Prepare the journal entries in the books of the corporation.

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 53P

Related questions

Question

100%

See the problem in the photo below.

On this date, the

value of the assets was P24,000 more than the carrying value on the firm’s books. Each of the partners was issued

10,000 shares of the corporation’s P1 par ordinary share.

Prepare the

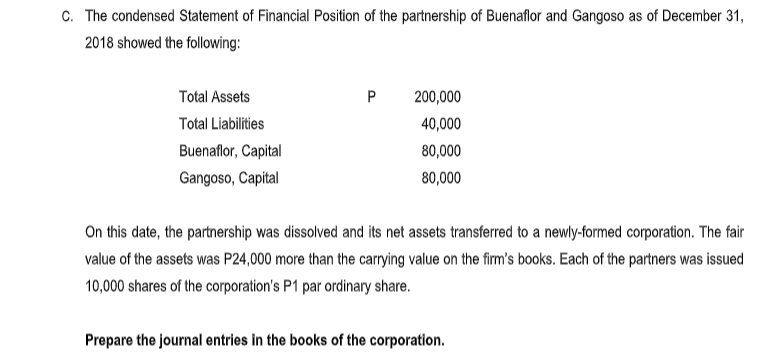

Transcribed Image Text:c. The condensed Statement of Financial Position of the partnership of Buenaflor and Gangoso as of December 31,

2018 showed the following:

Total Assets

P

200,000

Total Liabilities

40,000

Buenaflor, Capital

80,000

Gangoso, Capital

80,000

On this date, the partnership was dissolved and its net assets transferred to a newly-formed corporation.

value of the assets was P24,000 more than the carrying value on the firm's books. Each of the partners was issued

10,000 shares of the corporation's P1 par ordinary share.

Prepare the journal entries in the books of the corporation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College