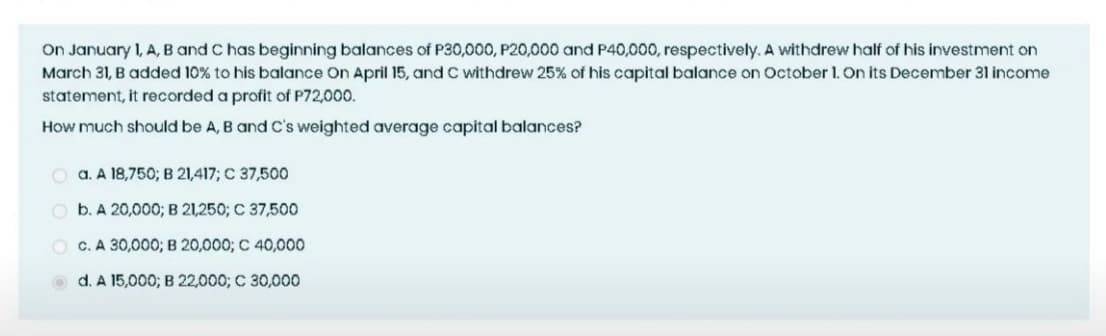

On January 1, A, B and C has beginning balances of P30,000, P20,000 and P40,000, respectively. A withdrew half of his investment on March 31, B added 10% to his balance On April 15, and C withdrew 25% of his capital balance on October 1. On its December 31 income statement, it recorded a profit of P72,000. How much should be A, B and C's weighted average capital balances? O a. A 18,750; B 21,417; C 37,500 O b. A 20,000; B 21,250; C 37,500 O C. A 30,000; B 20,000; C 40,000 o d. A 15,000; B 22,000; C 30,000

On January 1, A, B and C has beginning balances of P30,000, P20,000 and P40,000, respectively. A withdrew half of his investment on March 31, B added 10% to his balance On April 15, and C withdrew 25% of his capital balance on October 1. On its December 31 income statement, it recorded a profit of P72,000. How much should be A, B and C's weighted average capital balances? O a. A 18,750; B 21,417; C 37,500 O b. A 20,000; B 21,250; C 37,500 O C. A 30,000; B 20,000; C 40,000 o d. A 15,000; B 22,000; C 30,000

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 20EB: Trumpet and Trombone Manufacturing, Inc. began the year with a retained earnings balance of...

Related questions

Question

Hi can someone help me with this? Thank you.

Transcribed Image Text:On January 1, A, B and C has beginning balances of P30,000, P20,000 and P40,000, respectively. A withdrew half of his investment on

March 31, B added 10% to his balance On April 15, and C withdrew 25% of his capital balance on October 1. On its December 31 income

statement, it recorded a profit of P72,000.

How much should be A, B and C's weighted average capital balances?

O a. A 18,750;B 21,417; C 37,500

O b. A 20,000; B 21,250; C 37,500

O C. A 30,000; B 20,000; C 40,000

O d. A 15,000; B 22,000; C 30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning