Stephen his amule resident 2012. morind anded 21 1

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter12: Liabilities: Off-balance-sheet Financing, Retirement Benefits, And Income Taxes

Section: Chapter Questions

Problem 21E

Related questions

Question

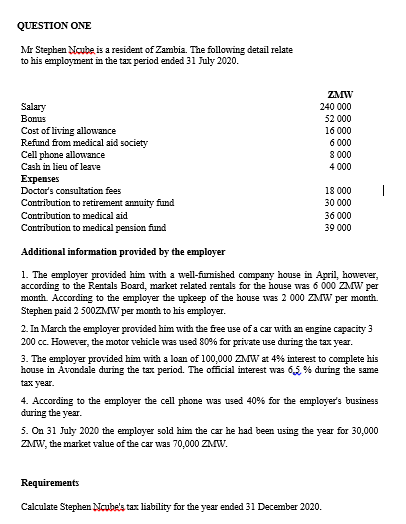

Transcribed Image Text:QUESTION ONE

Mr Stephen Ncube is a resident of Zambia. The following detail relate

to his employment in the tax period ended 31 July 2020.

Salary

Bonus

Cost of living allowance

Refund from medical aid society

Cell phone allowance

Cash in lieu of leave

Expenses

Doctor's consultation fees

Contribution to retirement annuity fund

Contribution to medical aid

Contribution to medical pension fund

Additional information provided by the employer

ZMW

240 000

52 000

16 000

6

000

8 000

000

4

18 000

30 000

36 000

39 000

Requirements

Calculate Stephen Ncube's tax liability for the year ended 31 December 2020.

1. The employer provided him with a well-furnished company house in April, however,

according to the Rentals Board, market related rentals for the house was 6 000 ZMW per

month. According to the employer the upkeep of the house was 2 000 ZMW per month.

Stephen paid 2 500ZMW per month to his employer.

2. In March the employer provided him with the free use of a car with an engine capacity 3

200 cc. However, the motor vehicle was used 80% for private use during the tax year.

3. The employer provided him with a loan of 100,000 ZMW at 4% interest to complete his

house in Avondale during the tax period. The official interest was 6,5 % during the same

tax year.

1

4. According to the employer the cell phone was used 40% for the employer's business

during the year.

5. On 31 July 2020 the employer sold him the car he had been using the year for 30,000

ZMW, the market value of the car was 70,000 ZMW.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning