On February 22, Stewart Corporation acquired 7,200 shares of the 200,000 outstanding shares of Edwards Co. common stock at $42 plus commission charges of $170. On June 1, a cash dividend of $1.85 per share was received. On November 12, 3,100 shares were sold at $49 less commission charges of $165. Using the cost method, journalize the entries for (a) the purchase of stock, (b) the receipt of dividends, and (c) the sale of 3,100 shares. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers to the nearest dollar. ournal JOURNAL Score: 56/88 Shaded cells have feedback. ACCOUNTING EQUATION

On February 22, Stewart Corporation acquired 7,200 shares of the 200,000 outstanding shares of Edwards Co. common stock at $42 plus commission charges of $170. On June 1, a cash dividend of $1.85 per share was received. On November 12, 3,100 shares were sold at $49 less commission charges of $165. Using the cost method, journalize the entries for (a) the purchase of stock, (b) the receipt of dividends, and (c) the sale of 3,100 shares. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers to the nearest dollar. ournal JOURNAL Score: 56/88 Shaded cells have feedback. ACCOUNTING EQUATION

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 11SPA

Related questions

Question

Transcribed Image Text:a

5

e

re

dv

ver

Re

ed

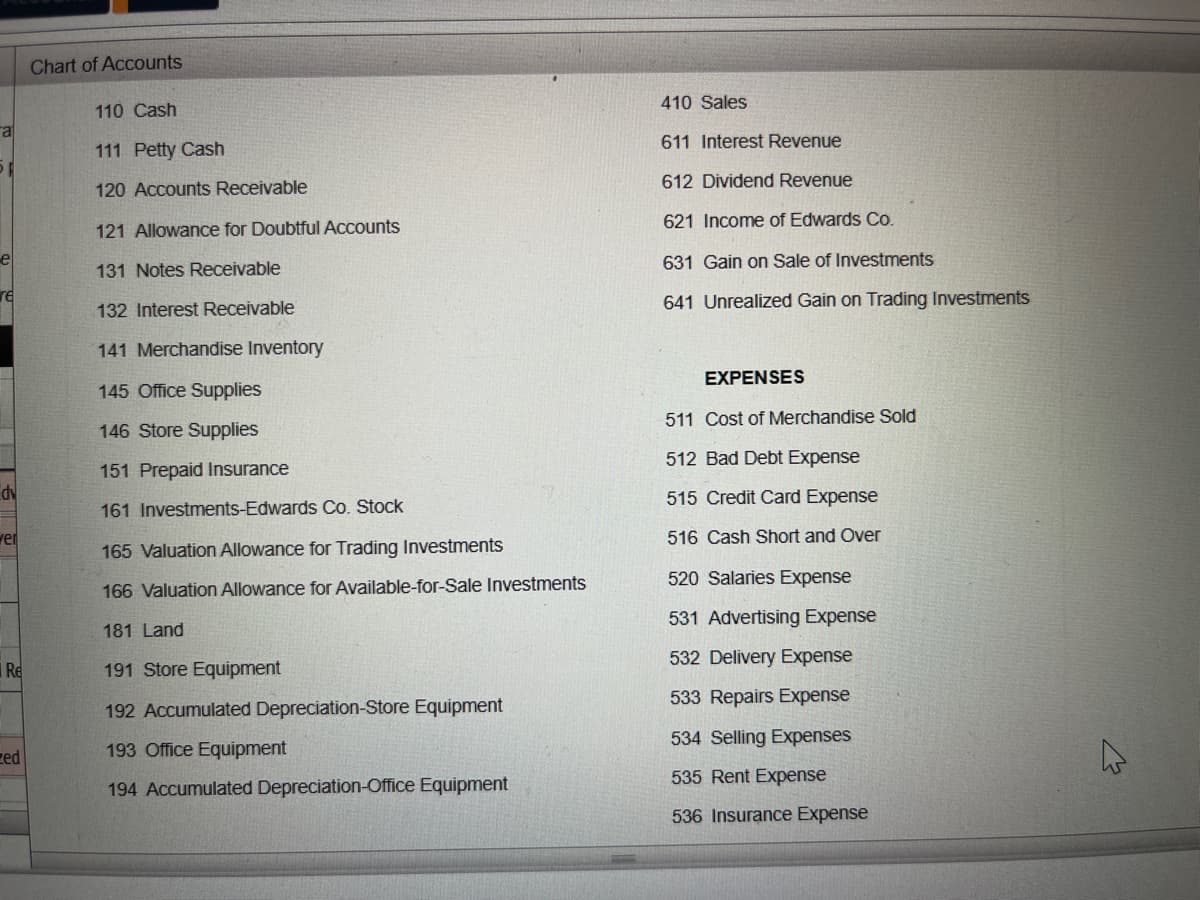

Chart of Accounts

110 Cash

111 Petty Cash

120 Accounts Receivable

121 Allowance for Doubtful Accounts

131 Notes Receivable

132 Interest Receivable

141 Merchandise Inventory

145 Office Supplies

146 Store Supplies

151 Prepaid Insurance

161 Investments-Edwards Co. Stock

165 Valuation Allowance for Trading Investments

166 Valuation Allowance for Available-for-Sale Investments

181 Land

191 Store Equipment

192 Accumulated Depreciation-Store Equipment

193 Office Equipment

194 Accumulated Depreciation-Office Equipment

410 Sales

611 Interest Revenue

612 Dividend Revenue

621 Income of Edwards Co.

631 Gain on Sale of Investments

641 Unrealized Gain on Trading Investments

EXPENSES

511 Cost of Merchandise Sold

512 Bad Debt Expense

515 Credit Card Expense

516 Cash Short and Over

520 Salaries Expense

531 Advertising Expense

532 Delivery Expense

533 Repairs Expense

534 Selling Expenses

535 Rent Expense

536 Insurance Expense

M

Transcribed Image Text:Show Me How

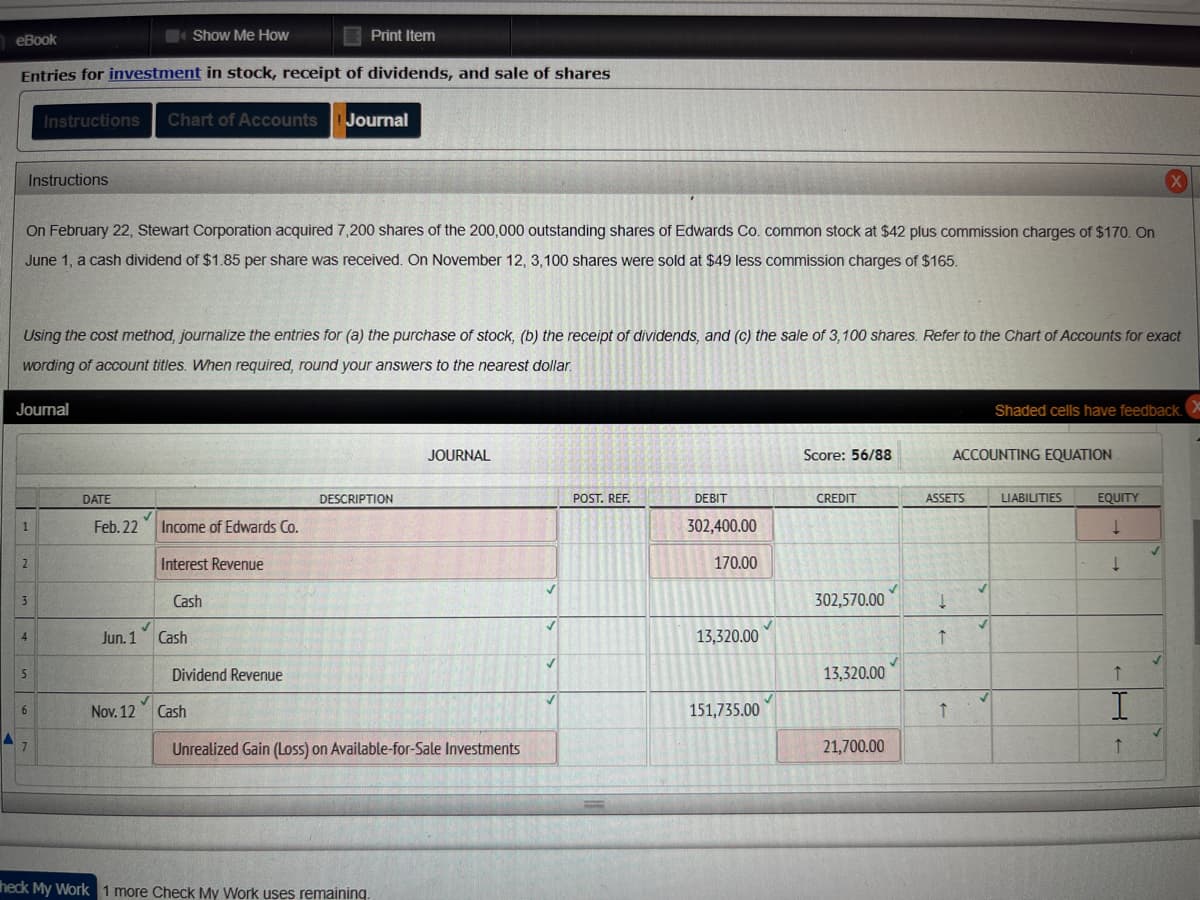

Entries for investment in stock, receipt of dividends, and sale of shares

eBook

Instructions

On February 22, Stewart Corporation acquired 7,200 shares of the 200,000 outstanding shares of Edwards Co. common stock at $42 plus commission charges of $170. On

June 1, a cash dividend of $1.85 per share was received. On November 12, 3,100 shares were sold at $49 less commission charges of $165.

Journal

1

Using the cost method, journalize the entries for (a) the purchase of stock, (b) the receipt of dividends, and (c) the sale of 3,100 shares. Refer to the Chart of Accounts for exact

wording of account titles. When required, round your answers to the nearest dollar.

2

3

4

Instructions Chart of Accounts !Journal

5

6

7

DATE

Feb. 22

Jun. 1

✓

Income of Edwards Co.

Interest Revenue

Print Item

Cash

Cash

Dividend Revenue

Nov. 12 Cash

DESCRIPTION

JOURNAL

Unrealized Gain (Loss) on Available-for-Sale Investments

heck My Work 1 more Check My Work uses remaining.

✓

POST. REF.

DEBIT

302,400.00

170.00

13,320.00

151,735.00

Score: 56/88

CREDIT

302,570.00

13,320.00

21,700.00

ASSETS

Į

↑

↑

ACCOUNTING EQUATION

✓

✓

Shaded cells have feedback.

LIABILITIES

X

EQUITY

↓

↓

↑

I

↑

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,