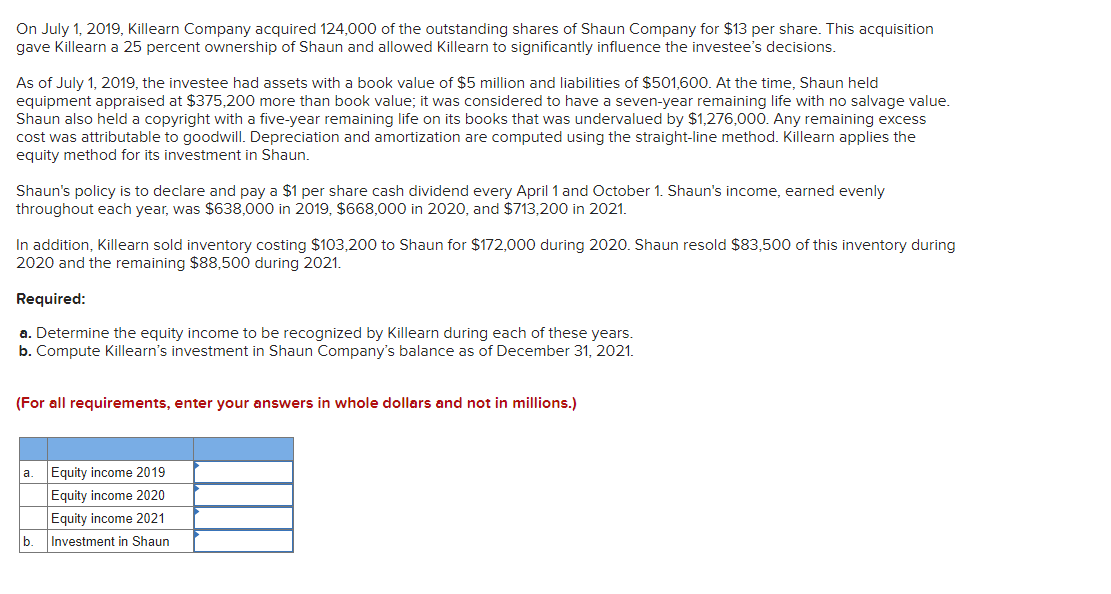

On July 1, 2019, Killearn Company acquired 124,000 of the outstanding shares of Shaun Company for $13 per share. This acquisition gave Killearn a 25 percent ownership of Shaun and allowed Killearn to significantly influence the investee's decisions. As of July 1, 2019, the investee had assets with a book value of $5 million and liabilities of $501,600. At the time, Shaun held equipment appraised at $375,200 more than book value; it was considered to have a seven-year remaining life with no salvage value. Shaun also held a copyright with a five-year remaining life on its books that was undervalued by $1,276,000. Any remaining excess cost was attributable to goodwill. Depreciation and amortization are computed using the straight-line method. Killearn applies the equity method for its investment in Shaun. Shaun's policy is to declare and pay a $1 per share cash dividend every April 1 and October 1. Shaun's income, earned evenly throughout each year, was $638,000 in 2019, $668,000 in 2020, and $713,200 in 2021. In addition, Killearn sold inventory costing $103,200 to Shaun for $172,000 during 2020. Shaun resold $83,500 of this inventory during 2020 and the remaining $88,500 during 2021. Required: a. Determine the equity income to be recognized by Killearn during each of these years. b. Compute Killearn's investment in Shaun Company's balance as of December 31, 2021. (For all requirements, enter your answers in whole dollars and not in millions.) a. Equity income 2019 Equity income 2020 Equity income 2021 b. Investment in Shaun

On July 1, 2019, Killearn Company acquired 124,000 of the outstanding shares of Shaun Company for $13 per share. This acquisition gave Killearn a 25 percent ownership of Shaun and allowed Killearn to significantly influence the investee's decisions. As of July 1, 2019, the investee had assets with a book value of $5 million and liabilities of $501,600. At the time, Shaun held equipment appraised at $375,200 more than book value; it was considered to have a seven-year remaining life with no salvage value. Shaun also held a copyright with a five-year remaining life on its books that was undervalued by $1,276,000. Any remaining excess cost was attributable to goodwill. Depreciation and amortization are computed using the straight-line method. Killearn applies the equity method for its investment in Shaun. Shaun's policy is to declare and pay a $1 per share cash dividend every April 1 and October 1. Shaun's income, earned evenly throughout each year, was $638,000 in 2019, $668,000 in 2020, and $713,200 in 2021. In addition, Killearn sold inventory costing $103,200 to Shaun for $172,000 during 2020. Shaun resold $83,500 of this inventory during 2020 and the remaining $88,500 during 2021. Required: a. Determine the equity income to be recognized by Killearn during each of these years. b. Compute Killearn's investment in Shaun Company's balance as of December 31, 2021. (For all requirements, enter your answers in whole dollars and not in millions.) a. Equity income 2019 Equity income 2020 Equity income 2021 b. Investment in Shaun

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:On July 1, 2019, Killearn Company acquired 124,000 of the outstanding shares of Shaun Company for $13 per share. This acquisition

gave Killearn a 25 percent ownership of Shaun and allowed Killearn to significantly influence the investee's decisions.

As of July 1, 2019, the investee had assets with a book value of $5 million and liabilities of $501,600. At the time, Shaun held

equipment appraised at $375,200 more than book value; it was considered to have a seven-year remaining life with no salvage value.

Shaun also held a copyright with a five-year remaining life on its books that was undervalued by $1,276,000. Any remaining excess

cost was attributable to goodwill. Depreciation and amortization are computed using the straight-line method. Killearn applies the

equity method for its investment in Shaun.

Shaun's policy is to declare and pay a $1 per share cash dividend every April 1 and October 1. Shaun's income, earned evenly

throughout each year, was $638,000 in 2019, $668,000 in 2020, and $713,200 in 2021.

In addition, Killearn sold inventory costing $103,200 to Shaun for $172,000 during 2020. Shaun resold $83,500 of this inventory during

2020 and the remaining $88,500 during 2021.

Required:

a. Determine the equity income to be recognized by Killearn during each of these years.

b. Compute Killearn's investment in Shaun Company's balance as of December 31, 2021.

(For all requirements, enter your answers in whole dollars and not in millions.)

a.

Equity income 2019

Equity income 2020

Equity income 2021

b.

Investment in Shaun

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning