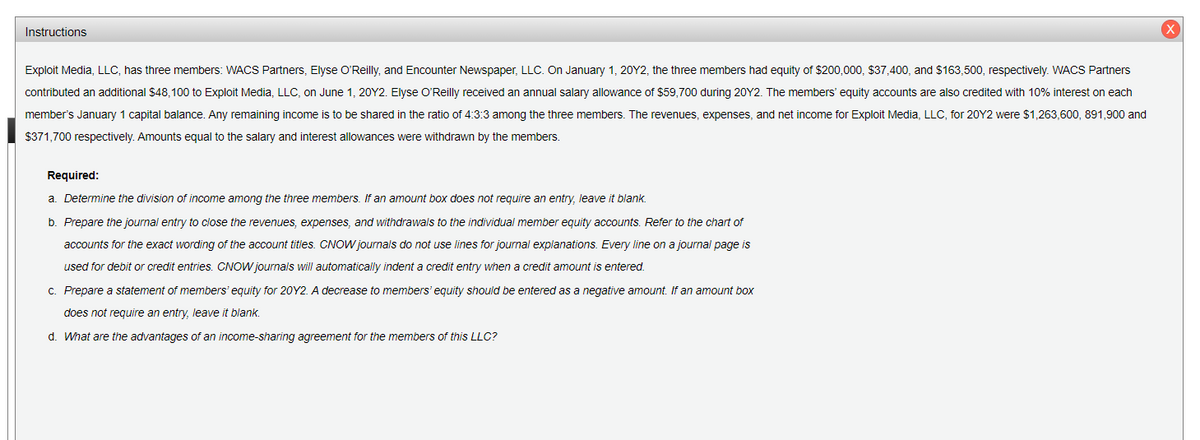

Exploit Media, LLC, has three members: WACS Partners, Elyse O'Reilly, and Encounter Newspaper, LLC. On January 1, 20Y2, the three members had equity of $200,000, $37,400, and $163,500, respectively. WACS Partners contributed an additional $48,100 to Exploit Media, LLC, on June 1, 20Y2. Elyse O'Reilly received an annual salary allowance of $59,700 during 20Y2. The members' equity accounts are also credited with 10% interest on each member's January 1 capital balance. Any remaining income is to be shared in the ratio of 4:3:3 among the three members. The revenues, expenses, and net income for Exploit Media, LLC, for 20Y2 were $1,263,600, 891,900 and $371,700 respectively. Amounts equal to the salary and interest allowances were withdrawn by the members. Required: a. Determine the division of income among the three members. If an amount box does not require an entry, leave it blank. b. Prepare the journal entry to close the revenues, expenses, and withdrawals to the individual member equity accounts. Refer to the chart of accounts for the exact wording of the account tities. CNOW jourmals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. C. Prepare a statement of members' equity for 20Y2. A decrease to members' equity should be entered as a negative amount. If an amount box does not require an entry, leave it blank. d. What are the advantages of an income-sharing agreement for the members of this LLC?

Exploit Media, LLC, has three members: WACS Partners, Elyse O'Reilly, and Encounter Newspaper, LLC. On January 1, 20Y2, the three members had equity of $200,000, $37,400, and $163,500, respectively. WACS Partners contributed an additional $48,100 to Exploit Media, LLC, on June 1, 20Y2. Elyse O'Reilly received an annual salary allowance of $59,700 during 20Y2. The members' equity accounts are also credited with 10% interest on each member's January 1 capital balance. Any remaining income is to be shared in the ratio of 4:3:3 among the three members. The revenues, expenses, and net income for Exploit Media, LLC, for 20Y2 were $1,263,600, 891,900 and $371,700 respectively. Amounts equal to the salary and interest allowances were withdrawn by the members. Required: a. Determine the division of income among the three members. If an amount box does not require an entry, leave it blank. b. Prepare the journal entry to close the revenues, expenses, and withdrawals to the individual member equity accounts. Refer to the chart of accounts for the exact wording of the account tities. CNOW jourmals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. C. Prepare a statement of members' equity for 20Y2. A decrease to members' equity should be entered as a negative amount. If an amount box does not require an entry, leave it blank. d. What are the advantages of an income-sharing agreement for the members of this LLC?

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 3DQ

Related questions

Question

.

Transcribed Image Text:Instructions

Exploit Media, LLC, has three members: WACS Partners, Elyse O'Reilly, and Encounter Newspaper, LLC. On January 1, 20Y2, the three members had equity of $200,000, $37,400, and $163,500, respectively. WACS Partners

contributed an additional $48,100 to Exploit Media, LLC, on June 1, 20Y2. Elyse O'Reilly received an annual salary allowance of $59,700 during 20Y2. The members' equity accounts are also credited with 10% interest on each

member's January 1 capital balance. Any remaining income is to be shared in the ratio of 4:3:3 among the three members. The revenues, expenses, and net income for Exploit Media, LLC, for 20Y2 were $1,263,600, 891,900 and

$371,700 respectively. Amounts equal to the salary and interest allowances were withdrawn by the members.

Required:

a. Determine the division of income among the three members. If an amount box does not require an entry, leave it blank.

b. Prepare the journal entry to close the revenues, expenses, and withdrawals to the individual member equity accounts. Refer to the chart of

accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is

used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

C. Prepare a statement of members' equity for 20Y2. A decrease to members' equity should be entered as a negative amount, If an amount box

does not require an entry, leave it blank.

d. What are the advantages of an income-sharing agreement for the members of this LLC?

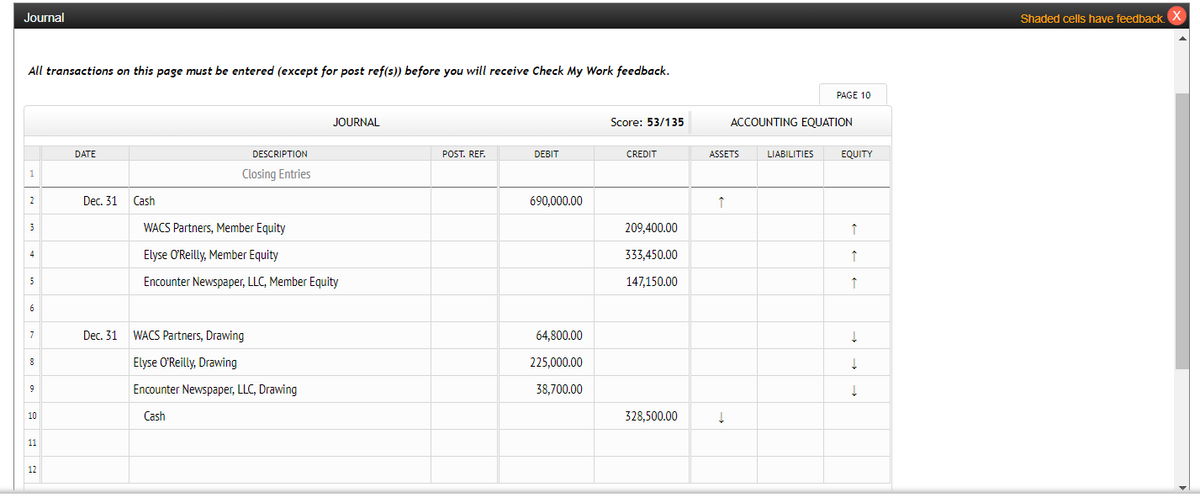

Transcribed Image Text:Journal

Shaded cells have feedback. X

All transactions on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback.

PAGE 10

JOURNAL

Score: 53/135

ACCOUNTING EQUATION

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

ASSETS

LIABILITIES

EQUITY

1

Closing Entries

2

Dec. 31

Cash

690,000.00

WACS Partners, Member Equity

209,400.00

3

↑

Elyse O'Reilly, Member Equity

333,450.00

4

Encounter Newspaper, LLC, Member Equity

147,150.00

5

6

Dec. 31

WACS Partners, Drawing

64,800.00

Elyse O'Reilly, Drawing

225,000.00

8

Encounter Newspaper, LLC, Drawing

38,700.00

9

10

Cash

328,500.00

11

12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning