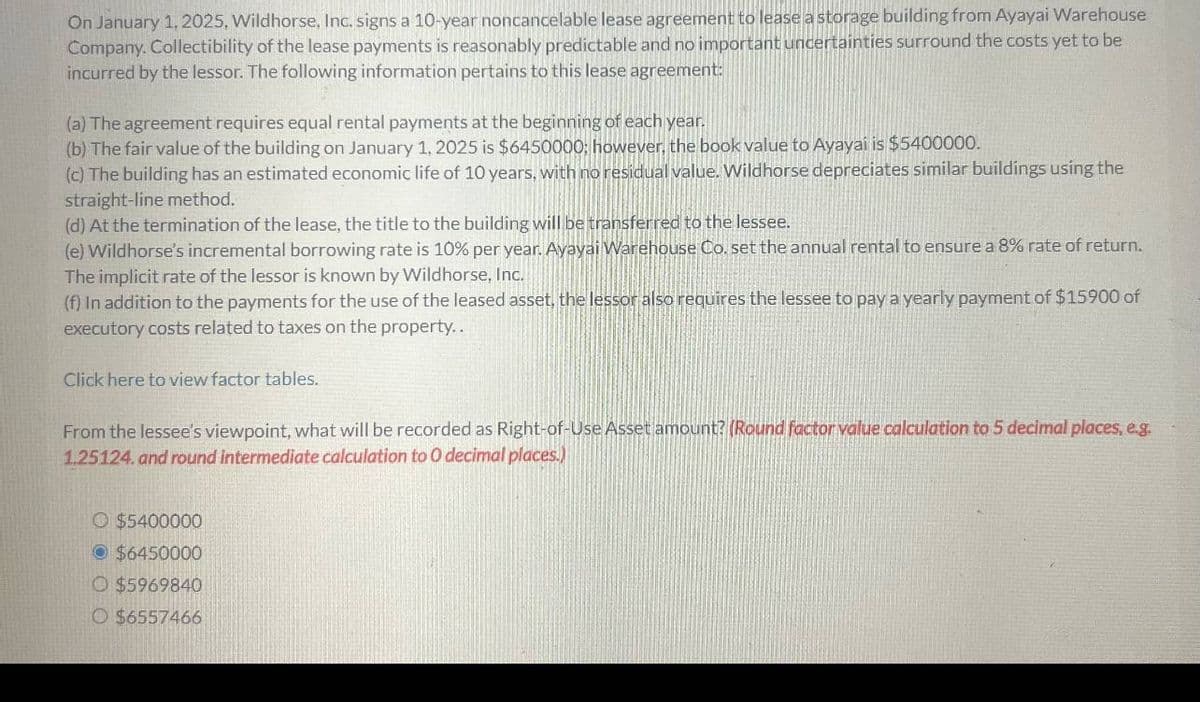

On January 1, 2025, Wildhorse, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Ayayai Warehouse Company, Collectibility of the lease payments is reasonably predictable and no important uncertainties surround the costs yet to be incurred by the lessor. The following information pertains to this lease agreement: (a) The agreement requires equal rental payments at the beginning of each year. (b) The fair value of the building on January 1, 2025 is $6450000; however, the book value to Ayayai is $5400000. (c) The building has an estimated economic life of 10 years, with no residual value. Wildhorse depreciates similar buildings using the straight-line method. (d) At the termination of the lease, the title to the building will be transferred to the lessee. (e) Wildhorse's incremental borrowing rate is 10% per year. Ayayai Warehouse Co. set the annual rental to ensure a 8% rate of return. The implicit rate of the lessor is known by Wildhorse, Inc. (f) In addition to the payments for the use of the leased asset, the lessor also requires the lessee to pay a yearly payment of $15900 of executory costs related to taxes on the property.. Click here to view factor tables. From the lessee's viewpoint, what will be recorded as Right-of-Use Asset amount? (Round factor value calculation to 5 decimal places, e.g. 1.25124. and round intermediate calculation to O decimal places.) O $5400000 $6450000 O $5969840 O $6557466

On January 1, 2025, Wildhorse, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Ayayai Warehouse Company, Collectibility of the lease payments is reasonably predictable and no important uncertainties surround the costs yet to be incurred by the lessor. The following information pertains to this lease agreement: (a) The agreement requires equal rental payments at the beginning of each year. (b) The fair value of the building on January 1, 2025 is $6450000; however, the book value to Ayayai is $5400000. (c) The building has an estimated economic life of 10 years, with no residual value. Wildhorse depreciates similar buildings using the straight-line method. (d) At the termination of the lease, the title to the building will be transferred to the lessee. (e) Wildhorse's incremental borrowing rate is 10% per year. Ayayai Warehouse Co. set the annual rental to ensure a 8% rate of return. The implicit rate of the lessor is known by Wildhorse, Inc. (f) In addition to the payments for the use of the leased asset, the lessor also requires the lessee to pay a yearly payment of $15900 of executory costs related to taxes on the property.. Click here to view factor tables. From the lessee's viewpoint, what will be recorded as Right-of-Use Asset amount? (Round factor value calculation to 5 decimal places, e.g. 1.25124. and round intermediate calculation to O decimal places.) O $5400000 $6450000 O $5969840 O $6557466

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1E: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a...

Related questions

Question

Transcribed Image Text:On January 1, 2025, Wildhorse, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Ayayai Warehouse

Company, Collectibility of the lease payments is reasonably predictable and no important uncertainties surround the costs yet to be

incurred by the lessor. The following information pertains to this lease agreement:

(a) The agreement requires equal rental payments at the beginning of each year.

(b) The fair value of the building on January 1, 2025 is $6450000; however, the book value to Ayayai is $5400000.

(c) The building has an estimated economic life of 10 years, with no residual value. Wildhorse depreciates similar buildings using the

straight-line method.

(d) At the termination of the lease, the title to the building will be transferred to the lessee.

(e) Wildhorse's incremental borrowing rate is 10% per year. Ayayai Warehouse Co. set the annual rental to ensure a 8% rate of return.

The implicit rate of the lessor is known by Wildhorse, Inc.

(f) In addition to the payments for the use of the leased asset, the lessor also requires the lessee to pay a yearly payment of $15900 of

executory costs related to taxes on the property..

Click here to view factor tables.

From the lessee's viewpoint, what will be recorded as Right-of-Use Asset amount? (Round factor value calculation to 5 decimal places, e.g.

1.25124. and round intermediate calculation to O decimal places.)

O $5400000

$6450000

O $5969840

O $6557466

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning