On January 1. 2

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 8RE: On January 2, 2019, Brust Corporation grants its new CFO 2,000 restricted share units. Each of the...

Related questions

Question

100%

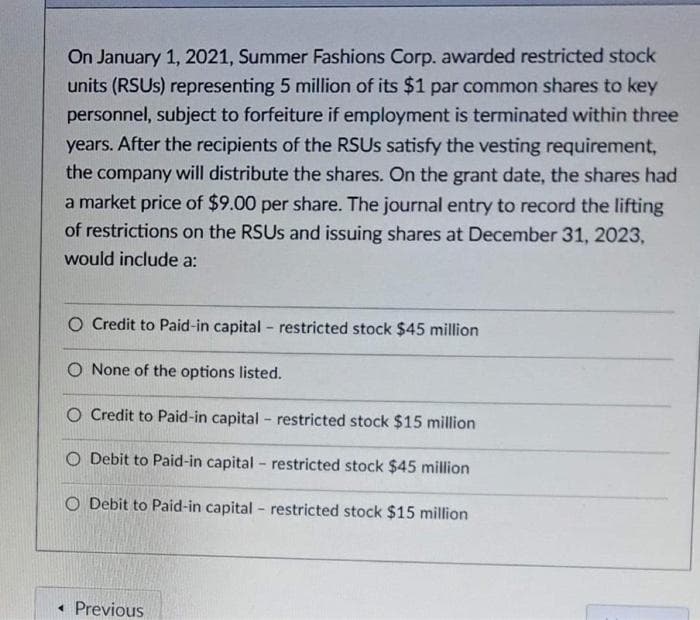

Transcribed Image Text:On January 1, 2021, Summer Fashions Corp. awarded restricted stock

units (RSUS) representing 5 million of its $1 par common shares to key

personnel, subject to forfeiture if employment is terminated within three

years. After the recipients of the RSUS satisfy the vesting requirement,

the company will distribute the shares. On the grant date, the shares had

a market price of $9.00 per share. The journal entry to record the lifting

of restrictions on the RSUS and issuing shares at December 31, 2023,

would include a:

O Credit to Paid-in capital - restricted stock $45 million

O None of the options listed.

O Credit to Paid-in capital - restricted stock $15 million

O Debit to Paid-in capital - restricted stock $45 million

O Debit to Paid-in capital - restricted stock $15 million

• Previous

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT