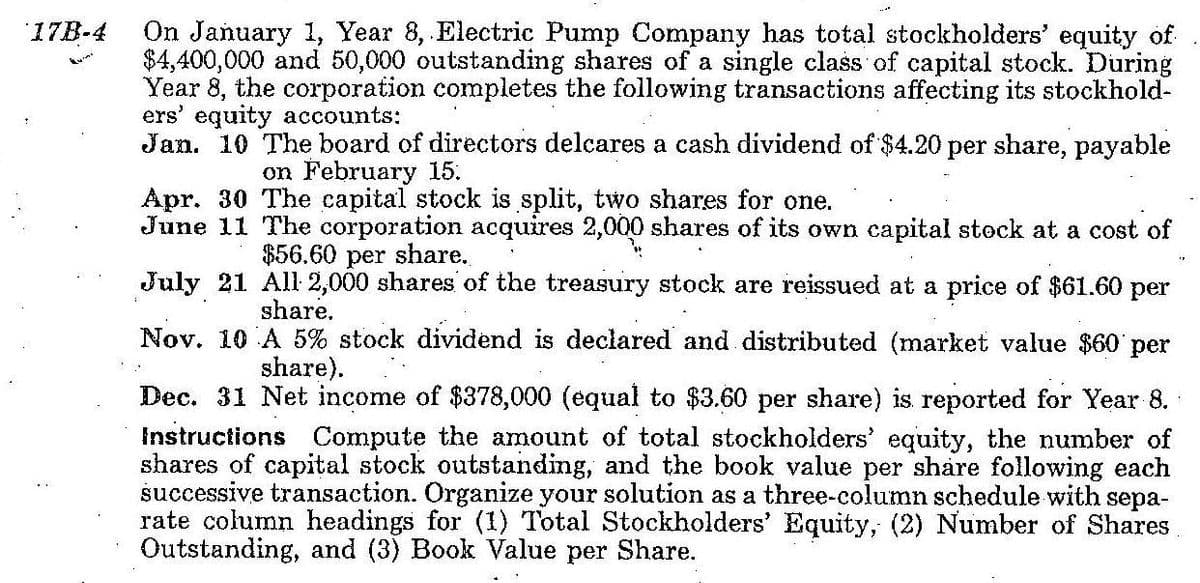

On January 1, Year 8, Electric Pump Company has total stockholders' equity of $4,400,000 and 50,000 outstanding shares of a single class of capital stock. During Year 8, the corporation completes the foillowing transactions affecting its stockhold- ers' equity accounts: Jan. 10 The board of directors delcares a cash dividend of $4.20 per share, payable 17B-4 on February 15. Apr. 30 The capital stock is split, two shares for one. June 11 The corporation acquires 2,000 shares of its own capital steck at a cost of $56.60 per share. July 21 All 2,000 shares of the treasury stock are reissued at a price of $61.60 per share. Nov. 10 A 5% stock dividend is declared and distributed (market value $60 per share). Dec. 31 Net income of $378,000 (equal to $3.60 per share) is reported for Year 8. Instructions Compute the amount of total stockholders' equity, the number of shares of capital stock outstanding, and the book value per share following each successive transaction. Organize your solution as a three-column schedule with sepa- rate column headings for (1) Total Stockholders' Equity, (2) Number of Shares

On January 1, Year 8, Electric Pump Company has total stockholders' equity of $4,400,000 and 50,000 outstanding shares of a single class of capital stock. During Year 8, the corporation completes the foillowing transactions affecting its stockhold- ers' equity accounts: Jan. 10 The board of directors delcares a cash dividend of $4.20 per share, payable 17B-4 on February 15. Apr. 30 The capital stock is split, two shares for one. June 11 The corporation acquires 2,000 shares of its own capital steck at a cost of $56.60 per share. July 21 All 2,000 shares of the treasury stock are reissued at a price of $61.60 per share. Nov. 10 A 5% stock dividend is declared and distributed (market value $60 per share). Dec. 31 Net income of $378,000 (equal to $3.60 per share) is reported for Year 8. Instructions Compute the amount of total stockholders' equity, the number of shares of capital stock outstanding, and the book value per share following each successive transaction. Organize your solution as a three-column schedule with sepa- rate column headings for (1) Total Stockholders' Equity, (2) Number of Shares

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 3PA: The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the...

Related questions

Question

100%

plzz answer it properly thank u

Transcribed Image Text:On January 1, Year 8, Electric Pump Company has total stockholders' equity of

$4,400,000 and 50,000 outstanding shares of a single class of capital stock. During

Year 8, the corporation completes the following transactions affecting its stockhold-

ers' equity accounts:

Jan. 10 The board of directors delcares a cash dividend of $4.20 per share, payable

17B-4

on February 15.

Apr. 30 The capital stock is split, two shares for one.

June 11 The corporation acquires 2,000 shares of its own capital stock at a cost of

$56.60 per share.

July 21 All: 2,000 shares of the treasury stock are reissued at a price of $61.60 per

share.

Nov. 10 A 5% stock dividend is declared and distributed (market value $60 per

share).

Dec. 31 Net income of $378,000 (equal to $3.60 per share) is reported for Year 8.

Instructions Compute the amount of total stockholders' equity, the number of

shares of capital stock outstanding, and the book value per share following each

successive transaction. Organize your solution as a three-column schedule with sepa-

rate column headings for (1) Total Stockholders' Equity, (2) Number of Shares

Outstanding, and (3) Book Value per Share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College