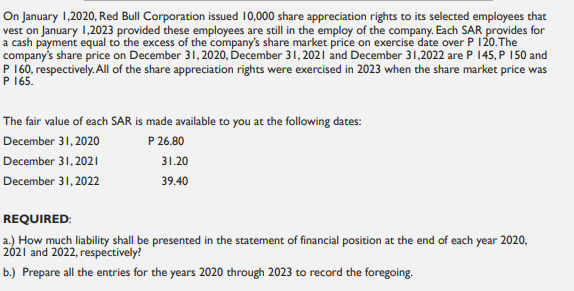

On January 1,2020, Red Bull Corporation issued 10,000 share appreciation rights to its selected employees that vest on January 1,2023 provided these employees are still in the employ of the company. Each SAR provides for a cash payment equal to the excess of the company's share market price on exercise date over P 12O.The company's share price on December 31, 2020, December 31, 2021 and December 31,2022 are P 145, P I50 and P 160, respectively. All of the share appreciation rights were exercised in 2023 when the share market price was P 165. The fair value of each SAR is made available to you at the following dates: December 31, 2020 P 26.80 December 31, 2021 31.20 December 31, 2022 39.40 REQUIRED: a.) How much liability shall be presented in the statement of financial position at the end of each 2021 and 2022, respectively! year 2020, b.) Prepare all the entries for the years 2020 through 2023 to record the foregoing.

On January 1,2020, Red Bull Corporation issued 10,000 share appreciation rights to its selected employees that vest on January 1,2023 provided these employees are still in the employ of the company. Each SAR provides for a cash payment equal to the excess of the company's share market price on exercise date over P 12O.The company's share price on December 31, 2020, December 31, 2021 and December 31,2022 are P 145, P I50 and P 160, respectively. All of the share appreciation rights were exercised in 2023 when the share market price was P 165. The fair value of each SAR is made available to you at the following dates: December 31, 2020 P 26.80 December 31, 2021 31.20 December 31, 2022 39.40 REQUIRED: a.) How much liability shall be presented in the statement of financial position at the end of each 2021 and 2022, respectively! year 2020, b.) Prepare all the entries for the years 2020 through 2023 to record the foregoing.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:On January 1,2020, Red Bull Corporation issued 10,000 share appreciation rights to its selected employees that

vest on January 1,2023 provided these employees are still in the employ of the company. Each SAR provides for

a cash payment equal to the excess of the company's share market price on exercise date over P 12o.The

company's share price on December 31, 2020, December 31, 2021 and December 31,2022 are P 145, P 150 and

P 160, respectively. All of the share appreciation rights were exercised in 2023 when the share market price was

P 165.

The fair value of each SAR is made available to you at the following dates:

December 31, 2020

P 26.80

December 31, 2021

31.20

December 31, 2022

39.40

REQUIRED:

a.) How much liability shall be presented in the statement of financial position at the end of each year 2020,

2621 and 2022, respectively?

b.) Prepare all the entries for the years 2020 through 2023 to record the foregoing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning