ 1,463,490 $ 325,813 Year 5 $ 5,643,230 $ 76,493 561,257 899,162 $ 1,536,912 $ 409,310 1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) Sales Year 1 Year 2 Year 3 Year 4 Year 5 % % % % % Current assets: Cash % % % % % Accounts receivable, net % % % % % Inventory % % % % % Total current assets % % % % % Current liabilities % % % % %

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter3: The Basics Of Record Keeping And Financial Statement Preparation: Income Statement

Section: Chapter Questions

Problem 18E

Related questions

Question

Haresh

Transcribed Image Text:Rotorua Products, Limited, of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's

current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows:

Sales

Cash

Accounts receivable, net

Inventory

Total current assets

Current liabilities

Required:

Year 1

$ 4,568,400

$ 85,225

406,458

818,889

$ 1,310,572

$ 313,578

Year 2

$ 4,887,590

$ 100,002

433,190

865,777

$ 1,398,969

$ 338,143

Year 3

$ 5,076,340

$ 100,571

438,649

829,920

$ 1,369,140

$ 335,245

Year 4

$ 5,456,050

$ 73,608

508,466

881,416

$ 1,463,490

$ 325,813

Year 5

$ 5,643,230

$ 76,493

561,257

899,162

$ 1,536,912

$ 409,310

1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers

to 1 decimal place (i.e., 0.1234 should be entered as 12.3).)

Sales

Year 1

Year 2

Year 3

Year 4

Year 5

%

%

%

%

%

Current assets:

Cash

%

%

%

%

%

Accounts receivable, net

%

%

%

%

%

Inventory

%

%

%

%

%

Total current assets

%

%

%

%

%

Current liabilities

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning