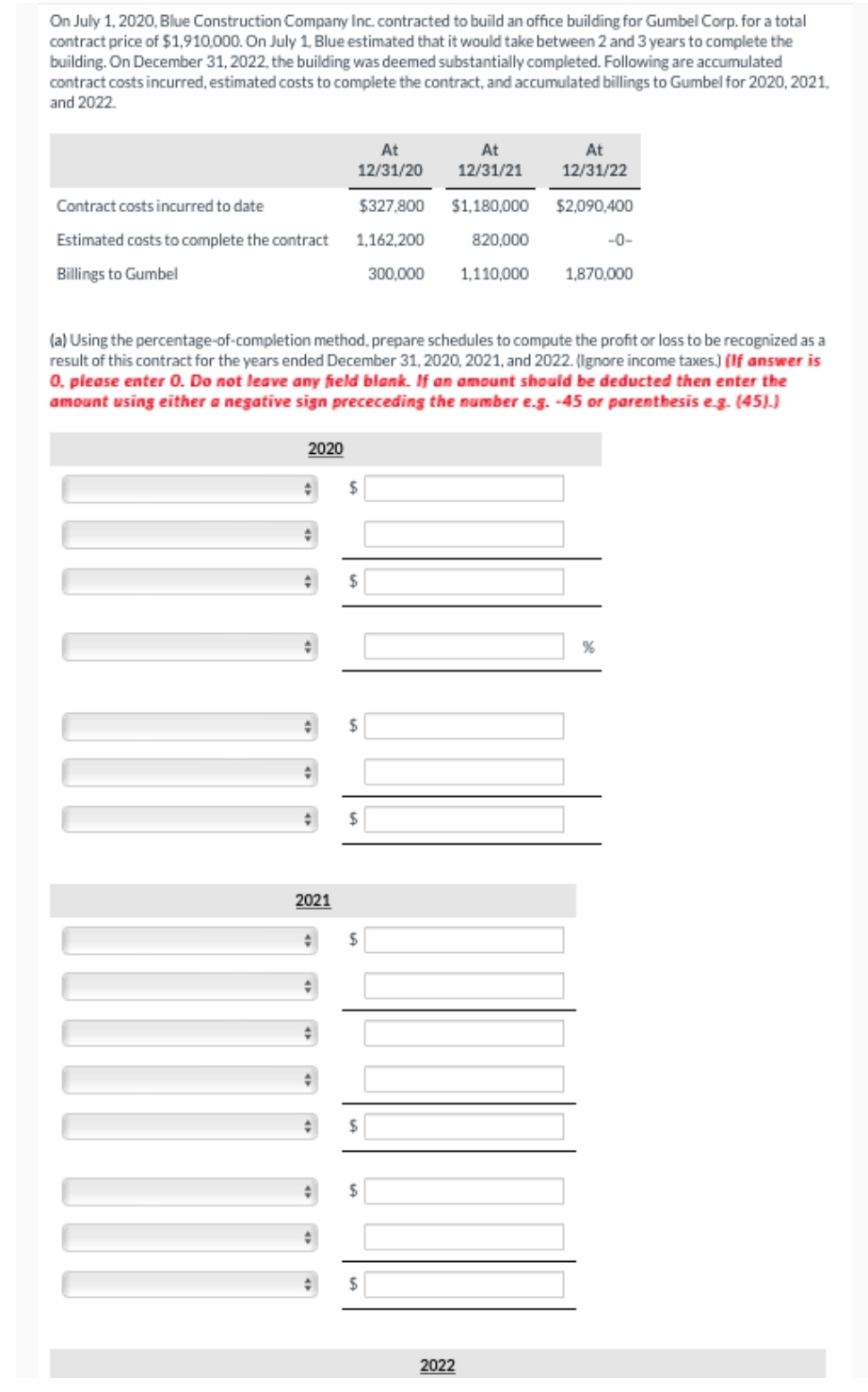

On July 1, 2020, Blue Construction Company Inc. contracted to build an office building for Gumbel Corp. for a total contract price of $1,910,000. On July 1, Blue estimated that it would take between 2 and 3 years to complete the building. On December 31, 2022, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gumbel for 2020, 2021, and 2022. Contract costs incurred to date Estimated costs to complete the contract At 12/31/20 At 12/31/21 $327,800 $1,180,000 1,162,200 820,000 At 12/31/22 $2,090,400 -0-

On July 1, 2020, Blue Construction Company Inc. contracted to build an office building for Gumbel Corp. for a total contract price of $1,910,000. On July 1, Blue estimated that it would take between 2 and 3 years to complete the building. On December 31, 2022, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gumbel for 2020, 2021, and 2022. Contract costs incurred to date Estimated costs to complete the contract At 12/31/20 At 12/31/21 $327,800 $1,180,000 1,162,200 820,000 At 12/31/22 $2,090,400 -0-

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 58P

Related questions

Question

Q-15

Transcribed Image Text:On July 1, 2020, Blue Construction Company Inc. contracted to build an office building for Gumbel Corp. for a total

contract price of $1,910,000. On July 1, Blue estimated that it would take between 2 and 3 years to complete the

building. On December 31, 2022, the building was deemed substantially completed. Following are accumulated

contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gumbel for 2020, 2021,

and 2022.

Contract costs incurred to date

Estimated costs to complete the contract

Billings to Gumbel

2020

+

2021

At

12/31/20

At

12/31/21

$327,800 $1,180,000

1,162,200

820,000

1,110,000

+

(a) Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a

result of this contract for the years ended December 31, 2020, 2021, and 2022. (Ignore income taxes.) (If answer is

0. please enter 0. Do not leave any field blank. If an amount should be deducted then enter the

amount using either a negative sign prececeding the number e.g. -45 or parenthesis e.g. (45).)

$

$

$

$

$

$

300,000

$

At

12/31/22

$2,090,400

2022

-0-

1,870,000

%

Transcribed Image Text:eTextbook and Media

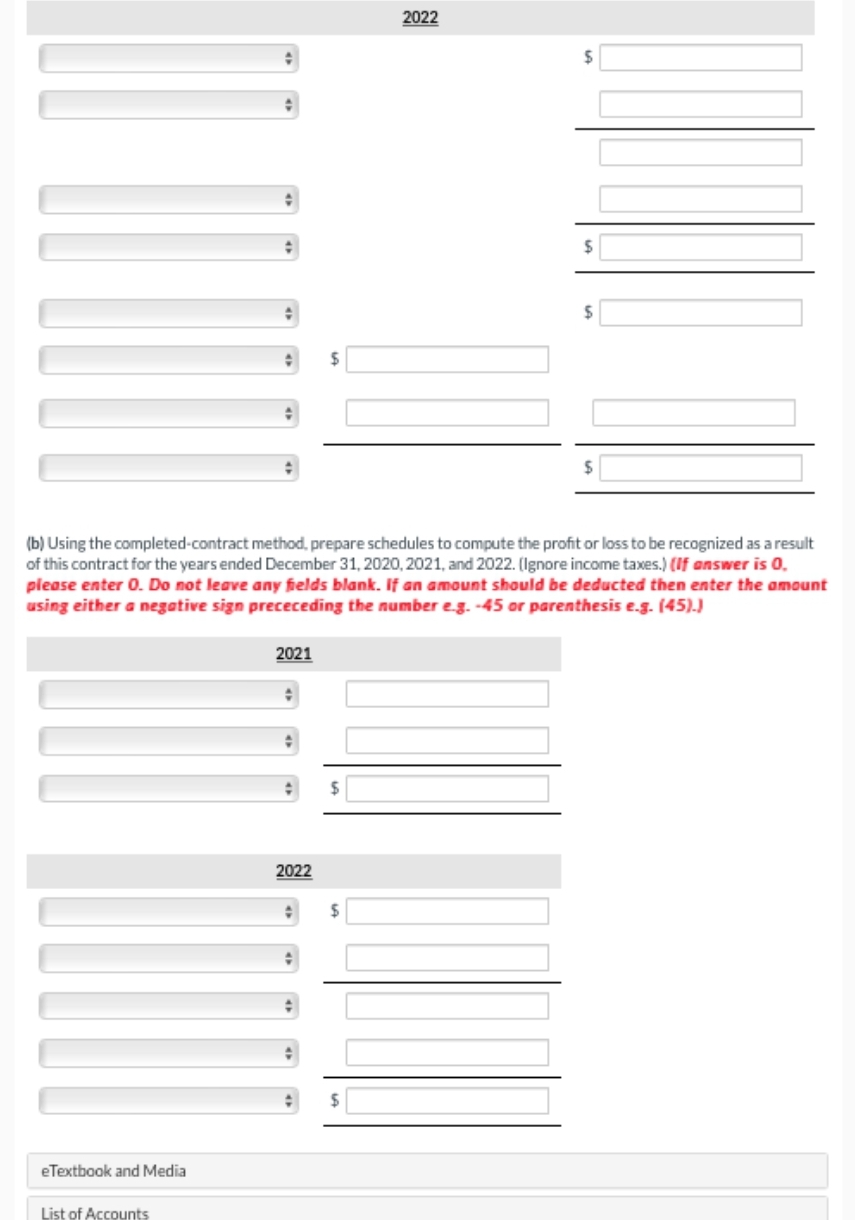

(b) Using the completed-contract method, prepare schedules to compute the profit or loss to be recognized as a result

of this contract for the years ended December 31, 2020, 2021, and 2022. (Ignore income taxes.) (If answer is 0.

please enter 0. Do not leave any fields blank. If an amount should be deducted then enter the amount

using either a negative sign prececeding the number e.g. -45 or parenthesis e.g. (45).)

List of Accounts

2021

2022

2022

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning