On July 1, 2021, Harvest, Inc., acquires 60 percent of Patricia Company for $360,000. The remaining 40 percent of Patricia's outstanding shares continuo to trade at a collective value of $240,000. On that date, patent owned by Patricia with 10-year remaining life is undervalued by S100,000. Patricia has book value of net assets at S400.000 on January 1, 2021. The affiliates report the following 2021 amounts from their own separate operations: Harvest S700,000 $210,000 450,000 124,000 Patricia Revenues Expenses Dividends (declared 80,000 30,000 quarterly) Assume Patricia's revenues and expenses occurred uniformly throughout the year What amount is reported for goodwill in the December 31, 2021 consolidated balance sheet? O s0 O $60,000 O $40,000 O $50.000

On July 1, 2021, Harvest, Inc., acquires 60 percent of Patricia Company for $360,000. The remaining 40 percent of Patricia's outstanding shares continuo to trade at a collective value of $240,000. On that date, patent owned by Patricia with 10-year remaining life is undervalued by S100,000. Patricia has book value of net assets at S400.000 on January 1, 2021. The affiliates report the following 2021 amounts from their own separate operations: Harvest S700,000 $210,000 450,000 124,000 Patricia Revenues Expenses Dividends (declared 80,000 30,000 quarterly) Assume Patricia's revenues and expenses occurred uniformly throughout the year What amount is reported for goodwill in the December 31, 2021 consolidated balance sheet? O s0 O $60,000 O $40,000 O $50.000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 24E

Related questions

Question

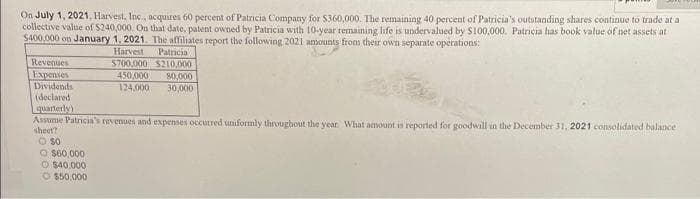

Transcribed Image Text:On July 1, 2021, Harvest, Inc., acquires 60 percent of Patricia Company for $360,000. The remaining 40 percent of Patricia's outstanding shares continue to trade at a

collective value of $240,000. On that date, patent owned by Patricia with 10-year remaining life is undervalued by S100,000. Patricia has book value of net assets at

$400,000 on January 1, 2021. The affiliates report the following 2021 amounts from their own separate operations:

Harvest

Patricia

S700,000 $210.000

80,000

30,000

Revenues

Expenses

Dividends

(declared

quarterly)

Assume Patricia's revenues and expenses occurred uniformly throughout the year What amount is reported for goodwill in the December 31, 2021 consolidated balance

450,000

124,000

sheet?

O so

O $60,000

O $40,000

O $50.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT