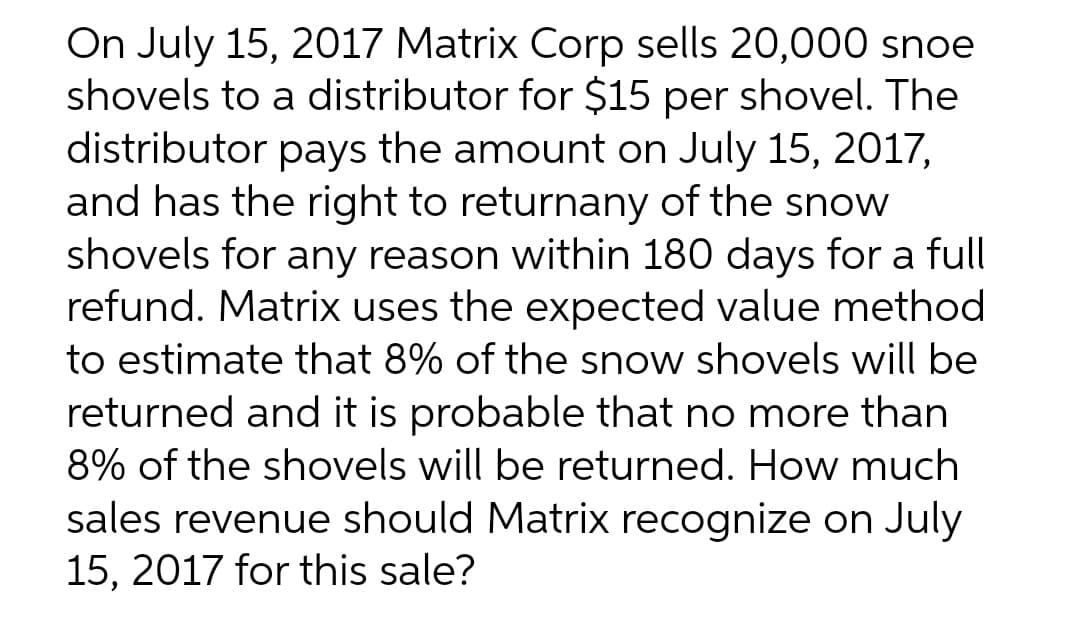

On July 15, 2017 Matrix Corp sells 20,000 snoe shovels to a distributor for $15 per shovel. The distributor pays the amount on July 15, 2017, and has the right to returnany of the snow shovels for any reason within 180 days for a full

Q: Two checks verified to have been recorded in 2021 cash disbursements book amounting to P22,000…

A: Here discuss about the details of the adjustment entry which are involved with this as well. The…

Q: Frieden Company's contribution format income statement for last month is shown below: Sales (40,000…

A: The indifference point is when the company neither incurs loss nor profit. It is a point above which…

Q: of interest of 10%, The service revenue to be recognized for the year ended December 31, 2020 is A.…

A: Service revenue is the revenue which has been earned through the performance of the obligations or…

Q: nd functionalit ery truck cam when should allenger and

A: Equivalent Uniform Annual Cost(EUAC) is annual cost computed by discounting cost with discounting…

Q: n in t

A: An action that is a civil action for injury damages death damages or property damages or damaging of…

Q: ent year, Goldilocks Inc. signed an agreement to operate as a franchise of Cafe for an initial…

A: Acquisition cost refers to the expenses born by an entity in acquiring an asset.

Q: Roaa and Salma were partners in a firm sharing profits in the ratio of their capitals contributed on…

A: The profit sharing ratio of Roaa and Salma is calculated as Capital of Roaa : Capital of Salma…

Q: On 1 July 2019, Brad Ltd acquired all assets and liabilities of Pitt Ltd. In exchange for these…

A: Acquisition costs- The acquisition cost is defined as the total cost of acquiring an asset. The cost…

Q: Prepare a summary of total cost variances and total sales variances. Identify possible…

A: Total sales variance is the variance which has been computed by the company in which it is…

Q: What is the gross profit and how do i calculate it

A: Manufacturing department profit is also known as gross profit. This profit includes only costs…

Q: In January 2022, Proton Mining Corporation purchased a minera mine for P4,200,000 with removable ore…

A: Under the units-of-activity method of depreciation, the asset's cost (less any salvage value) is…

Q: Total sales revenue Selling price per snowboard Variable selling expense per snowboard Variable…

A: The contribution margin is calculated by deducting all the variable costs related to the product…

Q: KK Limited owns a property that is used as its head office in Pretoria. On 1 st January 2020, its…

A: A compilation of summaries of an organization's financial results, financial position, and cash…

Q: 1. What amount of depreciation should be reported in the historical cost income statement for 2021?…

A: 1. Depreciation Expense based on Historical Cost = P5,000,000/5years = P1,000,000 2.…

Q: Prepare an income statement

A:

Q: PA2-3 (Algo) Part 2 4 2. Analyze transactions (a)-(e) to determine their effects on the accounting…

A: Solution Concept Accounting equation Accounting equation is expressed as Asset = liabilities +…

Q: What about capitalized interest in 2022?

A:

Q: Lion Consulting Adjusted Trial Balance June 30, 2019 Debit Balances Credit Balances Cash…

A: Current liability is present obligation which is expected to be settled within 12 months from the…

Q: Required information [The following information applies to the questions displayed below.] Carlos…

A: Net Income- Net income is the balance left over after deducting a company's cost of goods sold and…

Q: If beginning and ending interest receivable were P16,000 and P5,000, respectively. Total interest…

A: Interest receivable is the amount which is yet to be received from the amount invested for example…

Q: The balance of Partner B's Capital account after the sale is

A:

Q: Mason Industries purchased a drilling rig for $75,900. Delivery costs totaled $2,817. The useful…

A: Depreciation: It implies to a decrease in the fixed asset's value because of wear and tear,…

Q: The following balances were extracted from the books of AL Masa Cleaning Services at 31st December,…

A: The net income or loss is calculated as difference between total revenue and total expenses…

Q: Dart, Inc. makes and sells umbrellas. The company is in the process of preparing its Selling and…

A: Cost can be classified into two categories such as fixed cost and variable cost. The fixed cost…

Q: When a sale is made and sales tax is collected from the customer, the sales tax is recorded as a/an…

A: Sales tax is collected by the business owner for the government from the customer .

Q: Required: 1. Using the five most expensive activities, calculate the overhead cost assigned to each…

A: The ABC costing system refers to the activity-based costing system. It is a method of allocating…

Q: Use the Adjusted Trial Balance for Lion Consulting. On the Balance Sheet, what would is the book…

A: Solution Balance sheet Balance sheet is the financial statement that is prepared to present the…

Q: Companies conducting business outside their country's borders are required to translate the results…

A:

Q: -15% compounded semi-annually y has an equivalent rate of 1.8245 %, how many times does it pay every…

A: The actual number of times payment is made can be calculated using the following formula: Number of…

Q: Lion Consulting Adjusted Trial Balance June 30, 2019 Debit Balances Credit Balances Cash…

A: Accounting is based on double entry system , For each debits there is an equal amount of credits .…

Q: isn't the 5,000 not included in the computation?

A: Please see Step 2 for required information.

Q: hat amount of cash should Orange and Lemon respectively received?

A: Liquidation of the partnership is the process and act in which the liabilities which are external…

Q: Use the lower-of-cost-or-market rule to determine the value (in $) of the following inventory for…

A:

Q: What is the total costs transferred from Department 2 to Department 3?

A:

Q: average net profits expected in future by Khalifa and Co. are OMR 30,000 per year. The average…

A: 1) super profit method = super profit* number of year purchased Super profit= (actual average…

Q: A company expected its annual overhead costs to be $692920 and machine hours to equal 101900 hours.…

A: Answer - Predetermined Overhead Rate - = Estimated Total annual Overhead Costs / Estimated Total…

Q: Marissa converted an RRSP balance of $125,000 into an RRIF that will pay he $1,850 at the end of…

A: Given: - Pmt= $1,850 P= $125,000 t= 9 years or 108 months

Q: The below information will be used for the next two questions. A Company issued a convertible bond…

A: Convertible Bonds- Convertible bonds are investment bonds in which bondholders have the option of…

Q: BUS 208 - Principles of Accounting II Chapter 12 Karen Smith and Abby Jones formed a partnership,…

A: Total share in Net Income=Interest on Capital+Salary allowances+Share in Net Income

Q: Explain how variable costing system costing is used to calculate the cost of goods manufactured.…

A: (1) Variable costing system The variable costs are included in the product cost in variable…

Q: Ill Company provides the following data for the year 2020: Cash sales - 500,000; Collection from…

A: The gross sales are calculated as sum of net sales, sales discount and allowance and sales returns.

Q: Which financial statement reports the changes in owner's equity (legal ownership of the company) for…

A: Solution: There are various financial statements which reports the results of the transactuions of a…

Q: Proton Corporation incurred the following costs in 2022: Acquisition of R&D equipment with a useful…

A: The advertising costs and engineering costs are not included in the research and development costs.

Q: er the beginning cash and capital balances and post the transactions. (Post entries in the order of…

A: Cost of goods sold refers to the charges born by a company while selling its products or services to…

Q: An investor earns $138639 in the 2021/22 tax year. She purchases shares worth $4251 on 15 April 2021…

A: Income tax payable is tax liability which is paid to the government on the income of individual, A…

Q: How much is the income from sources within? Gross Income from the practice of profession as CPA in…

A: The income which has derived from the properties held in or any kind of activities undertaken in the…

Q: On July 1, 2022, Proton, Inc. sells equipment for P44,000. The equipment originally cost P120,000,…

A: Given: - Cost= 120,000 Accumulated Depreciation=70,000 Salvage value=20,000 Useful life= 5 years

Q: A subsidiary entity, crystal ltd, is for sale at a price $6 million. There has been someinterest…

A: Consolidation- Consolidation legally refers to the joining of two or more business organisations or…

Q: The following balances were extracted from the books of AL Masa Cleaning Services at 31st December,…

A: Current assets are those which are realizable within one year and assets that have a life of more…

Q: On January 1, 2020, the Carla Vista Company budget committee has reached agreement on the following…

A: Production budgets are used by manufacturers to specify the amount of product units to be…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The Goodson Company is a chain of retail electronics stores. How much of a loss can Goodson deduct in each of the following cases? Explain. a. An employee drops a 65-inch 3D television, cracking the plastic casing on the back. The television normally sells for 3,300. The cost of the set is 2,400, and Goodson sells the damaged set for 1,500. b. The company replaces its inventory system. The old system cost 45,000 and has a basis of 16,000. The company sells the old system for 7,500. The new system costs 75,000. c. A flood damages one of Goodsons retail stores. The building suffers extensive water damage. The basis of the building is 60,000, and the cost of repairing the damage is 72,000. The insurance company reimburses Goodson 50,000. d. The owner of Goodson sells a complete home entertainment center (e.g., projection TV, DVD, stereo system) to his sister for 7,000. The usual sales price is 8,500. The system costs 6,300. e. Assume the same facts as in part d, except that the owner sells the home entertainment center to his sister for 5,500. f. The owner of Goodson finds that the controller has embezzled 10,000 from the company. Before the owner can confront the controller, the controller leaves town and cannot be found. g. Upon arriving at the companys headquarters, the vice president of sales finds that someone has broken in and stolen three computers. The damage to the outside door is extensive. The cost of repairing the door is 1,500, and the cost of replacing the three computers is 9,500. The original cost of the computers totals 10,500. Goodsons basis in the computers is 5,000. The thieves also stole 350 from the petty cash fund. Goodson files a claim with its insurance company and receives 4,800.Stellar Inc. sells an irrigation system that cost $184,000 to McGraw Company for $365,000 on March 2, 2017. The sales price includes an installation fee. The standalone price of the installation fee is $54,000. The standalone price of the irrigation system is $344,000. The installation is considered a separate performance obligation and is expected to take 3 months to complete.On January 1, 2030, KKK consigned 300 units of gaming keyboards to SSS Each keyboard costs P400 and is sold at 50% above cost. After selling 200 keyboards, the remaining 200 units were repaired for some defects for P4,000. Because of this, SSS increased the selling price by P60. At the end of the month, SSS remitted P129,960 after deducting 15% commission, and reimbursable expenses of P1700 delivery expense and the P4,000 repair of the 100 units. How many consigned units were sold?

- On August 1, 2014, Lleiram Corporation purchased a new machine on a deferred payment basis. A down payment of P200,000 was made and 4 annual installments of P600,000 each are to be made beginning on September 1, 2014. Terms of the contract are not normal in the industry where the same types of assets are being traded. Due to an employee strike, Flight could not install the machine immediately, thus, incurred P3,000 of storage cost. Cost of installation (excluding the storage cost) amounted to P20,000. The cash price of the machine was P2,300,000. How much should be capitalized as cost of the machine? a. 2,300,000 c. 2,323,000 b. 2,320,000 d. 2,600,000On April 2, 2015, Montana Mining Co. pays $4,170,260 for an ore deposit containing 1,438,000 tons. The company installs machinery in the mine costing $199,600, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2015, and mines and sells 167,800 tons of ore during the remaining eight months of 2015. Prepare the December 31, 2015, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine’s depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) 1. Record the year-end adjusting entry for the depletion expense of ore mine. 2. Record the year-end adjusting entry for the depreciation expense of the mining machinery.Dowell Fishing Supply, Inc., sold $50,000 of Dowell Rods on December 15, 2021, to Bassadrome. Because of a shipping backlog, Dowell held the inventory in Dowell’s warehouse until January 12, 2022 (having assured Bassadrome that it would deliver sooner if necessary). How much revenue should Dowell recognize in 2021 for the sale to Bassadrome?

- On April 1, 2014, the company incurred capital cost of $100 million in respect of themine and it is expected that the mine will be abandoned in eight years’ time.The mine is situated in a country where there is no environmental legislationobliging companies to rectify environmental damage and is it very unlikely that anysuch legislation will be enacted within eight years.It has been estimated that the cost of cleaning the site and re-planting the treeswill be $25 million if the replanting were successful at the first attempt, but it willprobably be necessary to make a further attempt, which will increase the cost by afurther $5 million. The company’s cost of capital is 10%. Explain why a provision should be made for the cost of cleaning the site.On April 1, 2014, the company incurred capital cost of $100 million in respect of themine and it is expected that the mine will be abandoned in eight years’ time.The mine is situated in a country where there is no environmental legislationobliging companies to rectify environmental damage and is it very unlikely that anysuch legislation will be enacted within eight years. It has been estimated that the cost of the cleaning the site and re-planting the treeswill be $25 million if the replanting were successful at the first attempt, but it willprobably be necessary to make a further attempt, which will increase the cost by afurther $5 million. The company’s cost of capital is 10%. Prepare necessary journal entries for the period April 1, 2014 – March 31, 2015On April 1, 2014, the company incurred capital cost of $100 million in respect of themine and it is expected that the mine will be abandoned in eight years’ time.The mine is situated in a country where there is no environmental legislationobliging companies to rectify environmental damage and is it very unlikely that anysuch legislation will be enacted within eight years.It has been estimated that the cost of the cleaning the site and re-planting the treeswill be $25 million if the replanting were successful at the first attempt, but it willprobably be necessary to make a further attempt, which will increase the cost by afurther $5 million. The company’s cost of capital is 10%.

- During 2015, AD Company signed a non-cancelable contract with BARD Company to purchase 5,000, 50-kilos sacks of rice at P1,700 per sack with delivery to be made on June 1, 2020. On December 31, 2015, the price of rice had fallen to P1,680 per sack. On June 1, 2016, the price per sack of rice has further decrease to P1,540. In A’s December 31,2016 profit and loss, how much is reported as loss on purchase commitments?On March 10, 2017, Steele Company sold to Barr Hardware 200 tool sets at a price of $50 each (cost $30 per set) with terms of n/60, f.o.b. shipping point. Steele allows Barr to return any unused tool sets within 60 days of purchase. Steele estimates that (1) 10 sets will be returned, (2) the cost of recovering the products will be immaterial, and (3) the returned tools sets can be resold at a profit. On March 25, 2017, Barr returned six tool sets and received a credit to its account. Assume that instead of selling the tool sets on credit, that Steele sold them for cash.Instructions(a) Prepare journal entries for Steele to record (1) the sale on March 10, 2017, (2) the return on March 25, 2017, and (c) any adjusting entries required on March 31, 2017 (when Steele prepares financial statements). Steele believes the original estimate of returns is correct.(b) Indicate the income statement and balance sheet reporting by Steele at March 31, 2017, of the information related to the Barr sale.On June 30, 2016, a fire in Jeremy Company's plant caused the total loss of a production machine. The machine was being depreciated at P20,000 annually. And had a carrying amount of P160,000 on December 31, 2015. On the date of the fire, the fair value of the machine was P220,000 and Jeremy received insurance proceeds of P200,000 in October 2016. In its income statement for the year ended December 31, 2016, what amount should Jeremy recognize as a gain or loss on disposition? Answer: