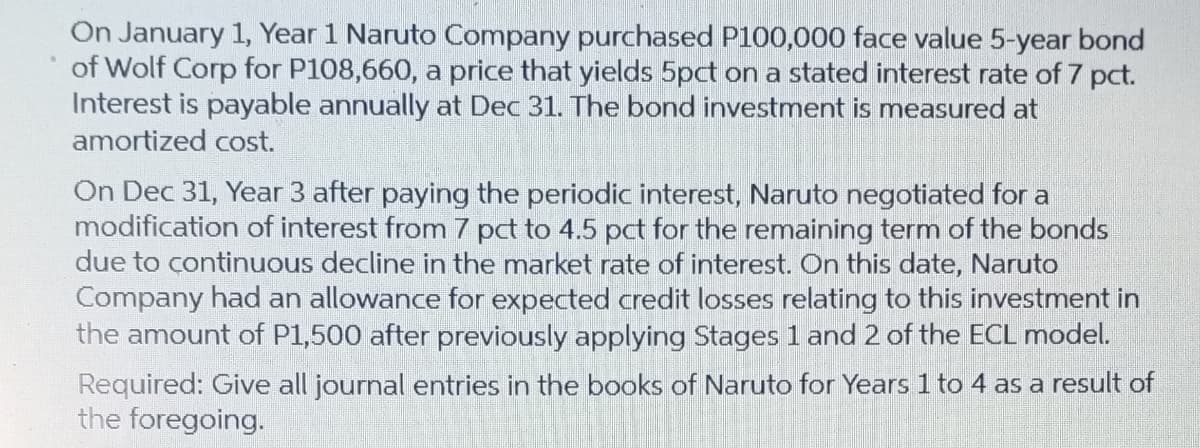

On January 1, Year 1 Naruto Company purchased P100,000 face value 5-year bond of Wolf Corp for P108,660, a price that yields 5pct on a stated interest rate of 7 pct. Interest is payable annually at Dec 31. The bond investment is measured at amortized cost. On Dec 31, Year 3 after paying the periodic interest, Naruto negotiated for a modification of interest from 7 pct to 4.5 pct for the remaining term of the bonds due to continuous decline in the market rate of interest. On this date, Naruto Company had an allowance for expected credit losses relating to this investment in the amount of P1,500 after previously applying Stages 1 and 2 of the ECL model. Required: Give all journal entries in the books of Naruto for Years 1 to 4 as a result of the foregoing.

On January 1, Year 1 Naruto Company purchased P100,000 face value 5-year bond of Wolf Corp for P108,660, a price that yields 5pct on a stated interest rate of 7 pct. Interest is payable annually at Dec 31. The bond investment is measured at amortized cost. On Dec 31, Year 3 after paying the periodic interest, Naruto negotiated for a modification of interest from 7 pct to 4.5 pct for the remaining term of the bonds due to continuous decline in the market rate of interest. On this date, Naruto Company had an allowance for expected credit losses relating to this investment in the amount of P1,500 after previously applying Stages 1 and 2 of the ECL model. Required: Give all journal entries in the books of Naruto for Years 1 to 4 as a result of the foregoing.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 7C

Related questions

Question

Transcribed Image Text:On January 1, Year 1 Naruto Company purchased P100,000 face value 5-year bond

of Wolf Corp for P108,660, a price that yields 5pct on a stated interest rate of 7 pct.

Interest is payable annually at Dec 31. The bond investment is measured at

amortized cost.

On Dec 31, Year 3 after paying the periodic interest, Naruto negotiated for a

modification of interest from 7 pct to 4.5 pct for the remaining term of the bonds

due to continuous decline in the market rate of interest. On this date, Naruto

Company had an allowance for expected credit losses relating to this investment in

the amount of P1,500 after previously applying Stages 1 and 2 of the ECL model.

Required: Give all journal entries in the books of Naruto for Years 1 to 4 as a result of

the foregoing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,