On January 6, 20Y8, Bulldog Co. purchased 26% of the outstanding common stock of $119,000. Gator Co. paid total dividends of $13,100 to all shareholders on June 30, 20Y8. Gator had a net loss of $23,800 for 20Y8. a. Journalize Bulldog's purchase of the stock, receipt of the dividends, and the adjusting entry for the equity loss in Gator Co. stock. Jan. 6 - Purchase June 30 - Dividend Dec. 31 - Equity Loss b. Compute the balance of Investment in Gator Co. Stock on December 31, 20Y8, $4 c. How does valuing an investment under the equity method differ from valuing an investment at fair value? Under the method, the investor will record their proportionate share of the net increase (or decrease) of the book value of the investee resulting from earnings and dividend distributions. The - method uses market price information to value the investment in the investee.

On January 6, 20Y8, Bulldog Co. purchased 26% of the outstanding common stock of $119,000. Gator Co. paid total dividends of $13,100 to all shareholders on June 30, 20Y8. Gator had a net loss of $23,800 for 20Y8. a. Journalize Bulldog's purchase of the stock, receipt of the dividends, and the adjusting entry for the equity loss in Gator Co. stock. Jan. 6 - Purchase June 30 - Dividend Dec. 31 - Equity Loss b. Compute the balance of Investment in Gator Co. Stock on December 31, 20Y8, $4 c. How does valuing an investment under the equity method differ from valuing an investment at fair value? Under the method, the investor will record their proportionate share of the net increase (or decrease) of the book value of the investee resulting from earnings and dividend distributions. The - method uses market price information to value the investment in the investee.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 11SPB

Related questions

Question

100%

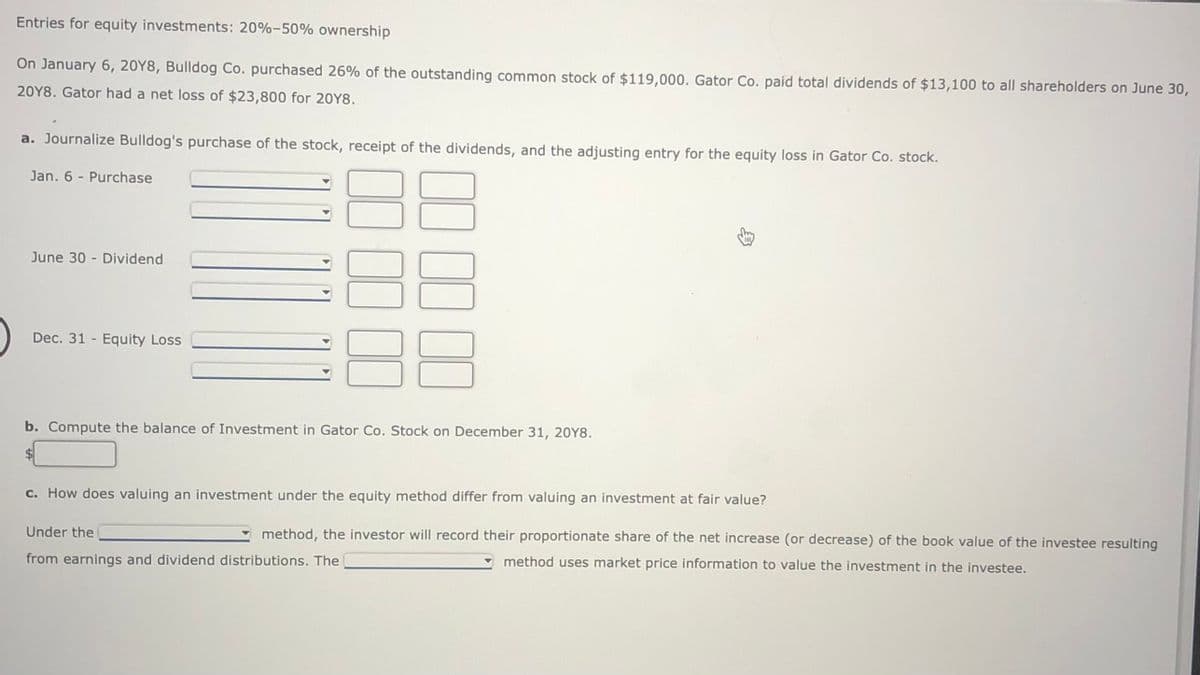

Transcribed Image Text:Entries for equity investments: 20%-50% ownership

On January 6, 20Y8, Bulldog Co. purchased 26% of the outstanding common stock of $119,000. Gator Co. paid total dividends of $13,100 to all shareholders on June 30,

20Y8. Gator had a net loss of $23,800 for 20Y8.

a. Journalize Bulldog's purchase of the stock, receipt of the dividends, and the adjusting entry for the equity loss in Gator Co. stock.

Jan. 6 - Purchase

June 30 - Dividend

Dec. 31 - Equity Loss

b. Compute the balance of Investment in Gator Co. Stock on December 31, 20Y8.

$4

c. How does valuing an investment under the equity method differ from valuing an investment at fair value?

Under the

method, the investor will record their proportionate share of the net increase (or decrease) of the book value of the investee resulting

from earnings and dividend distributions. The

method uses market price information to value the investment in the investee.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning