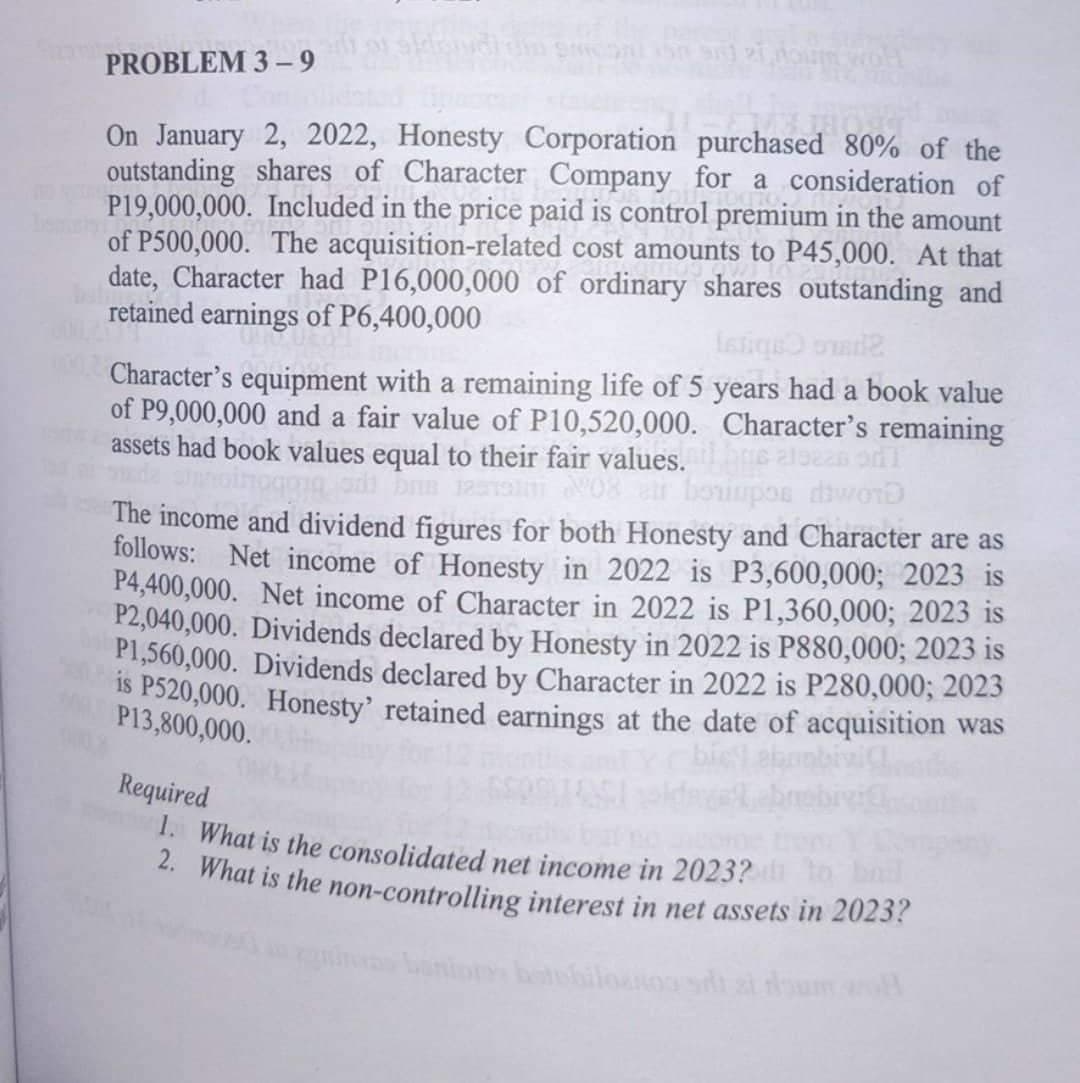

On January 2, 2022, Honesty Corporation purchased 80% of the THO outstanding shares of Character Company for a consideration of P19,000,000. Included in the price paid is control premium in the amount of P500,000. The acquisition-related cost amounts to P45,000. At that date, Character had P16,000,000 of ordinary shares outstanding and retained earnings of P6,400,000 Istiqomade Character's equipment with a remaining life of 5 years had a book value of P9,000,000 and a fair value of P10,520,000. Character's remaining assets had book values equal to their fair values. od brn 1219 08 at boriupos word The income and dividend figures for both Honesty and Character are as follows: Net income of Honesty in 2022 is P3,600,000; 2023 is P4,400,000. Net income of Character in 2022 is P1,360,000; 2023 is P2,040,000. Dividends declared by Honesty in 2022 is P880,000; 2023 is P1,560,000. Dividends declared by Character in 2022 is P280,000; 2023 is P520,000. Honesty' retained earnings at the date of acquisition was P13,800,000. Required 1. What is the consolidated net income in 2023? 2. What is the non-controlling interest in net assets in 2023?

On January 2, 2022, Honesty Corporation purchased 80% of the THO outstanding shares of Character Company for a consideration of P19,000,000. Included in the price paid is control premium in the amount of P500,000. The acquisition-related cost amounts to P45,000. At that date, Character had P16,000,000 of ordinary shares outstanding and retained earnings of P6,400,000 Istiqomade Character's equipment with a remaining life of 5 years had a book value of P9,000,000 and a fair value of P10,520,000. Character's remaining assets had book values equal to their fair values. od brn 1219 08 at boriupos word The income and dividend figures for both Honesty and Character are as follows: Net income of Honesty in 2022 is P3,600,000; 2023 is P4,400,000. Net income of Character in 2022 is P1,360,000; 2023 is P2,040,000. Dividends declared by Honesty in 2022 is P880,000; 2023 is P1,560,000. Dividends declared by Character in 2022 is P280,000; 2023 is P520,000. Honesty' retained earnings at the date of acquisition was P13,800,000. Required 1. What is the consolidated net income in 2023? 2. What is the non-controlling interest in net assets in 2023?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

Answer the problem with solutions

Transcribed Image Text:PROBLEM 3-9

On January 2, 2022, Honesty Corporation purchased 80% of the

outstanding shares of Character Company for a consideration of

P19,000,000. Included in the price paid is control premium in the amount

of P500,000. The acquisition-related cost amounts to P45,000. At that

date, Character had P16,000,000 of ordinary shares outstanding and

retained earnings of P6,400,000

Istiqe omad2

Character's equipment with a remaining life of 5 years had a book value

of P9,000,000 and a fair value of P10,520,000. Character's remaining

assets had book values equal to their fair values.

ons aleas onl

ad be assim 08 er boriupos word

The income and dividend figures for both Honesty and Character are as

follows: Net income of Honesty in 2022 is P3,600,000; 2023 is

P4,400,000. Net income of Character in 2022 is P1,360,000; 2023 is

P2,040,000. Dividends declared by Honesty in 2022 is P880,000; 2023 is

P1,560,000. Dividends declared by Character in 2022 is P280,000; 2023

is P520,000. Honesty' retained earnings at the date of acquisition was

P13,800,000.

Required

1. What is the consolidated net income in 2023? to bad

2. What is the non-controlling interest in net assets in 2023?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning