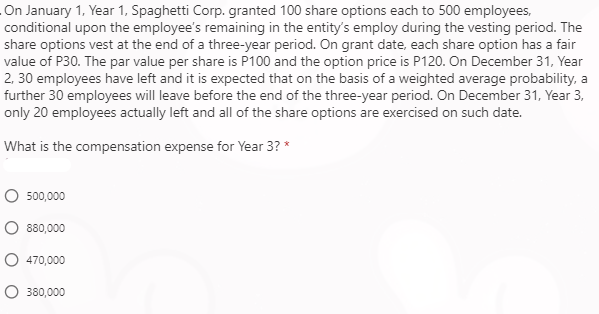

On January 1, Year 1, Spaghetti Corp. granted 100 share options each to 500 employees, conditional upon the employee's remaining in the entity's employ during the vesting period. The share options vest at the end of a three-year period. On grant date, each share option has a fair value of P30. The par value per share is P100 and the option price is P120. On December 31, Year 2, 30 employees have left and it is expected that on the basis of a weighted average probability, a further 30 employees will leave before the end of the three-year period. On December 31, Year 3, only 20 employees actually left and all of the share options are exercised on such date. What is the compensation expense for Year 3? * O 500,000 O 880,000 O 470,000 O 380,000

On January 1, Year 1, Spaghetti Corp. granted 100 share options each to 500 employees, conditional upon the employee's remaining in the entity's employ during the vesting period. The share options vest at the end of a three-year period. On grant date, each share option has a fair value of P30. The par value per share is P100 and the option price is P120. On December 31, Year 2, 30 employees have left and it is expected that on the basis of a weighted average probability, a further 30 employees will leave before the end of the three-year period. On December 31, Year 3, only 20 employees actually left and all of the share options are exercised on such date. What is the compensation expense for Year 3? * O 500,000 O 880,000 O 470,000 O 380,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 7RE: On January 1, 2019, Phoenix Corporation adopts a performance-based share option plan for 25...

Related questions

Question

13

Transcribed Image Text:On January 1, Year 1, Spaghetti Corp. granted 100 share options each to 500 employees,

conditional upon the employee's remaining in the entity's employ during the vesting period. The

share options vest at the end of a three-year period. On grant date, each share option has a fair

value of P30. The par value per share is P100 and the option price is P120. On December 31, Year

2, 30 employees have left and it is expected that on the basis of a weighted average probability, a

further 30 employees will leave before the end of the three-year period. On December 31, Year 3,

only 20 employees actually left and all of the share options are exercised on such date.

What is the compensation expense for Year 3? *

O 500,000

O 880,000

O 470,000

O 380,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT