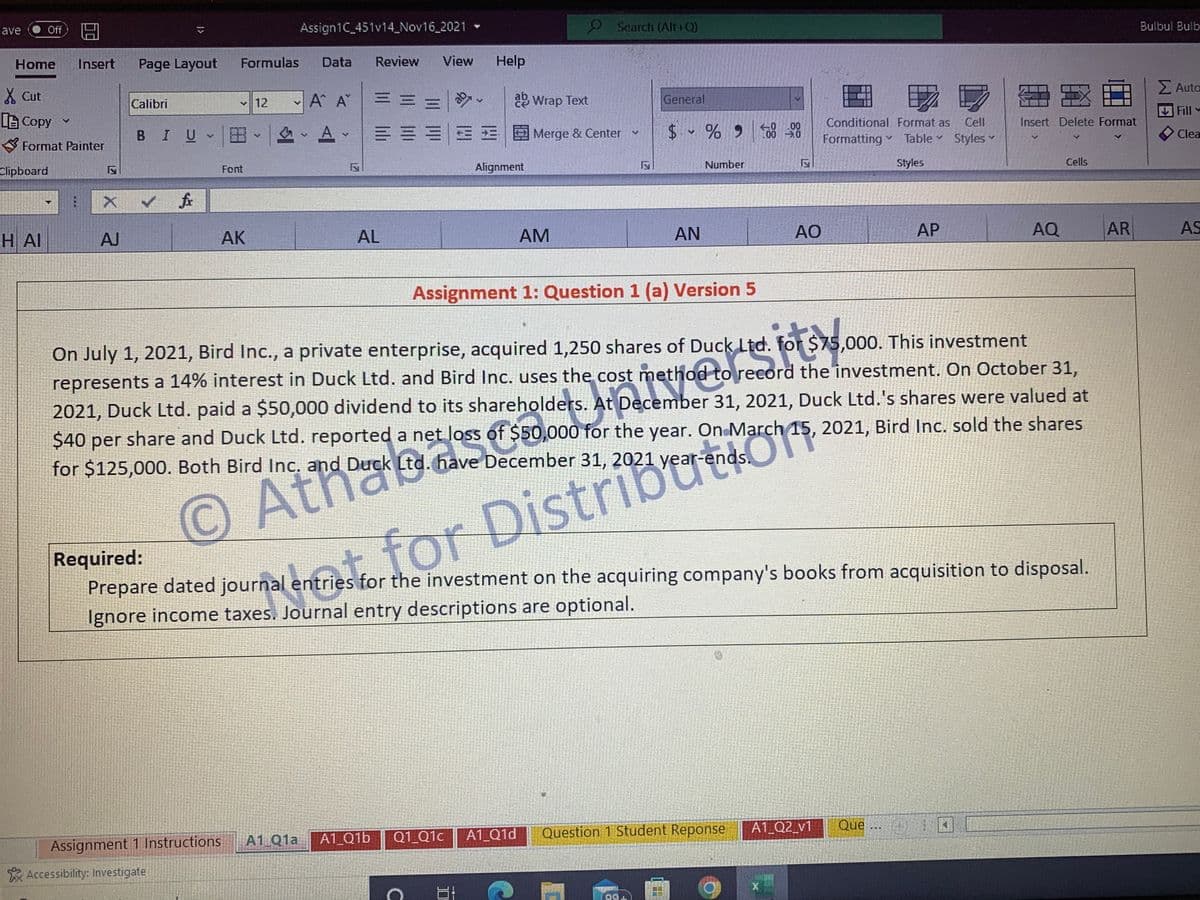

On July 1, 2021, Bird Inc., a private enterprise, acquired 1,250 shares of Duck Ltd. for $75,000. This investment ck Ltd. for $ represents a 14% interest in Duck Ltd. and Bird Inc. uses the cost method to record the investment. On October 31, 2021, Duck Ltd. paid a $50,000 dividend to its shareholders. At December 31, 2021, Duck Ltd.'s shares were valued at $40 per share and Duck Ltd. reported a net loss of $50,000 for the year. On March 15, 2021, Bird Inc. sold the shares for $125,000. Both Bird Inc. and Duck Ltd. have December 31, 2021 year-ends. ©At Required: Prepare dated journal entries for the investment on the acquiring company's books from acquisition to disposal. Ignore income taxes. Journal entry descriptions are optional. tenore indsted journis denfrenter for Distribution

On July 1, 2021, Bird Inc., a private enterprise, acquired 1,250 shares of Duck Ltd. for $75,000. This investment ck Ltd. for $ represents a 14% interest in Duck Ltd. and Bird Inc. uses the cost method to record the investment. On October 31, 2021, Duck Ltd. paid a $50,000 dividend to its shareholders. At December 31, 2021, Duck Ltd.'s shares were valued at $40 per share and Duck Ltd. reported a net loss of $50,000 for the year. On March 15, 2021, Bird Inc. sold the shares for $125,000. Both Bird Inc. and Duck Ltd. have December 31, 2021 year-ends. ©At Required: Prepare dated journal entries for the investment on the acquiring company's books from acquisition to disposal. Ignore income taxes. Journal entry descriptions are optional. tenore indsted journis denfrenter for Distribution

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 104.4C

Related questions

Question

Transcribed Image Text:Save Off

囧

Assign1C_451v14_Nov16_2021

Home Insert Page Layout Formulas Data Review View Help

Cut

Calibri

12

A A

EE

87-

V

ab Wrap Text

[Copy ✓

BIU A-

v

V

v

====Merge & Center

Clipboard

Font

Alignment

✓ fr

H AI

AJ

AK

AL

AM

AN

AO

AP

AQ

AR

Assignment 1: Question 1 (a) Version 5

On July 1, 2021, Bird Inc., a private enterprise, acquired 1,250 shares of Duck Ltd. for $75,000. This investment

represents a 14% interest in Duck Ltd. and Bird Inc. uses the cost method to record the investment. On October 31,

2021, Duck Ltd. paid a $50,000 dividend to its shareholders. At December 31, 2021, Duck Ltd.'s shares were valued at

$40 per share and Duck Ltd. reported a net loss of $50,000 for the year. On March 15, 2021, Bird Inc. sold the shares

for $125,000. Both Bird Inc. and Duck Ltd. have December 31, 2021 year

gepacem fan to read 540

© Atro Derck ( loss of S

Required:

Prepare dated journal entries for the investment on the acquiring company's books from acquisition to disposal.

Ignore income taxes. Journal entry descriptions are optional.

triestor for Distribrends,

A1 Q1a A1 01b

Q1_Q1c

A1 Q1d

Question 1 Student Reponse

A1_Q2_v1

Assignment 1 Instructions

Que ...)

99+

Format Painter

⠀

X

Accessibility: Investigate

V

Search (Alt+Q)

General

$ % 900-00

3

Number

C

17

Conditional Format as Cell

Table Styles

.0 Formatting Table

Styles

17

Insert Delete Format

Cells

Bulbul Bulb

Σ Auto

Fill

Clea

AS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning