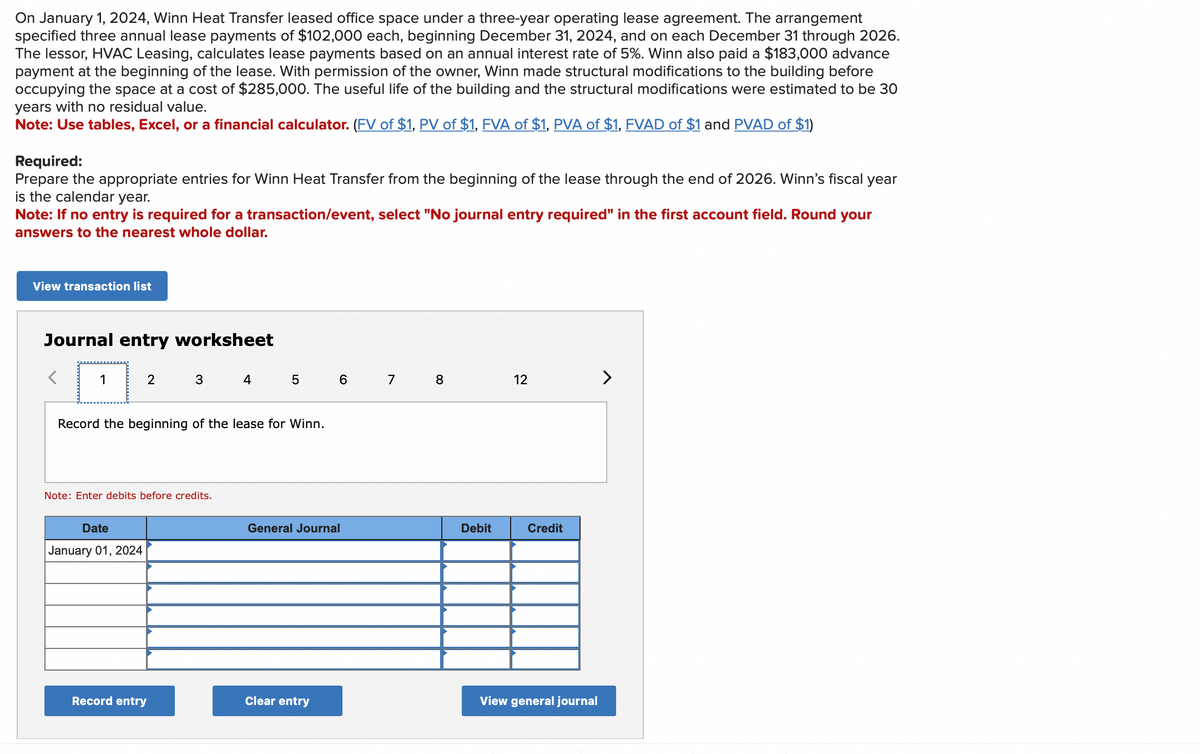

On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $102,000 each, beginning December 31, 2024, and on each December 31 through 2026. The lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 5%. Winn also paid a $183,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $285,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar. View transaction list Journal entry worksheet 1 2 Record the beginning of the lease for Winn. Date January 01, 2024 3 4 5 6 7 8 Note: Enter debits before credits. Record entry General Journal Clear entry Debit 12 Credit View general journal >

On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $102,000 each, beginning December 31, 2024, and on each December 31 through 2026. The lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 5%. Winn also paid a $183,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $285,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar. View transaction list Journal entry worksheet 1 2 Record the beginning of the lease for Winn. Date January 01, 2024 3 4 5 6 7 8 Note: Enter debits before credits. Record entry General Journal Clear entry Debit 12 Credit View general journal >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 2E: Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement...

Related questions

Question

Transcribed Image Text:On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement

specified three annual lease payments of $102,000 each, beginning December 31, 2024, and on each December 31 through 2026.

The lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 5%. Winn also paid a $183,000 advance

payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before

occupying the space at a cost of $285,000. The useful life of the building and the structural modifications were estimated to be 30

years with no residual value.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year

is the calendar year.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your

answers to the nearest whole dollar.

View transaction list

Journal entry worksheet

1

2

Date

January 01, 2024

3

Note: Enter debits before credits.

Record the beginning of the lease for Winn.

Record entry

4

5 6 7 8

General Journal

Clear entry

Debit

12

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning