On January 1, Puroland Corporation was incorporated, with 100,000 authorized ordinaryshares of P100 par value. On the same date, 50,000 shares were sold and issued at P110 per share. On May 14, the corporation reacquired 800 ordinary shares at P120 per share. On September 16, 500 treasury shares were sold at P110. At the end of the year, the corporation realized a net income of $950,000. Out of unrestricted retained earnings, cash dividend of P300,000 was paid and P150,000 was appropriated for contingencies. How much is total shareholders' equity as of December 31?

On January 1, Puroland Corporation was incorporated, with 100,000 authorized ordinaryshares of P100 par value. On the same date, 50,000 shares were sold and issued at P110 per share. On May 14, the corporation reacquired 800 ordinary shares at P120 per share. On September 16, 500 treasury shares were sold at P110. At the end of the year, the corporation realized a net income of $950,000. Out of unrestricted retained earnings, cash dividend of P300,000 was paid and P150,000 was appropriated for contingencies. How much is total shareholders' equity as of December 31?

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 4PA: Wingra Corporation was organized in March. It is authorized to issue 500,000 shares of $100 par...

Related questions

Question

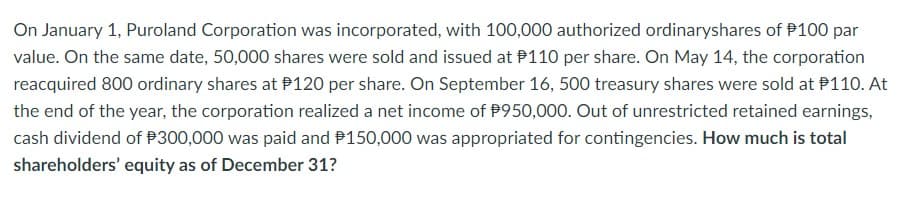

Transcribed Image Text:On January 1, Puroland Corporation was incorporated, with 100,000 authorized ordinaryshares of $100 par

value. On the same date, 50,000 shares were sold and issued at $110 per share. On May 14, the corporation

reacquired 800 ordinary shares at $120 per share. On September 16, 500 treasury shares were sold at $110. At

the end of the year, the corporation realized a net income of $950,000. Out of unrestricted retained earnings,

cash dividend of $300,000 was paid and $150,000 was appropriated for contingencies. How much is total

shareholders' equity as of December 31?

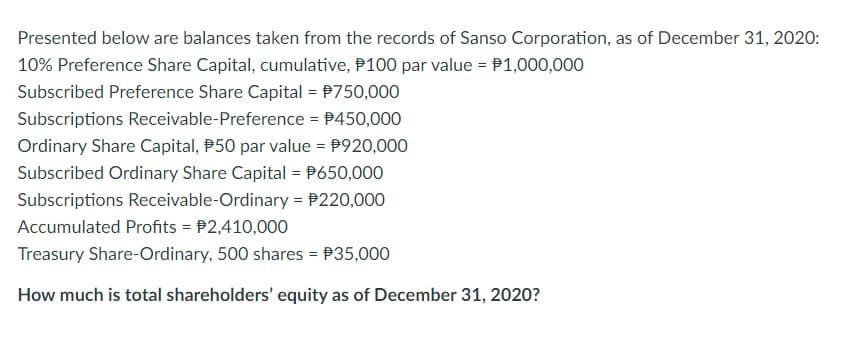

Transcribed Image Text:Presented below are balances taken from the records of Sanso Corporation, as of December 31, 2020:

10% Preference Share Capital, cumulative, #100 par value = $1,000,000

Subscribed Preference Share Capital = $750,000

Subscriptions Receivable-Preference = $450,000

Ordinary Share Capital, 50 par value = $920,000

Subscribed Ordinary Share Capital = $650,000

Subscriptions Receivable-Ordinary = $220,000

Accumulated Profits = $2,410,000

Treasury Share-Ordinary, 500 shares = $35,000

How much is total shareholders' equity as of December 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning