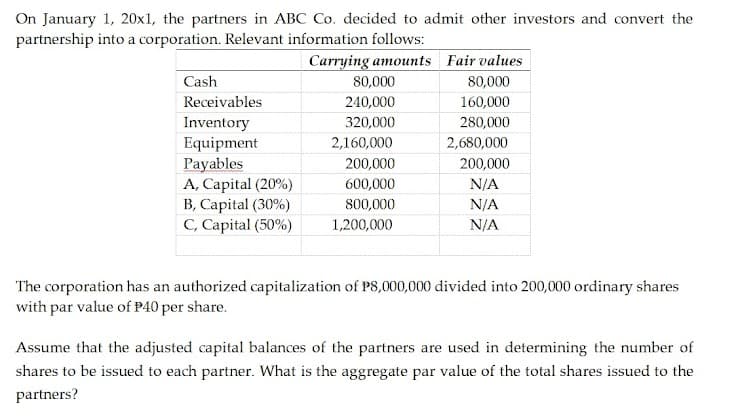

On January 1, 20x1, the partners in ABC Co. decided to admit other investors and convert the partnership into a corporation. Relevant information follows: Carrying amounts Fair values Cash 80,000 80,000 Receivables 240,000 160,000 Inventory Equipment Payables A, Capital (20%) B, Capital (30%) C, Capital (50%) 320,000 280,000 2,160,000 2,680,000 200,000 200,000 600,000 N/A 800,000 N/A 1,200,000 N/A The corporation has an authorized capitalization of PS,000,000 divided into 200,000 ordinary shares with par value of P40 per share. Assume that the adjusted capital balances of the partners are used in determining the number of shares to be issued to each partner. What is the aggregate par value of the total shares issued to the partners?

On January 1, 20x1, the partners in ABC Co. decided to admit other investors and convert the partnership into a corporation. Relevant information follows: Carrying amounts Fair values Cash 80,000 80,000 Receivables 240,000 160,000 Inventory Equipment Payables A, Capital (20%) B, Capital (30%) C, Capital (50%) 320,000 280,000 2,160,000 2,680,000 200,000 200,000 600,000 N/A 800,000 N/A 1,200,000 N/A The corporation has an authorized capitalization of PS,000,000 divided into 200,000 ordinary shares with par value of P40 per share. Assume that the adjusted capital balances of the partners are used in determining the number of shares to be issued to each partner. What is the aggregate par value of the total shares issued to the partners?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 1MC

Related questions

Question

Transcribed Image Text:On January 1, 20x1, the partners in ABC Co. decided to admit other investors and convert the

partnership into a corporation. Relevant information follows:

Carrying amounts Fair values

Cash

80,000

80,000

Receivables

240,000

160,000

320,000

Inventory

Equipment

Payables

A, Capital (20%)

B, Capital (30%)

C, Capital (50%)

280,000

2,160,000

2,680,000

200,000

200,000

600,000

N/A

800,000

N/A

1,200,000

N/A

The corporation has an authorized capitalization of P8,000,000 divided into 200,000 ordinary shares

with par value of P40 per share.

Assume that the adjusted capital balances of the partners are used in determining the number of

shares to be issued to each partner. What is the aggregate par value of the total shares issued to the

partners?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning