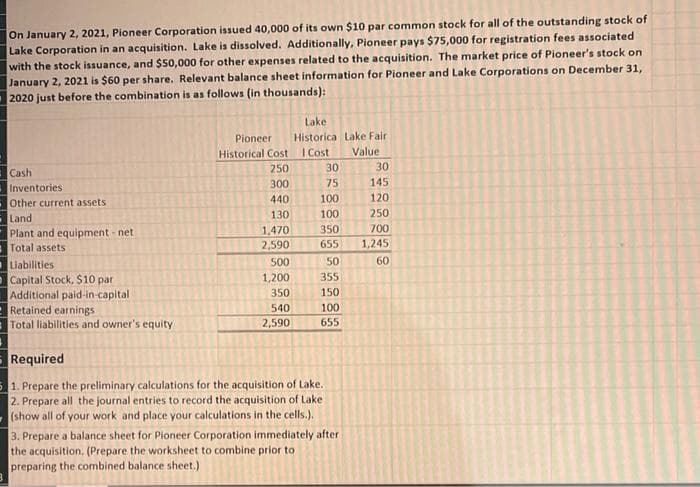

On January 2, 2021, Pioneer Corporation issued 40,000 of its own $10 par common stock for all of the outstanding stock of Lake Corporation in an acquisition. Lake is dissolved. Additionally, Pioneer pays $75,000 for registration fees associated with the stock issuance, and $50,000 for other expenses related to the acquisition. The market price of Pioneer's stock on January 2, 2021 is $60 per share. Relevant balance sheet information for Pioneer and Lake Corporations on December 31, 2020 just before the combination is as follows (in thousands):

On January 2, 2021, Pioneer Corporation issued 40,000 of its own $10 par common stock for all of the outstanding stock of Lake Corporation in an acquisition. Lake is dissolved. Additionally, Pioneer pays $75,000 for registration fees associated with the stock issuance, and $50,000 for other expenses related to the acquisition. The market price of Pioneer's stock on January 2, 2021 is $60 per share. Relevant balance sheet information for Pioneer and Lake Corporations on December 31, 2020 just before the combination is as follows (in thousands):

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Transcribed Image Text:On January 2, 2021, Pioneer Corporation issued 40,000 of its own $10 par common stock for all of the outstanding stock of

Lake Corporation in an acquisition. Lake is dissolved. Additionally, Pioneer pays $75,000 for registration fees associated

with the stock issuance, and $50,000 for other expenses related to the acquisition. The market price of Pioneer's stock on

January 2, 2021 is $60 per share. Relevant balance sheet information for Pioneer and Lake Corporations on December 31,

2020 just before the combination is as follows (in thousands):

Lake

Pioneer

Historica Lake Fair

Historical Cost

I Cost

Value

250

30

30

Cash

300

75

145

Inventories

Other current assets

440

100

120

130

100

250

Land

Plant and equipment - net

Total assets

1,470

350

700

2,590

655

1,245

500

50

60

Liabilities

Capital Stock, $10 par

Additional paid-in-capital

Retained earnings

Total liabilities and owner's equity

1,200

355

350

150

540

100

2,590

655

-Required

5 1. Prepare the preliminary calculations for the acquisition of Lake.

2. Prepare all the journal entries to record the acquisition of Lake

(show all of your work and place your calculations in the cells.).

3. Prepare a balance sheet for Pioneer Corporation immediately after

the acquisition. (Prepare the worksheet to combine prior to

preparing the combined balance sheet.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT