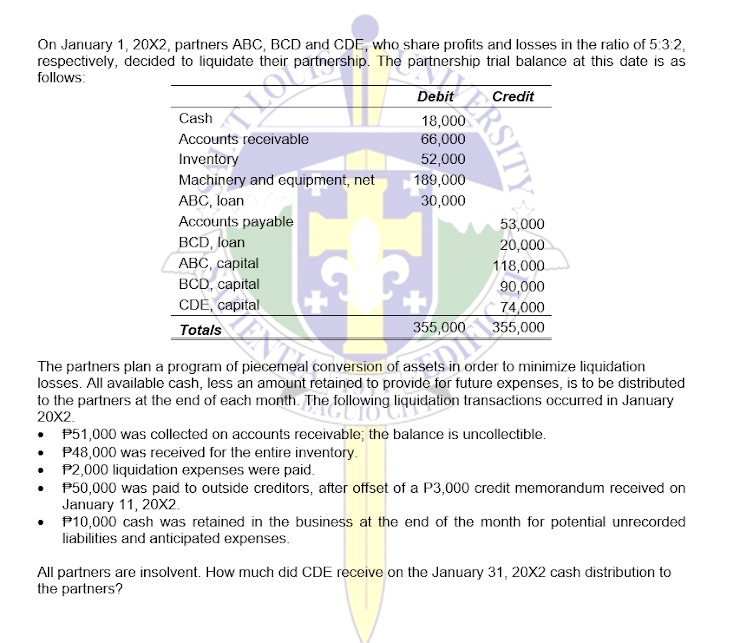

On January 1, 20X2, partners ABC, BCD and CDE, who share profits and losses in the ratio of 5:3:2, respectively, decided to liquidate their partnership. The partnership trial balance at this date is as follows: Credit Cash Accounts receivable Debit 18,000 66,000 52,000 189,000 30,000 Inventory Machinery and equipment, net ABC, loan Accounts payable BCD, loan 53,000 20,000 ABC, capital 118,000 BCD, capital CDE, capital Totals 2.. 90,000 74,000 355,000 355,000 The partners plan a program of piecemeal conversion of assets in order to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month. The following liquidation transactions occurred in January 20X2. . P51,000 was collected on accounts receivable; the balance is uncollectible. P48,000 was received for the entire inventory. P2,000 liquidation expenses were paid. P50,000 was paid to outside creditors, after offset of a P3,000 credit memorandum received on January 11, 20X2. • P10,000 cash was retained in the business at the end of the month for potential unrecorded liabilities and anticipated expenses. All partners are insolvent. How much did CDE receive on the January 31, 20X2 cash distribution to the partners? ERSITY

On January 1, 20X2, partners ABC, BCD and CDE, who share profits and losses in the ratio of 5:3:2, respectively, decided to liquidate their partnership. The partnership trial balance at this date is as follows: Credit Cash Accounts receivable Debit 18,000 66,000 52,000 189,000 30,000 Inventory Machinery and equipment, net ABC, loan Accounts payable BCD, loan 53,000 20,000 ABC, capital 118,000 BCD, capital CDE, capital Totals 2.. 90,000 74,000 355,000 355,000 The partners plan a program of piecemeal conversion of assets in order to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, is to be distributed to the partners at the end of each month. The following liquidation transactions occurred in January 20X2. . P51,000 was collected on accounts receivable; the balance is uncollectible. P48,000 was received for the entire inventory. P2,000 liquidation expenses were paid. P50,000 was paid to outside creditors, after offset of a P3,000 credit memorandum received on January 11, 20X2. • P10,000 cash was retained in the business at the end of the month for potential unrecorded liabilities and anticipated expenses. All partners are insolvent. How much did CDE receive on the January 31, 20X2 cash distribution to the partners? ERSITY

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:On January 1, 20X2, partners ABC, BCD and CDE, who share profits and losses in the ratio of 5:3:2,

respectively, decided to liquidate their partnership. The partnership trial balance at this date is as

follows:

Debit

Credit

Cash

Accounts receivable

18,000

66,000

52,000

Inventory

Machinery and equipment, net

189,000

30,000

ABC, loan

Accounts payable

53,000

20,000

BCD, loan

118,000

ABC, capital

BCD, capital

CDE, capital

Totals

Pr

90,000

74,000

355,000

355,000

The partners plan a program of piecemeal conversion of assets in order to minimize liquidation

losses. All available cash, less an amount retained to provide for future expenses, is to be distributed

to the partners at the end of each month. The following liquidation transactions occurred in January

P51,000 was collected on accounts receivable; the balance is uncollectible.

P48,000 was received for the entire inventory.

P2,000 liquidation expenses were paid.

P50,000 was paid to outside creditors, after offset of a P3,000 credit memorandum received on

January 11, 20X2.

P10,000 cash was retained in the business at the end of the month for potential unrecorded

liabilities and anticipated expenses.

All partners are insolvent. How much did CDE receive on the January 31, 20X2 cash distribution to

the partners?

ERSITY

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College